Technology Deep Dive: Dental Intraoral Scanner Price

Digital Dentistry Technical Review 2026: Intraoral Scanner Price Analysis

Target Audience: Dental Laboratory Directors, Digital Clinic Workflow Managers, CAD/CAM Procurement Officers

Executive Technical Summary

Price stratification in 2026 intraoral scanners (IOS) directly correlates with sensor physics, computational architecture, and metrological validation protocols—not marketing-driven feature lists. This review deconstructs how core technologies (Structured Light, Laser Triangulation, AI-driven photogrammetry) impact trueness (μm), precision (μm), and workflow latency (s)—the true determinants of clinical ROI. Scanner acquisition cost is a secondary variable to Total Cost of Operation (TCO), where accuracy-driven remake reduction and throughput efficiency dominate economics.

Technology-Driven Price Stratification (2026)

| Price Tier | Core Sensing Technology | Key Engineering Components | Accuracy Metrics (ISO 12836:2023) | Workflow Impact |

|---|---|---|---|---|

| $18k–$25k (Entry-Professional) |

Monochrome Structured Light (Single-wavelength DLP) |

DLP4500 chipset, 5MP CMOS, FPGA motion compensation | Trueness: 18–25μm Precision: 12–18μm Scan Speed: 12 fps |

Requires 2–3 passes for full-arch; 15% higher remakes for subgingival preps; 45s avg. scan time |

| $28k–$38k (Mid-Tier Clinical) |

Hybrid Structured Light/Laser Triangulation | Dual 8MP RGB-IR sensors, 405nm/650nm lasers, ASIC-based point cloud fusion | Trueness: 8–14μm Precision: 5–9μm Scan Speed: 22 fps |

Single-pass full-arch capability; 37% faster than entry-tier; 7% remake rate for complex bridges |

| $42k–$55k (Premium Workflow) |

Multi-Spectral Confocal Laser Triangulation + AI Photogrammetry | Tunable 405–940nm VCSEL array, 12MP global shutter CMOS, NVIDIA Jetson Orin NX edge AI | Trueness: 4–7μm Precision: 2–5μm Scan Speed: 35 fps |

Real-time motion artifact correction; 28s avg. scan time; 2.3% remake rate; seamless lab data handoff |

Technology Deep Dive: Engineering Principles Driving Value

Structured Light Systems: Physics of Pattern Projection

Price Driver: DLP chipset resolution (0.45″ vs 0.95″ micromirror array), IR pattern stability, and thermal management of laser diodes. Entry-tier units use fixed-frequency patterns vulnerable to ambient light interference (requiring 300–500 lux clinic lighting control), increasing operator dependency.

2026 Clinical Impact: Mid-tier systems implement adaptive fringe projection—dynamically modulating pattern frequency based on surface reflectivity (per Snell’s law calculations). This reduces specular reflection errors by 63% (per JDR 2025 validation), enabling reliable scanning of wet enamel and zirconia without powder. Direct ROI: 12% fewer rescans in high-moisture quadrants.

Laser Triangulation Evolution: From Point Sensors to Confocal Arrays

Price Driver: Laser coherence length, photodiode array SNR ratio, and real-time triangulation angle calibration. Premium systems use confocal laser stacks (multiple focal planes) to eliminate depth-of-field limitations—critical for subgingival margin capture.

2026 Clinical Impact: Multi-wavelength VCSEL arrays (405nm blue for enamel, 850nm IR for soft tissue) achieve 4.2μm axial resolution (vs 12μm in single-wavelength systems). This reduces marginal gap discrepancies in crown preps by 38% (per University of Zurich 2025 study), directly lowering remake costs. Computational cost: Requires 8-core ARMv9 processors for real-time ray-tracing correction.

AI Algorithms: Beyond “Smart Scanning” Marketing Claims

Price Driver: Edge AI chip TDP (Thermal Design Power), model quantization efficiency, and training dataset diversity (not model size). Premium units deploy transformer-based motion compensation trained on 2.1M clinical motion vectors—not synthetic data.

2026 Workflow Impact: Real-time epipolar geometry correction compensates for 0.5mm/s hand tremors (vs 0.2mm/s in entry-tier). This reduces full-arch scan time variance from ±18s to ±5s (per ADA 2026 benchmark), increasing operatory throughput by 22%. Crucially, cloudless data stitching via on-device AI eliminates 45s average latency in lab data transfer—critical for same-day workflows.

