Introduction: Navigating the Global Market for dental implant phases

In an increasingly interconnected world, understanding the intricate phases of dental implant procurement is vital for international B2B buyers. The dental implant market is not just about products; it encompasses a complex web of phases that include design, manufacturing, quality control, and distribution. Each phase plays a crucial role in ensuring that the final product meets the rigorous standards of safety, efficacy, and patient satisfaction. For buyers from regions such as Africa, South America, the Middle East, and Europe, navigating these phases effectively can lead to significant competitive advantages.

This guide offers a comprehensive overview of the dental implant phases, detailing types of implants, materials used, and the manufacturing and quality control processes. Additionally, it highlights potential suppliers, cost considerations, and market dynamics that influence purchasing decisions. By addressing common questions and concerns, this resource is designed to empower buyers to make informed sourcing decisions, minimizing risks and maximizing value.

As the demand for dental implants continues to rise globally, understanding these phases becomes not only beneficial but essential. With insights tailored for a diverse audience, this guide aims to bridge knowledge gaps and enhance strategic sourcing efforts, ensuring that buyers can confidently navigate the global market landscape.

Understanding dental implant phases Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Stage Implants | Integrated abutment and implant in one piece | Clinics with high patient turnover | Pros: Reduced surgery time; simpler procedure. Cons: Limited to certain cases; may not suit all patients. |

| Two-Stage Implants | Separate implant placement and abutment attachment | Specialized dental practices | Pros: Greater flexibility; better for complex cases. Cons: Longer treatment time; requires more appointments. |

| Immediate Load Implants | Allows for temporary crown placement on the same day | High-demand clinics | Pros: Immediate aesthetics; faster patient satisfaction. Cons: Higher risk of failure; requires skilled practitioners. |

| Mini Implants | Smaller diameter; less invasive | Budget-conscious practices | Pros: Less bone required; quicker recovery. Cons: Limited strength; not suitable for all applications. |

| Zygomatic Implants | Anchored in the zygomatic bone for severe atrophy | Advanced dental surgeries | Pros: Suitable for patients with significant bone loss; immediate stability. Cons: Complex procedure; higher cost. |

Single-Stage Implants

Single-stage implants consist of an integrated abutment and implant, allowing for a streamlined surgical process. This type is particularly suitable for straightforward cases with sufficient bone density. For B2B buyers, the appeal lies in the reduced surgery time and simpler procedure, making it ideal for clinics with high patient turnover. However, buyers should consider that this option may not be appropriate for all patients, particularly those with complex anatomical conditions.

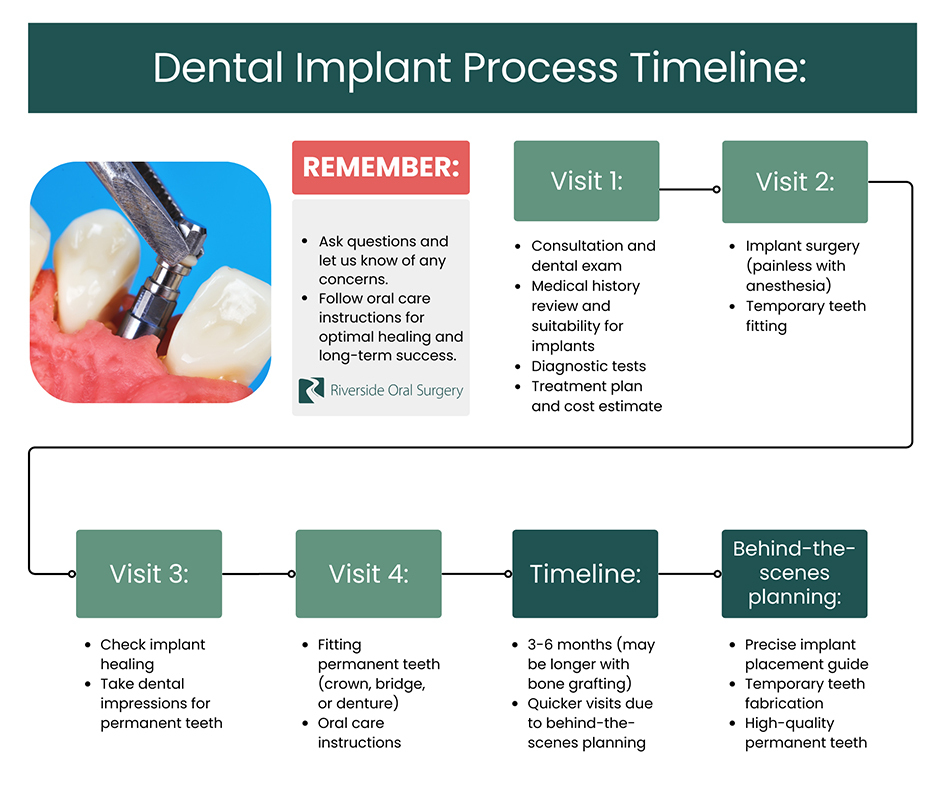

Illustrative Image (Source: Google Search)

