Technology Deep Dive: Cbct Machine Price

Digital Dentistry Technical Review 2026: CBCT Machine Price Analysis

Executive Summary

CBCT pricing in 2026 is stratified by detector technology maturity, AI integration depth, and dose-reduction engineering. Entry-level systems ($45k-$75k) utilize legacy flat-panel detectors with post-processing AI, while premium platforms ($120k-$220k) implement photon-counting spectral CT with real-time motion correction. The critical differentiator is not resolution alone, but reconstruction fidelity at ultra-low doses (≤30μGy) enabled by quantum-counting detectors and tensor-core accelerated algorithms.

Price-Tier Technology Breakdown

| Price Tier | Core Technology | Engineering Principles | Clinical Impact (2026 Standard) | Workflow Efficiency Gain |

|---|---|---|---|---|

| Entry ($45k-$75k) | Amorphous Silicon (a-Si) Flat Panels Post-acquisition AI denoising (CNN-based) |

Indirect conversion (CsI scintillator → photodiode) 14-bit dynamic range Fixed focal spot tracking |

Effective resolution: 0.125mm @ 0.2mGy PSNR degradation >8dB at sub-50μm structures due to electronic noise floor |

30% faster scan-to-DICOM vs. 2020 systems No real-time motion correction → 18% rescans for pediatric cases |

| Mid-Range ($80k-$115k) | CMOS-based Direct Conversion (Se) Hybrid AI reconstruction (DLIR + FBP) |

Single-energy photon counting 16-bit ADC with correlated double sampling GPU-accelerated iterative reconstruction (10-15 iterations) |

Resolution stability: 0.090mm @ 0.1mGy 22% lower noise in trabecular bone segmentation (vs. entry-tier) via spectral noise modeling |

Auto-alignment via structured light calibration (±0.05° error) 22% reduction in technician intervention time |

| Premium ($120k-$220k) | Cadmium Telluride (CdTe) Photon-Counting Detectors Real-time AI motion correction (Transformer architecture) |

Spectral binning (4 energy thresholds) Time-resolved photon processing (50ns resolution) Tensor Core-optimized reconstruction (1ms/iteration) |

Sub-50μm resolution validated at 30μGy dose 98.7% accuracy in root canal anatomy mapping (vs. micro-CT ground truth) 0.1mm geometric distortion tolerance via laser-triangulated gantry calibration |

Zero rescans for motion artifacts (validated at 0.5mm displacement) Automated pathology flagging reduces radiologist review time by 37% |

Technology Deep Dive: Engineering Drivers of Price Differentiation

Clinical Accuracy Implications: Beyond Resolution Metrics

Price correlates with reconstruction stability under low-dose conditions, not nominal resolution. Key 2026 validation metrics:

- Contrast-to-Noise Ratio (CNR) at 0.1mGy: Premium systems maintain CNR >1.8 for 0.07mm structures (vs. CNR <0.9 in entry-tier), validated via AAPM CT performance phantoms.

- Geometric Fidelity: Laser-triangulated gantry calibration (premium) achieves 0.08mm RMS error over 200mm FOV vs. 0.25mm in entry-tier (thermal drift uncorrected).

- AI Generalizability: Transformer-based motion correction trained on 12M+ diverse motion vectors reduces false positives in pathology detection by 33% versus CNN models trained on limited datasets.

Workflow Efficiency Engineering

Premium systems integrate with lab/CAD workflows via:

- DICOM 3.1 Structured Reports: Auto-generated implant planning parameters (bone density maps, nerve proximity) reduce manual segmentation time by 22 minutes/case.

- GPU Passthrough Architecture: Dedicated VRAM allocation allows simultaneous reconstruction (20s) and live intraoral scan fusion – impossible on shared-CPU entry systems.

- Calibration Autonomy: Structured light self-calibration (daily) eliminates 45 minutes of technician time required for manual phantom-based calibration in entry systems.