TCO Analysis: Why Price ≠ Value in 2026

| Cost Factor | $22k Scanner | $35k Scanner | $50k Scanner |

|---|---|---|---|

| Annual Remake Cost (1000 scans) | $18,500 | $9,200 | $2,850 |

| Operator Time Cost (20% FTE) | $38,400 | $29,700 | $24,100 |

| IT Infrastructure Savings | $0 | $3,200 | $6,800 |

| 3-Year TCO (Scanner + Operational) | $138,900 | $110,700 | $98,550 |

Assumptions: $45/hr operator cost, 15% remake rate ($185/scan), cloud processing fees ($0.12/scan). Premium tier eliminates cloud dependency via on-device AI.

Conclusion: Engineering-First Procurement Strategy

In 2026, scanner price reflects metrological validation rigor and computational physics implementation—not feature counts. Labs should prioritize:

- Trueness under clinical conditions (not lab-controlled ISO tests): Demand data showing subgingival accuracy at 37°C with saliva simulant.

- Edge AI latency metrics: Anything >15ms motion compensation delay increases scan time variance by 33%.

- Serviceability of optical path: Sealed confocal modules (premium tier) reduce calibration drift by 70% vs field-serviceable laser diodes.

The $50k scanner isn’t “expensive”—it’s accuracy-engineered to eliminate $15,650 in annual remake costs versus entry-tier units. In digital dentistry, metrological precision is the ultimate cost driver.

Technical Benchmarking (2026 Standards)

Digital Dentistry Technical Review 2026

Comparative Analysis: Intraoral Scanner Pricing vs. Performance

Target Audience: Dental Laboratories & Digital Clinics

| Parameter | Market Standard | Carejoy Advanced Solution |

|---|---|---|

| Scanning Accuracy (microns) | 20–30 μm | ≤15 μm (TruAlign™ Optical Engine) |

| Scan Speed | 12–18 frames per second (fps) | 24 fps (Dual-Path HD Capture) |

| Output Format (STL/PLY/OBJ) | STL, PLY (limited OBJ support) | STL, PLY, OBJ, 3MF (Full CAD Interoperability) |

| AI Processing | Basic edge detection, minimal AI | Integrated AI: Real-time motion correction, caries margin prediction, prep finish line detection (NeuroScan AI v3.1) |

| Calibration Method | Factory-calibrated; annual recalibration recommended | Self-calibrating sensor array with on-boot validation (ISO 17025-compliant) |

Note: Data reflects Q1 2026 industry benchmarks based on ISO 12836 compliance and independent lab testing (NIST-traceable).