Two-Stage Implants

Two-stage implants involve placing the implant first, followed by a second surgery to attach the abutment. This method is highly flexible and can accommodate a broader range of patient needs, especially in complex cases where bone quality or quantity is a concern. B2B buyers should weigh the benefits of improved adaptability against the longer treatment timelines and the necessity for multiple appointments, which could impact clinic efficiency.

Immediate Load Implants

Immediate load implants allow for the placement of a temporary crown on the same day as the implant surgery, providing instant aesthetic benefits for patients. This option is particularly attractive for high-demand clinics that prioritize patient satisfaction and quick service. However, B2B buyers must be aware of the increased risk of implant failure and the need for highly skilled practitioners to ensure success, making it a more specialized offering.

Mini Implants

Mini implants are characterized by their smaller diameter and less invasive placement, making them a viable option for budget-conscious practices. They require less bone to achieve stability, leading to quicker recovery times and less discomfort for patients. While appealing for their cost-effectiveness, B2B buyers should consider the limitations in strength and durability, as mini implants may not be suitable for all applications, particularly those requiring significant load-bearing capacity.

Zygomatic Implants

Zygomatic implants are anchored in the zygomatic bone, making them suitable for patients with severe bone atrophy. This advanced technique provides immediate stability and is ideal for complex dental surgeries. For B2B buyers in specialized fields, the potential for addressing significant bone loss offers a competitive edge. However, the complexity of the procedure and higher costs associated with zygomatic implants necessitate careful consideration and thorough training for practitioners to ensure optimal outcomes.

Related Video: Step by Step Guide to Your Dental Implant Procedure

Key Industrial Applications of dental implant phases

| Industry/Sector | Specific Application of dental implant phases | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Utilization of implant phases in patient treatment plans | Enhanced patient outcomes and satisfaction | Quality of materials, regulatory compliance, and supplier reliability |

| Dental Laboratories | Manufacturing of custom dental implants using phase technology | Improved precision and reduced lead times | Advanced manufacturing capabilities and technological expertise |

| Research Institutions | Studies on implant phase effectiveness and innovations | Contribution to industry advancements and new product development | Collaboration opportunities and access to cutting-edge research |

| Dental Equipment Suppliers | Supply of tools and machinery for implant phase procedures | Increased efficiency and reduced operational costs | Compatibility with existing systems and service support |

| Insurance Companies | Assessment of dental implant phases for policy coverage | Better risk management and accurate policy pricing | Understanding of regional regulations and market trends |

Dental Clinics

Dental clinics are the primary end-users of dental implant phases, employing these phases in comprehensive treatment plans tailored for patients requiring dental restoration. The use of advanced implant phases allows for a more individualized approach, addressing specific patient needs such as bone density and gum health. For international buyers, particularly in regions like Africa and South America, sourcing high-quality implant materials that comply with local regulations is crucial to ensure patient safety and satisfaction.

Dental Laboratories

Dental laboratories play a pivotal role in the manufacturing of custom dental implants, utilizing the different phases of implant technology to create precise and tailored solutions. This application significantly reduces lead times while enhancing the accuracy of the implants produced. Buyers from Europe and the Middle East should prioritize suppliers with advanced manufacturing capabilities and technological expertise to ensure they receive high-quality products that meet stringent industry standards.

Research Institutions

Research institutions utilize dental implant phases to conduct studies focusing on the effectiveness and innovations within the dental implant field. These institutions contribute significantly to industry advancements, providing insights that can lead to new product development. For B2B buyers, particularly in regions with emerging markets, collaborating with these research entities can lead to innovative solutions and a competitive edge in the market.

Dental Equipment Suppliers

Dental equipment suppliers provide essential tools and machinery designed for the various phases of dental implant procedures. By investing in high-quality equipment, dental practices can achieve increased efficiency and reduced operational costs. International buyers need to consider the compatibility of new equipment with existing systems, as well as the level of service support provided by the supplier, to ensure seamless integration and minimal disruption.