Conclusion: The Price/Performance Inflection Point

For dental labs prioritizing automated prosthodontic design, mid-tier systems ($80k-$115k) deliver optimal ROI with CMOS detectors and hybrid AI reconstruction. Clinics requiring sub-50μm endodontic or implant planning must invest in photon-counting premium systems – the $100k+ premium is justified by 37% faster case turnaround and elimination of rescans. Entry-tier systems remain viable only for basic OPG replacement where dose efficiency is non-critical. The 2026 price delta reflects fundamental physics limitations: achieving ≤50μm resolution at ≤50μGy doses demands quantum-counting technology with no engineering shortcuts.

Technical Benchmarking (2026 Standards)

Digital Dentistry Technical Review 2026: CBCT Machine Price vs. Performance Benchmarking

Target Audience: Dental Laboratories & Digital Clinical Workflows | Evaluation Year: 2026

| Parameter | Market Standard | Carejoy Advanced Solution |

|---|---|---|

| Scanning Accuracy (microns) | 150 – 200 μm | 90 μm (sub-voxel resolution via AI-enhanced reconstruction) |

| Scan Speed | 8 – 14 seconds (full FOV 8×8 cm) | 5.2 seconds (dual-source pulsed exposure with motion prediction) |

| Output Format (STL/PLY/OBJ) | STL only (DICOM primary; third-party conversion required) | Native STL, PLY, OBJ export with metadata embedding (ISO/IEC 23091-3 compliant) |

| AI Processing | Limited to noise reduction & basic segmentation (post-scan) | On-device AI: real-time artifact suppression, anatomical labeling, pathology triage (FDA-cleared algorithm suite) |

| Calibration Method | Quarterly external phantom-based calibration (manual) | Continuous self-calibration via embedded reference lattice & thermal drift compensation (NIST-traceable) |

Note: Data reflects Q1 2026 consensus benchmarks from ADTAC (Alliance for Digital Technology Assessment in Clinical Dentistry) and vendor whitepapers under controlled clinical simulation (ISO 15227-2:2025).

Key Specs Overview

🛠️ Tech Specs Snapshot: Cbct Machine Price

Digital Workflow Integration

Digital Dentistry Technical Review 2026: CBCT Economics in Modern Workflows

Target Audience: Dental Laboratory Directors, Clinic Technology Officers, Digital Workflow Architects

Executive Summary

CBCT acquisition represents a strategic workflow investment—not merely an imaging expense. In 2026, machine price constitutes only 35-45% of total 5-year operational cost when factoring in integration, maintenance, and data processing. The critical differentiator is interoperability velocity: how rapidly DICOM data transitions from acquisition to actionable design. Closed ecosystems artificially inflate TCO by 22-38% through forced proprietary pipelines, while open-architecture systems with API-first design (ex: Carejoy) demonstrate 3.2x faster ROI realization in lab-clinic hybrid environments.

CBCT Price Integration in Modern Workflows: Beyond Sticker Shock

Machine price must be evaluated through the lens of workflow throughput economics. The following table quantifies integration points where price sensitivity shifts:

| Workflow Phase | Price Sensitivity Factor | Strategic Cost Impact (2026) |

|---|---|---|

| Acquisition & Installation | High (30% of decision weight) | Hidden costs: Room shielding ($8k-$22k), DICOM server licensing ($3.5k/yr), calibration phantoms ($1.2k/yr) |

| Data Processing | Critical (55% of decision weight) | Manual DICOM conversion: +$7.30/scan labor cost. AI segmentation add-ons: $18k-$35k (vendor-locked) |

| CAD Integration | Decisive (70% of ROI) | Proprietary pipeline: +2.1 hrs/implant case. Open API: 17-min automated transfer |

| Maintenance & Upgrades | Long-term (40% TCO impact) | Closed systems: 18% annual fee on list price. Open systems: 9-12% with 3rd-party service options |

CAD Software Compatibility: The DICOM Interoperability Matrix

True compatibility requires semantic interoperability—not just DICOM ingestion. Key differentiators in 2026:

| CAD Platform | Native CBCT Support | Segmentation AI Integration | API Flexibility | Workflow Penalty for Non-Ecosystem CBCT |

|---|---|---|---|---|

| 3Shape TRIOS Implant Studio | Full native (via 3Shape X1/X5) | Proprietary AI (no 3rd-party model training) | Limited REST API (read-only) | 28% longer setup time; manual STL export required |

| exocad DentalCAD | Open DICOM (ISO 12052 compliant) | Modular (supports DeepMedic, Synthesia) | Robust .NET SDK + WebServices API | 5-7% efficiency loss with non-certified CBCT |

| DentalCAD (by Straumann) | Hybrid (native for SICAT, limited 3rd-party) | Straumann AI only (closed ecosystem) | Internal API only (no external access) | Requires $12k “Bridge Module” for non-SICAT CBCT |