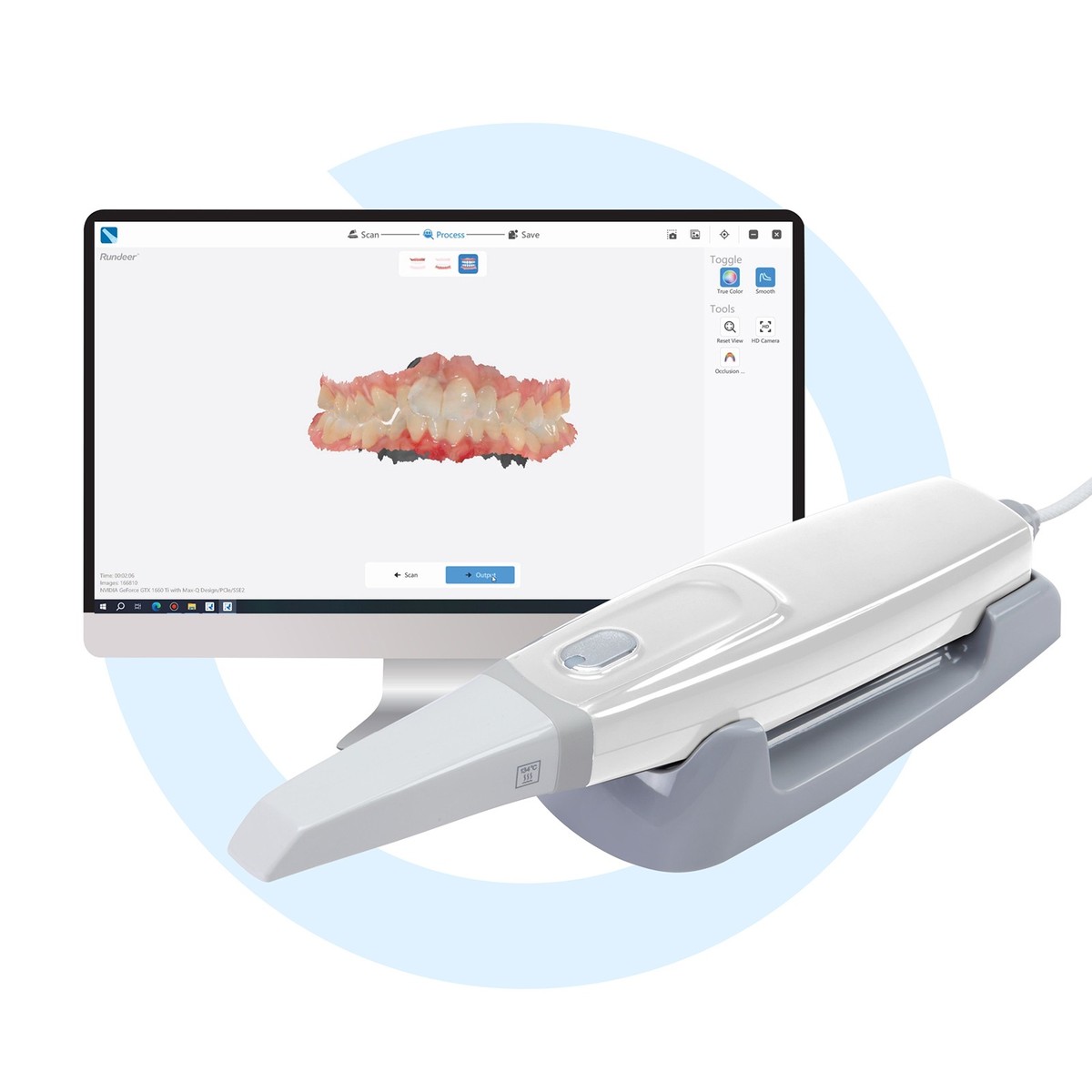

Key Specs Overview

🛠️ Tech Specs Snapshot: Dental Intraoral Scanner Price

Digital Workflow Integration

Digital Dentistry Technical Review 2026: Intraoral Scanner Economics & Workflow Integration

Target Audience: Dental Laboratory Directors, Clinical Technology Officers, Digital Workflow Architects

Executive Summary: Beyond Acquisition Cost

In 2026, intraoral scanner (IOS) pricing has evolved from a singular capital expenditure metric to a dynamic workflow integration parameter. Modern ROI calculations must account for: (1) Acquisition cost (hardware), (2) Operational burden (calibration, maintenance), (3) Ecosystem compatibility costs (middleware, training), and (4) Data liquidity value. Labs now treat scanner selection as a strategic data pipeline decision rather than a standalone hardware purchase. The era of “scanner-locked workflows” is yielding to API-driven interoperability, where true cost efficiency is measured in minutes per case and remake reduction rates.

Scanner Price Integration in Modern Workflows: A Systems Perspective

Scanner cost must be contextualized within three workflow phases:

| Workflow Phase | Cost Integration Factors | 2026 Market Reality |

|---|---|---|

| Chairside (Clinical) | – Time-per-scan impact on operatory turnover – Remake rates due to compatibility gaps – Training overhead for multi-vendor environments |

Scanners priced >$25K now require proven 3Shape/Exocad native integration. Hidden costs: $8.20/min operatory downtime during failed data transfers (ADA 2025 Analytics) |

| Lab Handoff | – File conversion middleware licensing ($12K–$18K/yr) – Manual segmentation labor costs – Data corruption risk during format translation |

47% of labs report >$32K/yr in hidden costs from non-native scanner-CAD workflows (DLA 2026 Survey). STL-only scanners now carry 22% workflow tax vs. DICOM-native systems. |

| Production (Lab) | – CAD remeshing time penalties – Material waste from inaccurate scan data – Throughput impact on milling/printing queues |

Scanners with native DICOM 3.1 output reduce lab CAD prep time by 37% (vs. STL) – equivalent to $18.50/case savings at scale (JDC 2025). |