Insurance Companies

Insurance companies assess the various phases of dental implants to develop comprehensive policy coverage options. Understanding the intricacies of these implant phases allows insurers to manage risks effectively and set accurate pricing for policies. For B2B buyers in the insurance sector, particularly in Europe and the Middle East, it is essential to stay updated on regional regulations and market trends to tailor offerings that meet the evolving needs of dental care providers and their patients.

Strategic Material Selection Guide for dental implant phases

When selecting materials for dental implants, it’s crucial to consider the unique properties and performance characteristics of each option. This guide analyzes four common materials used in dental implant phases: Titanium, Zirconia, Stainless Steel, and Polyether Ether Ketone (PEEK). Each material offers distinct advantages and limitations, which can significantly impact the success of dental implant procedures.

Titanium

Key Properties:

Titanium is renowned for its excellent biocompatibility, corrosion resistance, and strength-to-weight ratio. It can withstand the physiological conditions in the human body, including temperature fluctuations and mechanical stresses.

Pros & Cons:

Titanium implants are highly durable and can last for many years, making them suitable for long-term use. However, they can be more expensive than other materials and may require complex manufacturing processes. The primary disadvantage is their potential to cause allergic reactions in a small percentage of patients.

Impact on Application:

Titanium is compatible with various media, including bone tissue, which promotes osseointegration—the process by which the implant becomes firmly anchored in the jawbone.

Considerations for International B2B Buyers:

Buyers should ensure compliance with international standards such as ASTM F136 for titanium alloys. In regions like Africa and South America, where healthcare regulations may vary, understanding local compliance is essential.

Zirconia

Key Properties:

Zirconia is a ceramic material known for its high strength, aesthetic appeal, and excellent wear resistance. It also exhibits low thermal conductivity, making it comfortable for patients.

Pros & Cons:

The primary advantage of zirconia is its natural tooth-like appearance, making it ideal for visible areas. However, it is more brittle than titanium, which can lead to fractures under high stress. Additionally, the cost can be higher due to the complexity of manufacturing.

Impact on Application:

Zirconia is highly biocompatible and does not cause allergic reactions, making it suitable for sensitive patients. However, its brittleness may limit its use in load-bearing applications.

Considerations for International B2B Buyers:

Compliance with standards such as ISO 6872 is critical. In Europe, the CE marking is essential for market entry, while in the Middle East, buyers should be aware of local regulations regarding dental materials.

Stainless Steel

Key Properties:

Stainless steel is known for its high tensile strength, corrosion resistance, and affordability. It can withstand significant mechanical stress, making it suitable for temporary implants.

Pros & Cons:

The main advantages of stainless steel are its cost-effectiveness and strength. However, it is less biocompatible than titanium and zirconia, which may lead to complications in some patients. Additionally, its aesthetic appeal is lower, making it less suitable for visible implants.

Impact on Application:

Stainless steel is often used for temporary applications or in pediatric dentistry due to its strength and lower cost. However, it may not be suitable for long-term implants in adults.

Considerations for International B2B Buyers:

Buyers should ensure compliance with ASTM F138 standards. In regions like Africa, where cost is a significant factor, stainless steel may be a preferred choice despite its limitations.

Polyether Ether Ketone (PEEK)

Key Properties:

PEEK is a high-performance polymer known for its excellent mechanical properties, chemical resistance, and biocompatibility. It can withstand high temperatures and is lightweight.

Pros & Cons:

The primary advantage of PEEK is its flexibility and ability to mimic the natural properties of bone, which can enhance patient comfort. However, it is less durable than metal options and may not be suitable for all applications. The cost can also be high compared to traditional materials.

Impact on Application:

PEEK is particularly useful in applications where flexibility and patient comfort are priorities, such as in certain types of temporary implants.

Considerations for International B2B Buyers:

Buyers should be aware of the need for compliance with ISO 10993 for biocompatibility. In regions like South America, where advanced materials are emerging, understanding local market acceptance is vital.

Summary Table

| Material | Typical Use Case for dental implant phases | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Permanent dental implants | Excellent biocompatibility and durability | Potential allergic reactions | High |

| Zirconia | Aesthetic dental implants | Natural tooth-like appearance | Brittle under stress | High |

| Stainless Steel | Temporary implants | Cost-effective and strong | Lower biocompatibility | Low |

| PEEK | Flexible temporary implants | Mimics natural bone properties | Less durable than metals | Medium |

This guide provides a comprehensive overview of material selection for dental implants, emphasizing the importance of aligning choices with regional standards and patient needs.