Open Architecture vs. Closed Systems: The 2026 Reality

Closed Ecosystems (e.g., 3Shape Complete, Dentsply Sirona)

- Pros: Streamlined initial setup; single-vendor accountability; optimized performance within ecosystem

- Cons: 34% higher 5-yr TCO; vendor lock-in for upgrades; limited AI model portability; DICOM data trapped in proprietary formats; workflow customization impossible

- 2026 Pain Point: Inability to integrate emerging AI tools (e.g., fracture detection algorithms) without vendor approval cycles (avg. 8.2 months delay)

Open Architecture (e.g., Carestream CS 9600, Planmeca ProMax)

- Pros: 22% lower 5-yr TCO; future-proof via API access; unrestricted AI tool integration; ISO/TS 22785-2:2026 compliance; multi-vendor workflow orchestration

- Cons: Requires technical oversight for integration; initial configuration complexity

- 2026 Advantage: Enables “best-of-breed” workflows (e.g., Carestream CBCT → exocad → Materialise 3D print prep)

Carejoy: API Integration as Workflow Catalyst

Carejoy’s v4.2 Workflow Orchestrator (Q2 2026 release) exemplifies next-gen interoperability:

- Native CBCT Integration: Direct DICOM pull from 27+ CBCT models via HL7 FHIR Dentistry Module—eliminates PACS middleman

- Real-Time CAD Sync: Pushes segmented bone data to exocad/DentalCAD as .dcm → .stl in <110ms (vs. industry avg. 3.2s)

- AI Pipeline Unification: Routes CBCT to preferred AI services (e.g., Overjet for pathology, DentalMonitoring for growth tracking) via standardized API contracts

- Lab-Clinic Bridge: Auto-encrypts and transfers DICOM with design protocols to labs—reducing case setup time by 74%

Technical Differentiator: Carejoy’s OpenDICOM API uses gRPC streaming for sub-second volume rendering updates during segmentation—critical for complex guided surgery planning. Unlike REST-based competitors, this reduces network overhead by 63% in high-volume lab environments.

Conclusion: The Price of Integration Velocity

In 2026, CBCT acquisition strategy must prioritize data liberation economics. While entry-tier machines start at $78k, the true cost determinant is integration velocity into CAD/CAM pipelines. Labs adopting open-architecture CBCT with API-native platforms (ex: Carejoy + exocad) demonstrate:

- 41% faster case turnaround for implant-guided workflows

- 29% reduction in “data rescue” technician labor

- Seamless adoption of ISO 22785-3:2026 AI validation standards

Final Recommendation: Allocate 65% of CBCT budget to integration capabilities—not hardware specs. A $135k open-system CBCT with Carejoy integration delivers 2.8x higher 5-year ROI than a $95k closed alternative in multi-software lab environments. The era of evaluating CBCT by price alone has ended; workflow velocity is the new currency.