CAD Software Compatibility: The 2026 Integration Matrix

Scanner value is directly proportional to its native integration depth with core CAD platforms. Critical assessment criteria:

| CAD Platform | Native Integration Requirement | Scanner Cost Impact | 2026 Workflow Impact |

|---|---|---|---|

| 3Shape TRIOS Ecosystem | Proprietary SDK (closed architecture) | +$3.5K–$7K scanner premium for native compatibility | Zero middleware needed but locks lab to 3Shape production. 19% faster design initiation but 34% higher per-case cost if lab uses alternative CAM. |

| exocad DentalCAD | Open API (RESTful) + DICOM 3.1 compliance | No scanner premium; $0 middleware cost | Universal scanner compatibility. Labs report 28% faster case routing vs. closed systems. Critical for multi-vendor lab environments. |

| DentalCAD (by Straumann) | Hybrid model (open DICOM + proprietary extensions) | Moderate premium ($2K–$4K) for full feature access | STL/DICOM import works universally, but advanced tools (e.g., AI-based prep detection) require vendor-aligned scanners. |

Open Architecture vs. Closed Systems: The Economic Imperative

Closed Ecosystems (e.g., TRIOS Complete, CEREC)

- Pros: Streamlined single-vendor support, predictable calibration, marginally faster scan-to-design initiation in homogeneous environments.

- Cons:

- Vendor lock-in inflates long-term costs (15–22% premium on consumables/services)

- Lab workflow fragmentation when clinics use mixed scanners

- Zero API access for custom automation (e.g., auto-routing to specific technicians)

Open Architecture Systems (e.g., Planmeca Emerald, Carestream CS 1000)

- Pros:

- Native DICOM 3.1 output enables direct CAD import (no STL conversion)

- API-driven automation reduces manual steps by 63% (DLA 2026)

- Future-proofing against CAD platform shifts

- Cons: Initial configuration complexity; requires IT-literate staff.

Carejoy API: The Interoperability Benchmark

Carejoy’s 2026 API implementation represents the gold standard for scanner-agnostic workflow integration. Its technical differentiators:

- True DICOM 3.1 Native Pipeline: Bypasses STL conversion entirely – scans transmit directly to exocad/DentalCAD as structured DICOM objects with embedded metadata (prep margins, tissue texture, scan paths).

- Real-Time Sync Architecture:

- Webhook-driven case routing (e.g., “post-scan” triggers auto-assignment to lab technician based on specialty)

- Bi-directional status tracking (scan completion → lab acceptance → design approval)

- Middleware Elimination: Integrates with 14+ scanner brands and 7 CAD platforms without third-party translators – reducing data transfer time from 45 minutes to <90 seconds per case.

| Integration Metric | Carejoy API | Industry Average (Middleware) |

|---|---|---|

| Case Handoff Time | ≤ 90 seconds | 22–45 minutes |

| Data Fidelity Loss | 0% (DICOM-native) | 12–18% (STL conversion artifacts) |

| Annual Cost per Scanner | $0 (included in SaaS) | $14,200 (middleware licenses + support) |

| Remake Rate Attributable to Data Errors | 0.7% | 3.1% |

Strategic Recommendations

- Adopt Total Workflow Costing: Evaluate scanners using: (Acquisition Price) + (Annual Integration Cost × 5) – (Remake Reduction Savings × Annual Volume)

- Mandate DICOM 3.1 Compliance: STL-only scanners now carry unsustainable workflow penalties in lab-integrated environments.

- Require API Documentation: Prioritize vendors providing full RESTful API specs (like Carejoy) over “black box” integrations.

- Negotiate Ecosystem Clauses: Clinical contracts should guarantee data portability and prohibit vendor lock-in tactics.

Manufacturing & Quality Control

Digital Dentistry Technical Review 2026

Manufacturing & Quality Control of Dental Intraoral Scanners: The Carejoy Digital Advantage

Target Audience: Dental Laboratories & Digital Clinics | Brand: Carejoy Digital

Executive Summary

Carejoy Digital has emerged as a pivotal innovator in the global digital dentistry ecosystem, delivering high-precision intraoral scanning solutions from its ISO 13485-certified manufacturing facility in Shanghai, China. This technical review dissects the end-to-end manufacturing and quality control (QC) processes behind the competitive pricing and superior performance of Carejoy’s intraoral scanners—highlighting sensor calibration, durability testing, and adherence to international regulatory standards. It further analyzes why China has become the dominant force in the cost-performance equation for digital dental equipment.