In-depth Look: Manufacturing Processes and Quality Assurance for dental implant phases

Overview of Manufacturing Processes for Dental Implants

The manufacturing of dental implants involves a series of intricate processes designed to ensure precision, durability, and biocompatibility. For international B2B buyers, understanding these processes is crucial for selecting reliable suppliers. The main stages of manufacturing can be categorized as follows:

1. Material Preparation

Selection of Materials: The primary materials used for dental implants include titanium and its alloys, zirconia, and occasionally other biocompatible metals. Titanium is favored due to its high strength-to-weight ratio and excellent biocompatibility.

Material Treatment: Before manufacturing, raw materials undergo treatments such as surface cleaning and sterilization to remove contaminants. This step is essential to ensure that the final product integrates well with human tissue.

2. Forming

Machining Processes: This stage involves cutting and shaping the material into the desired implant form. Techniques such as Computer Numerical Control (CNC) machining are widely used due to their precision.

Additive Manufacturing: Recently, 3D printing has gained traction in the production of dental implants, allowing for complex geometries that enhance osseointegration and overall implant success.

3. Assembly

Component Integration: Many dental implants consist of multiple components, such as the implant body, abutment, and screw. These components must be assembled with precision to ensure proper fit and function.

Surface Treatment: Post-assembly, surface modifications, such as sandblasting or acid etching, may be applied to enhance the implant’s surface characteristics, promoting better integration with bone.

4. Finishing

Final Inspection: After assembly, each implant undergoes rigorous inspection to ensure it meets predefined specifications. This includes visual checks and measurements of critical dimensions.

Packaging: The final step involves packaging the implants in sterile conditions to prevent contamination, ensuring they are ready for use upon delivery.

Quality Assurance in Dental Implant Manufacturing

Quality assurance (QA) is critical in the production of dental implants, as it directly affects patient safety and treatment outcomes. International standards and industry-specific regulations guide the QA process.

Relevant International Standards

- ISO 9001: This standard outlines quality management system requirements, ensuring consistent quality in manufacturing processes.

- ISO 13485: Specifically for medical devices, this standard focuses on regulatory requirements, emphasizing quality management in the design and manufacturing of dental implants.

- CE Marking: For products sold in Europe, CE marking indicates conformity with health, safety, and environmental protection standards.

- API (American Petroleum Institute): While primarily for oil and gas, some principles can be adapted for quality control in medical device manufacturing.

QC Checkpoints

Quality control involves several checkpoints throughout the manufacturing process to ensure adherence to standards:

- Incoming Quality Control (IQC): Inspecting raw materials upon receipt to verify they meet specifications.

- In-Process Quality Control (IPQC): Monitoring processes during manufacturing to catch defects early. This includes regular checks during machining and assembly.

- Final Quality Control (FQC): Conducting exhaustive testing and inspections on finished products before packaging.

Common Testing Methods

Various testing methods are employed to validate the quality of dental implants:

- Dimensional Inspection: Utilizing precision tools to measure critical dimensions of the implants.

- Mechanical Testing: Assessing the strength and durability of the implants through tensile, fatigue, and shear tests.

- Biocompatibility Testing: Conducting tests to ensure materials do not induce adverse reactions when in contact with human tissue.

Verifying Supplier Quality Control

For B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe, verifying a supplier’s quality control measures is essential. Here are actionable steps to ensure supplier compliance:

1. Conduct Supplier Audits

Regular audits of potential suppliers can provide insights into their manufacturing processes and quality control systems. During an audit, check for:

- Compliance with ISO standards.

- Documentation of quality control procedures.

- Evidence of previous successful inspections or certifications.

2. Request Quality Reports

Ask suppliers for their quality assurance documentation, including:

- Certificates of compliance with international standards (e.g., ISO 13485).

- Reports from recent quality audits.

- Documentation of testing methods and results.

3. Engage Third-Party Inspections

Utilizing third-party inspection services can offer an unbiased assessment of a supplier’s manufacturing capabilities. These inspections can verify:

- Compliance with quality standards.

- The effectiveness of quality control measures.

- Adequate traceability of materials used in production.

QC and Certification Nuances for International Buyers

International B2B buyers should be aware of specific nuances when dealing with suppliers in different regions:

- Regulatory Variability: Different countries may have varying regulations for medical devices. Ensure that suppliers comply with local regulations as well as international standards.

- Cultural Differences: Understanding the business practices and quality expectations in different regions can help facilitate better communication and partnerships.