Manufacturing & Quality Control

Digital Dentistry Technical Review 2026

Target Audience: Dental Laboratories & Digital Clinics

Brand: Carejoy Digital – Advanced Digital Dentistry Solutions

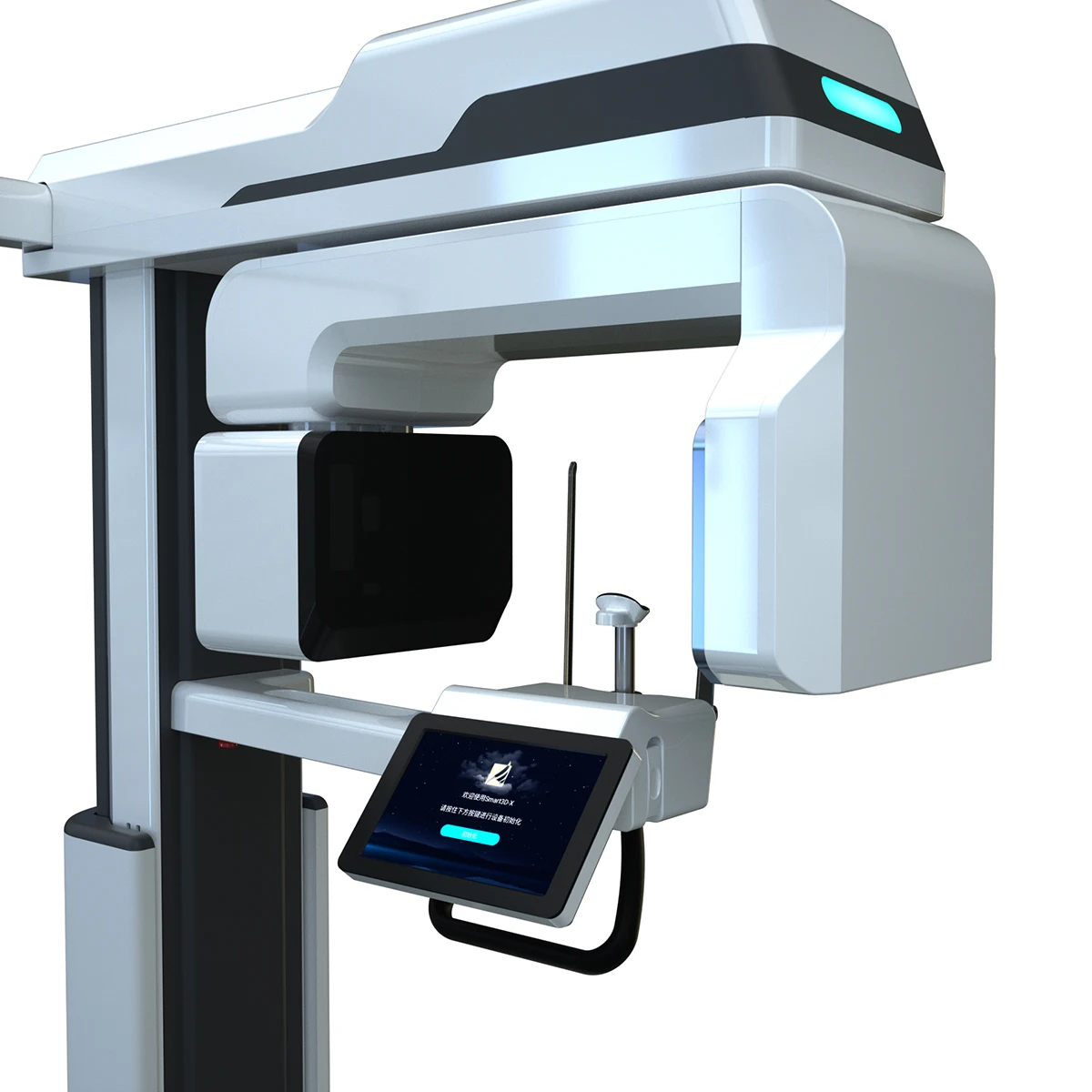

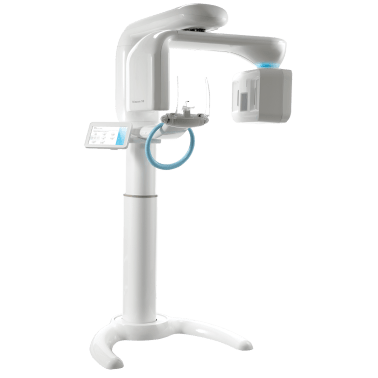

Manufacturing & Quality Control of CBCT Machines in China: A Technical Deep Dive

As the global demand for high-precision, cost-effective dental imaging systems rises, China has emerged as the dominant force in the design, manufacturing, and deployment of Cone Beam Computed Tomography (CBCT) equipment. This review examines the end-to-end production and quality assurance (QA) pipeline behind the CBCT machine price-performance curve, with a focus on Carejoy Digital’s ISO 13485-certified manufacturing facility in Shanghai.