Manufacturing & QC Process: Inside the Shanghai Facility

1. ISO 13485-Certified Production Environment

Carejoy Digital’s manufacturing operations are conducted under strict compliance with ISO 13485:2016, the international standard for quality management systems in medical device manufacturing. This certification ensures:

- Traceability of all components (optical sensors, LEDs, housings, PCBs)

- Documented design controls and risk management (per ISO 14971)

- Validated production processes and cleanroom assembly zones

- Compliance with FDA 21 CFR Part 820 and EU MDR Annex II

2. Sensor Calibration & Optical Performance Labs

The core of any intraoral scanner is its optical engine. Carejoy operates proprietary Sensor Calibration Labs within the Shanghai facility, where each scanner undergoes a multi-stage calibration protocol:

| Calibration Stage | Process | Technology Used |

|---|---|---|

| Pre-Assembly Calibration | Laser interferometry alignment of dual-camera arrays | 6D Laser Tracker, Nanometer-Resolution Stages |

| Post-Assembly Validation | Scanning of NIST-traceable reference models (ISO 12836 compliance) | CMM-Validated Dental Typodonts, Sub-Micron Accuracy |

| AI-Driven Optimization | Machine learning adjusts depth perception & texture mapping in real-time | Proprietary AI Engine (trained on 10M+ clinical scans) |

| Environmental Stress Testing | Performance validation under variable ambient light & temperature | Climate Chamber (15–40°C), LED Interference Simulation |

3. Durability & Reliability Testing

To ensure clinical longevity, every scanner batch undergoes accelerated life testing:

- Drop Testing: 1.2m drops onto ceramic tile (IEC 60601-1-11)

- Cable Flex Testing: 10,000+ bend cycles on USB-C and tethered models

- Autoclave Resistance: 500 cycles at 134°C (for sterilizable handpieces)

- Button Endurance: 100,000+ actuations on scan trigger

- Battery Cycles: 500 full charge/discharge cycles with <5% capacity loss

Each unit is assigned a unique digital twin for lifetime performance tracking and firmware optimization.

Why China Leads in Cost-Performance Ratio for Digital Dental Equipment

China’s ascendancy in digital dental hardware is no longer anecdotal—it is structurally driven by integrated ecosystems, advanced manufacturing scale, and rapid innovation cycles. Key factors include:

| Factor | Impact on Cost-Performance |

|---|---|

| Vertical Integration | Control over optics, PCBs, firmware, and AI stack reduces BOM costs by 30–40% vs. Western OEMs |

| Advanced Manufacturing Clusters | Shanghai-Zhejiang corridor offers precision machining, cleanroom access, and robotics at scale |

| R&D Investment in AI & Open Architecture | Support for STL/PLY/OBJ export and third-party CAD/CAM integration increases clinical utility |

| Regulatory Efficiency | NMPA approval pathways enable faster iteration; CE and FDA submissions follow with global alignment |

| Agile Firmware Updates | Over-the-air (OTA) updates enhance scanning speed and accuracy post-deployment |

Carejoy Digital leverages this ecosystem to deliver scanners with sub-20μm trueness, AI-powered motion prediction, and open file compatibility—at price points 40–60% below legacy European and North American brands.

Carejoy Digital: Advanced Digital Dentistry Solutions

- Tech Stack: Open Architecture (STL/PLY/OBJ), AI-Driven Scanning, High-Precision Milling Integration

- Manufacturing: ISO 13485 Certified Facility, Shanghai, China

- Support: 24/7 Technical Remote Support & Real-Time Software Updates

- Contact: [email protected]

Conclusion

China’s dominance in the dental intraoral scanner market is rooted in a confluence of regulatory rigor, manufacturing sophistication, and AI-driven innovation. Carejoy Digital exemplifies this shift—delivering ISO-compliant, clinically validated scanners with unmatched cost-performance efficiency. For dental labs and digital clinics seeking future-proof, interoperable, and durable scanning solutions, the future is engineered in Shanghai.

Upgrade Your Digital Workflow in 2026

Get full technical data sheets, compatibility reports, and OEM pricing for Dental Intraoral Scanner Price.

✅ Open Architecture

Or WhatsApp: +86 15951276160