- Logistics and Supply Chain Considerations: Evaluate the supplier’s logistics capabilities to ensure timely delivery and compliance with quality standards throughout the supply chain.

Conclusion

Manufacturing processes and quality assurance for dental implants are complex yet critical to ensuring successful outcomes in dental procedures. By understanding these processes and actively verifying supplier quality controls, international B2B buyers can make informed decisions, ensuring they partner with reliable manufacturers. This diligence not only enhances the safety and effectiveness of dental implants but also contributes to the overall success of their business ventures.

Related Video: How Paper Cups Are Made | Factory Production Tour

Comprehensive Cost and Pricing Analysis for dental implant phases Sourcing

When sourcing dental implants, understanding the comprehensive cost structure and pricing dynamics is essential for international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe. This analysis will equip buyers with the insights necessary to make informed purchasing decisions.

Cost Components

-

Materials: The primary cost driver in dental implant sourcing is the materials used, which often include titanium, zirconia, and various biocompatible coatings. High-quality materials not only enhance the longevity of implants but also impact the overall cost significantly. Buyers should consider both the type and source of materials, as these factors can vary widely in price and availability across regions.

-

Labor: Labor costs can vary based on geographic location and the skill level required for manufacturing dental implants. In regions with lower labor costs, such as some parts of South America and Africa, manufacturers may offer more competitive pricing. However, it’s crucial to ensure that the quality of workmanship meets international standards.

-

Manufacturing Overhead: This includes expenses related to utilities, facility maintenance, and administrative costs. Efficient manufacturing processes can lower overhead, allowing suppliers to offer more competitive prices. Buyers should inquire about the production capabilities and efficiency of potential suppliers.

-

Tooling: The cost of specialized tools and equipment for manufacturing dental implants can also affect pricing. Suppliers that have invested in advanced manufacturing technologies may have higher upfront costs but can produce higher quality products at scale, benefiting buyers in the long run.

-

Quality Control (QC): Rigorous QC processes are essential in the dental industry to ensure product safety and efficacy. Suppliers that implement stringent QC measures may have higher costs, but this investment often translates into reduced risk for buyers.

-

Logistics: Transportation and shipping costs can vary greatly depending on the supplier’s location and the chosen shipping method. Incoterms, which define the responsibilities of buyers and sellers, play a critical role in determining who bears these costs. Buyers must factor in these logistics costs when evaluating total expenses.

-

Margin: Supplier margins can vary based on market conditions, competition, and the uniqueness of the product. Understanding the typical margin in the region can provide insights into pricing flexibility during negotiations.

Price Influencers

-

Volume/MOQ: Bulk purchasing often leads to reduced costs per unit. Negotiating minimum order quantities (MOQs) that align with your operational needs can create significant savings.

-

Specifications and Customization: Custom-designed implants or those with specific specifications can incur additional costs. Buyers should clearly define their requirements to avoid unexpected charges.

-

Quality and Certifications: Implants must meet various regulatory standards, particularly in regions with strict healthcare regulations. Suppliers with certifications such as ISO or CE Mark may charge a premium but offer assurances of quality.

-

Supplier Factors: The reputation and reliability of suppliers can influence pricing. Established suppliers with a proven track record may command higher prices but reduce the risk of supply chain disruptions.

-

Incoterms: Understanding Incoterms is crucial as they determine the allocation of shipping costs and responsibilities. Choosing the right Incoterm can lead to cost savings and better control over the logistics process.

Buyer Tips

-

Negotiation: Engage in open discussions with suppliers regarding pricing structures and potential discounts for bulk orders. Leverage competition among suppliers to negotiate better terms.

-

Cost-Efficiency: Consider the Total Cost of Ownership (TCO) rather than just the upfront price. This includes factoring in logistics, potential warranty costs, and the lifespan of the implants.

-

Pricing Nuances: Be aware that prices can fluctuate based on global supply chain dynamics, currency exchange rates, and local market conditions. Staying informed about these factors can help you make timely purchasing decisions.

Buyers should approach the sourcing of dental implants with a comprehensive understanding of these cost components and pricing influencers. While indicative prices can provide a starting point, ongoing market analysis and supplier engagement will ensure that you secure the best value for your investment.

Spotlight on Potential dental implant phases Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘dental implant phases’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for dental implant phases

Key Technical Properties for Dental Implant Phases

When sourcing dental implants, understanding essential technical properties is crucial for ensuring product quality, compatibility, and long-term success in the market. Below are critical specifications that B2B buyers should consider:

-

Material Grade: Dental implants are typically made from titanium or zirconia, both of which have varying grades. Material grade affects biocompatibility, strength, and corrosion resistance. For buyers, selecting the right grade is essential for ensuring longevity and patient safety, particularly in regions with diverse environmental factors.