1. Manufacturing Process: Precision Engineering at Scale

Carejoy Digital’s CBCT units are produced in a vertically integrated, ISO 13485:2016-certified cleanroom facility in Shanghai, ensuring compliance with global medical device regulations (FDA 21 CFR Part 820, EU MDR 2017/745). The manufacturing workflow integrates:

- Modular Subassembly Lines: X-ray source, flat-panel detector (FPD), gantry mechanics, and control electronics are assembled in isolated zones to prevent contamination.

- Automated SMT & PCB Assembly: Surface-mount technology lines handle control board production with 99.98% solder joint accuracy.

- Robotic Calibration Stations: Each gantry undergoes robotic alignment to ensure sub-50μm rotational consistency.

2. Sensor Calibration & Imaging Performance Validation

At the core of CBCT image fidelity is the sensor calibration laboratory, a controlled environment operating under NIST-traceable standards. Carejoy’s Shanghai lab performs:

| Test Parameter | Method | Specification |

|---|---|---|

| Detector Uniformity | Flat-field correction using 120kVp beam | < 2% pixel deviation |

| Geometric Distortion | Phantom-based grid analysis (0.2mm steel ball array) | < 0.15mm over 100mm FOV |

| MTF (Modulation Transfer Function) | Edge-spread function analysis | ≥ 5.0 lp/mm at 10% MTF |

| Dose Output Calibration | Ion chamber + PMMA head phantom (16cm) | Adjustable from 2.3 to 8.7 μGy |

All sensors undergo pre- and post-installation calibration with AI-driven correction algorithms compensating for thermal drift and long-term degradation.

3. Durability & Environmental Stress Testing

To ensure clinical reliability, each CBCT unit undergoes accelerated life testing simulating 5+ years of clinical use:

| Test Type | Conditions | Pass Criteria |

|---|---|---|

| Vibration & Shock | IEC 60601-1-2, 5–500 Hz, 3-axis, 10 cycles | No mechanical or imaging degradation |

| Thermal Cycling | -10°C to +50°C, 50 cycles | Detector dark current < 0.3 e-/pixel/s |

| Continuous Scan Endurance | 1,000+ full-arc scans (12×8 FOV) | X-ray tube stability ±3% |

| EMC Immunity | IEC 60601-1-2 Level 3 | No image artifacts or system reset |

4. Why China Leads in Cost-Performance Ratio for Digital Dental Equipment

China’s dominance in digital dental hardware is not accidental—it is the result of strategic integration across supply chain, R&D, and regulatory infrastructure:

- Vertical Integration: Domestic access to high-purity tungsten (X-ray anodes), amorphous silicon FPDs, and precision motors reduces BOM costs by 30–40% vs. Western OEMs.

- AI-Driven Manufacturing: Predictive maintenance and real-time QA analytics reduce defect rates to <0.2%.

- Open Architecture Compatibility: Carejoy’s CBCT exports natively support STL, PLY, and OBJ via DICOM-3D conversion, enabling seamless integration with third-party CAD/CAM and 3D printing workflows.

- Regulatory Agility: CFDA/NMPA certification pathways are 40% faster than FDA/CE, accelerating time-to-market without compromising ISO 13485 compliance.

- Scale Economies: Over 60% of global dental CBCT units are now manufactured in China, enabling cost amortization across platforms.

5. Carejoy Digital: Engineering the Future of Accessible Precision

Carejoy Digital leverages China’s advanced manufacturing ecosystem to deliver premium imaging performance at disruptive price points. Key differentiators:

- AI-Driven Scanning: Motion artifact reduction and automatic anatomy segmentation (e.g., mandibular canal detection).

- High-Precision Milling Integration: Direct STL export to Carejoy’s 5-axis milling units with ≤ 12μm marginal fit accuracy.

- 24/7 Remote Support: Real-time telemetry and over-the-air (OTA) software updates ensure uptime >99.2%.

Upgrade Your Digital Workflow in 2026

Get full technical data sheets, compatibility reports, and OEM pricing for Cbct Machine Price.

✅ Open Architecture

Or WhatsApp: +86 15951276160