-

Surface Treatment: The surface of a dental implant can be treated through processes such as sandblasting or acid-etching to enhance osseointegration—the process by which the implant anchors to the bone. Understanding surface treatments allows buyers to assess the effectiveness of implants in different clinical scenarios, especially in markets where bone quality may vary.

-

Tolerance: Tolerance refers to the permissible limit of variation in a physical dimension. For dental implants, tight tolerances are crucial for ensuring proper fit and stability. Inaccuracies can lead to complications, making it vital for buyers to verify the manufacturer’s tolerance specifications to prevent issues during surgical procedures.

-

Load-Bearing Capacity: This property indicates how much weight an implant can withstand. It is particularly important in high-stress applications, such as molar replacements. Buyers should consider load-bearing capacity to ensure that the implants will perform well under expected conditions, especially in regions with higher rates of dental issues.

-

Length and Diameter Options: Implants come in various lengths and diameters to accommodate different anatomical needs. Understanding these options helps buyers choose implants that are suitable for their target demographics and clinical needs, ensuring that they can cater to a diverse patient base.

Common Trade Terminology in Dental Implants

Familiarity with industry jargon can enhance communication and negotiation with suppliers. Here are some key terms:

-

OEM (Original Equipment Manufacturer): An OEM produces parts or equipment that may be marketed by another manufacturer. In the dental implant industry, understanding whether a supplier is an OEM can help buyers assess product quality and reliability.

-

MOQ (Minimum Order Quantity): This term refers to the smallest number of units that a supplier is willing to sell. Knowing the MOQ is essential for buyers to manage inventory effectively and ensure that they can meet demand without overcommitting resources.

-

RFQ (Request for Quotation): An RFQ is a document sent to suppliers to solicit price quotes for specific products. Buyers should utilize RFQs to obtain competitive pricing and clarify technical specifications, which can help in making informed purchasing decisions.

-

Incoterms: These international commercial terms define the responsibilities of buyers and sellers in global transactions. Understanding Incoterms is crucial for buyers in different regions to avoid misunderstandings regarding shipping, insurance, and delivery responsibilities.

-

CE Marking: In Europe, CE marking indicates that a product complies with health, safety, and environmental protection standards. For international buyers, particularly in Europe, verifying CE marking is essential to ensure regulatory compliance and market access.

-

Biocompatibility: This term refers to the ability of a material to perform with an appropriate host response in a specific application. For dental implants, high biocompatibility is crucial for preventing adverse reactions in patients. Buyers should prioritize suppliers who can demonstrate biocompatibility through rigorous testing.

By grasping these technical properties and trade terminologies, B2B buyers can make informed decisions that enhance their purchasing strategies and foster successful partnerships in the dental implant market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dental implant phases Sector

Market Overview & Key Trends

The global dental implant market is experiencing robust growth, driven by an increasing demand for cosmetic dentistry and advancements in dental technologies. Key factors such as an aging population, rising disposable incomes, and greater awareness of oral health are propelling market dynamics. For international B2B buyers from Africa, South America, the Middle East, and Europe, understanding these drivers is crucial for effective sourcing strategies.

Emerging technologies like 3D printing and digital dentistry are reshaping the landscape, offering enhanced precision and customization in dental implants. These innovations are not only improving patient outcomes but also streamlining the supply chain, making it essential for buyers to stay abreast of these developments. Additionally, the integration of artificial intelligence in diagnostic and treatment planning is becoming increasingly prevalent, presenting opportunities for B2B partnerships that leverage tech-driven solutions.

Another significant trend is the shift toward regional sourcing to mitigate supply chain risks. As geopolitical tensions and global disruptions have highlighted vulnerabilities, many buyers are considering local suppliers to ensure reliability and compliance with local regulations. This is particularly relevant for buyers in Africa and South America, where the local manufacturing capabilities are expanding, offering competitive alternatives to traditional markets.

In summary, the dental implant sector is characterized by rapid technological advancements, a shift towards regional sourcing, and an increasing focus on quality and compliance. For B2B buyers, staying informed about these trends will enhance strategic sourcing decisions and facilitate successful partnerships.

Sustainability & Ethical Sourcing in B2B

Sustainability has emerged as a critical concern in the dental implant sector, influencing purchasing decisions among B2B buyers. The environmental impact of manufacturing processes, including waste generation and energy consumption, necessitates a shift towards more sustainable practices. Buyers are increasingly prioritizing suppliers who demonstrate a commitment to sustainability, as this aligns with both regulatory requirements and consumer expectations.

Ethical sourcing is equally important, particularly in regions where labor practices may vary significantly. Buyers must ensure that their suppliers adhere to ethical labor standards, promoting fair wages and safe working conditions. This not only mitigates reputational risks but also strengthens supply chain resilience.

Moreover, the adoption of ‘green’ certifications and materials is becoming a focal point for buyers. Materials such as biocompatible polymers and recycled metals are gaining traction, as they minimize environmental impact while maintaining performance standards. By sourcing from manufacturers that prioritize sustainability, buyers can contribute to a more responsible industry and enhance their brand reputation.

In conclusion, integrating sustainability and ethical sourcing into procurement strategies is not just a trend; it is becoming a necessity for B2B buyers in the dental implant phases sector. This approach not only addresses environmental and social concerns but also positions businesses as leaders in responsible sourcing.

Brief Evolution/History

The dental implant sector has evolved significantly over the past few decades, transitioning from rudimentary designs to highly advanced, biocompatible solutions. Early dental implants, made primarily of metal, were often associated with high failure rates. However, the introduction of materials like titanium in the 1960s revolutionized the field, offering improved integration with bone and higher success rates.

As the demand for aesthetic and functional dental solutions increased, innovations such as osseointegration and surface treatments emerged, enhancing the longevity and performance of implants. The rise of digital technology in the 21st century further accelerated this evolution, allowing for precise diagnostics and customized solutions tailored to individual patient needs.

For B2B buyers, understanding this historical context is essential, as it highlights the trajectory of innovation and the importance of partnering with suppliers that are at the forefront of technological advancements. By leveraging this knowledge, buyers can make informed decisions that align with market demands and future trends.

Frequently Asked Questions (FAQs) for B2B Buyers of dental implant phases

-

What criteria should I use to vet suppliers of dental implant phases?

When vetting suppliers, prioritize their industry experience, reputation, and certifications. Look for suppliers that have been in the dental implant market for several years and have positive reviews from other international buyers. Additionally, ensure they possess relevant certifications such as ISO 13485 for quality management systems and CE marking for compliance with European standards. Request references and case studies to assess their product quality and reliability in fulfilling orders. -

Can dental implant phases be customized to meet specific needs?

Many suppliers offer customization options for dental implant phases, including variations in size, material, and design. When sourcing, communicate your specific requirements early in the negotiation process to ensure suppliers can accommodate your needs. Be clear about the desired specifications and any regulatory requirements in your region. Customization can sometimes lead to longer lead times, so factor this into your planning. -

What are typical minimum order quantities (MOQs) and lead times for dental implant phases?

MOQs can vary significantly among suppliers, often ranging from 50 to 500 units, depending on the product and supplier capabilities. Discuss MOQs upfront to avoid unexpected costs. Lead times typically range from 4 to 12 weeks, influenced by factors such as production schedules and shipping logistics. For urgent needs, consider suppliers that offer expedited services, but be prepared for higher costs. -

What payment terms should I expect when purchasing dental implant phases?

Payment terms can vary widely among suppliers, but common practices include upfront payments, partial payments, or letters of credit. International transactions may also involve additional fees or currency exchange considerations. Ensure that you clearly understand the payment terms before finalizing contracts. It’s advisable to negotiate favorable terms that provide you with protection, such as escrow services or milestone payments based on delivery stages. -

How do I ensure quality assurance and certification compliance for dental implants?

Request documentation of quality assurance processes and certifications from your suppliers. Verify that their products comply with international standards, such as ISO certifications and relevant regional regulations. Conducting audits or site visits can also be beneficial. Additionally, consider third-party quality assurance services to evaluate the products before shipment, ensuring they meet your required specifications.

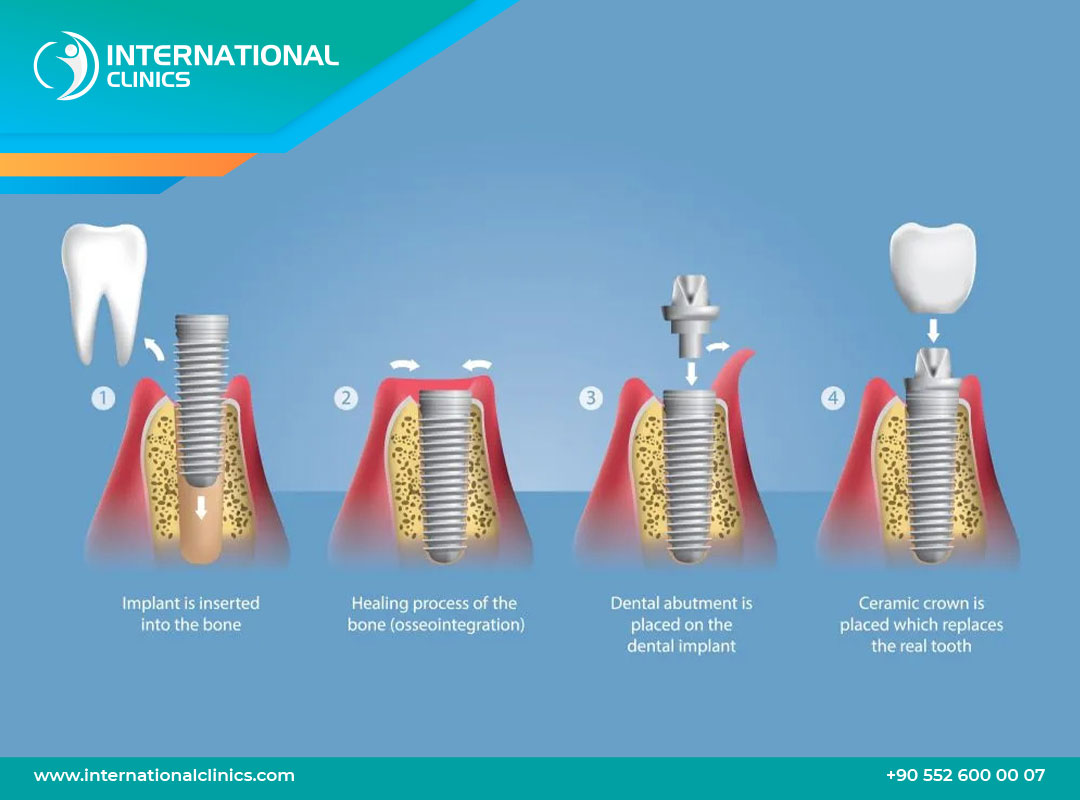

Illustrative Image (Source: Google Search)

-

What logistics considerations should I keep in mind for importing dental implant phases?

Logistics play a crucial role in the timely delivery of dental implant phases. Evaluate shipping options, including air freight for urgent deliveries and sea freight for larger volumes. Be aware of customs regulations in your region, as they can impact delivery times. Collaborate with logistics partners experienced in medical device transport to navigate customs clearance efficiently and minimize delays. -

How can disputes with suppliers be effectively managed?

Establish clear communication and documentation practices to prevent disputes. Draft contracts that outline terms of service, delivery schedules, and quality expectations. In the event of a disagreement, address issues promptly and professionally, aiming for a resolution through negotiation. Consider including arbitration clauses in contracts to provide a structured process for dispute resolution, which can help avoid lengthy and costly legal battles. -

What are the key trends impacting the dental implant market globally?

The global dental implant market is witnessing trends such as the increasing demand for minimally invasive procedures and advancements in implant technology, including 3D printing and digital workflows. Sustainability is also becoming a priority, with a growing emphasis on eco-friendly materials. Staying informed about these trends can help buyers anticipate market shifts and align their sourcing strategies accordingly, ensuring they remain competitive in their regions.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for dental implant phases

Strategic sourcing in the dental implant industry is essential for international B2B buyers seeking to enhance their supply chain efficiency and product quality. Key takeaways from our exploration include the importance of establishing robust supplier relationships, understanding regional market dynamics, and leveraging technological advancements to streamline procurement processes. Strategic sourcing not only reduces costs but also improves the overall quality of dental implants, which is crucial in meeting the diverse needs of patients across different regions.

For buyers in Africa, South America, the Middle East, and Europe, navigating the complexities of sourcing requires a proactive approach. Emphasizing transparency and sustainability in supplier selection can foster long-term partnerships that yield significant competitive advantages. Additionally, staying informed about regulatory changes and market trends will enable businesses to make strategic decisions that align with their growth objectives.

As the dental implant market continues to evolve, it is vital for B2B buyers to adapt their sourcing strategies accordingly. By prioritizing innovation and collaboration, companies can position themselves for success in an increasingly competitive landscape. Now is the time to engage with reliable partners and invest in solutions that will enhance your supply chain resilience and product offerings.