Introduction: Navigating the Global Market for dental implant rate

The dental implant market is rapidly evolving, presenting significant opportunities for international B2B buyers. As the demand for dental implants continues to surge, fueled by an increasing prevalence of dental diseases and a growing geriatric population, understanding the dental implant rate becomes essential for informed sourcing decisions. This guide serves as a comprehensive resource, detailing the various types of dental implants, including titanium and zirconium options, and the latest advancements in manufacturing and quality control processes.

By exploring the intricacies of materials and manufacturing standards, buyers can ensure compliance with diverse regulatory frameworks across regions, including those in Africa, South America, the Middle East, and Europe. The insights provided will also cover supplier landscapes and cost structures, enabling buyers to effectively negotiate and select the best partners for their needs.

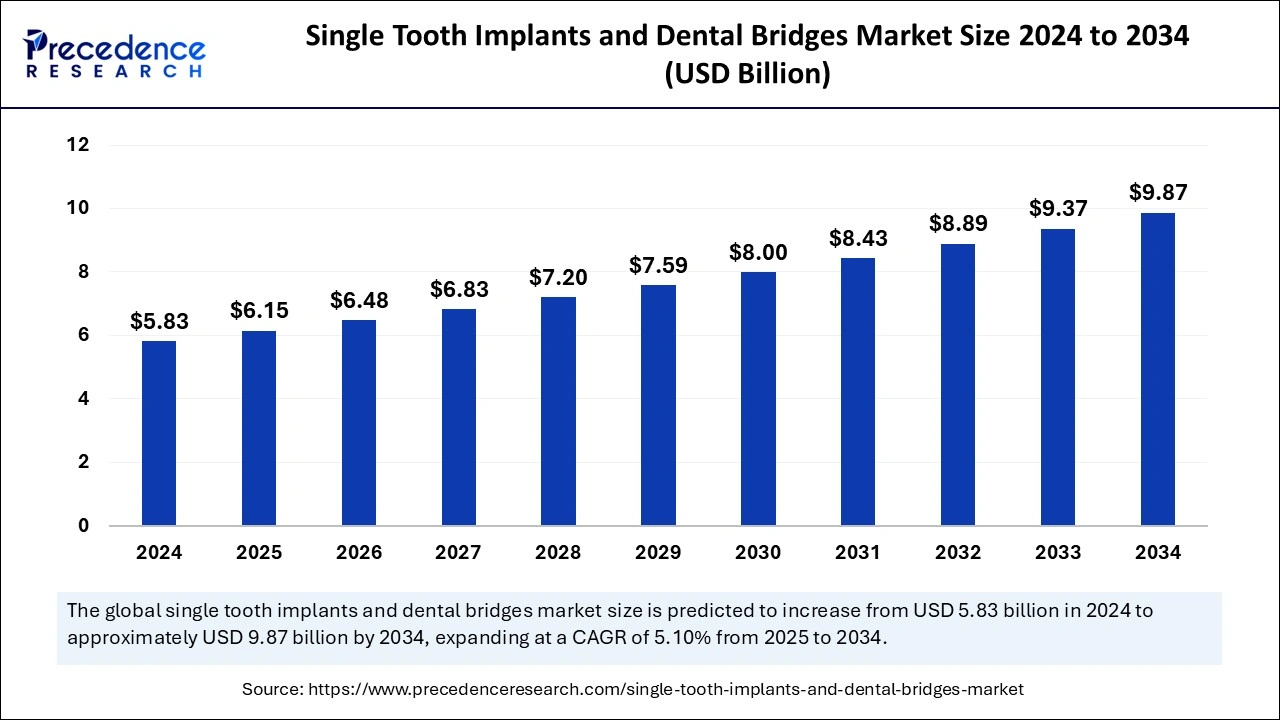

Additionally, this guide addresses frequently asked questions, demystifying complex topics and empowering buyers with the knowledge needed to navigate the competitive landscape. With a projected market growth from USD 6.7 billion in 2024 to USD 10.48 billion by 2030, understanding market trends and dynamics is crucial for capitalizing on emerging opportunities.

By leveraging the information in this guide, B2B buyers can make strategic decisions, ensuring they are well-equipped to meet the evolving demands of the dental implant sector while maximizing their investment returns.

Understanding dental implant rate Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Titanium Implants | Made from biocompatible titanium, strong and durable | General dental practices, oral surgeons | Pros: High strength, excellent osseointegration; Cons: May cause allergic reactions in rare cases. |

| Zirconium Implants | Metal-free, aesthetic appeal, good for sensitive patients | Cosmetic dentistry, dental aesthetics | Pros: Great aesthetics, biocompatible; Cons: Higher cost, less long-term data than titanium. |

| Mini Dental Implants | Smaller diameter, less invasive, quicker recovery | Dentists in need of alternatives for patients with limited bone | Pros: Less invasive, quicker placement; Cons: Not suitable for all cases, lower stability. |

| Implant-Supported Dentures | Combines implants with removable dentures, enhanced stability | Prosthodontics, full-mouth rehabilitation | Pros: Improved function and comfort; Cons: More complex treatment planning required. |

| Immediate Load Implants | Allows for immediate placement of crowns after implant insertion | Practices focused on expedited patient care | Pros: Reduces treatment time; Cons: Higher risk of implant failure if not properly executed. |

Titanium Implants

Titanium implants are the most widely used type due to their strength and durability. They are made from biocompatible titanium, which integrates well with bone, promoting osseointegration. B2B buyers should consider the reputation of manufacturers and the quality of titanium used, as this can affect long-term performance. They are suitable for a broad range of patients but may pose a risk of allergic reactions in rare cases.

Zirconium Implants

Zirconium implants offer an aesthetic advantage as they are metal-free, making them ideal for patients concerned about the appearance of traditional metal implants. Their biocompatibility makes them a great option for sensitive individuals. However, buyers should note that zirconium implants typically come at a higher cost and have less long-term clinical data compared to titanium options, which may impact purchasing decisions.

Mini Dental Implants

Mini dental implants are designed for patients with limited bone structure and are less invasive than traditional implants. They offer a quicker recovery time, making them appealing for practices that prioritize patient comfort. However, their smaller diameter may result in lower stability, making them unsuitable for all cases. Buyers should assess the specific needs of their patient base before investing in mini implants.

Implant-Supported Dentures

These implants combine the stability of dental implants with the convenience of removable dentures, making them a popular choice for patients requiring full-mouth rehabilitation. They enhance comfort and function but require more complex treatment planning. B2B buyers should evaluate their practice’s capabilities in providing comprehensive care, as well as the training required for staff to manage these solutions effectively.

Immediate Load Implants

Immediate load implants allow for the placement of a crown right after the implant is inserted, significantly reducing treatment time. This approach can improve patient satisfaction but carries a higher risk of implant failure if not executed properly. Buyers should consider the expertise of their surgical team and the specific protocols necessary to ensure success when opting for immediate load solutions.

Related Video: Step by Step Guide to Your Dental Implant Procedure

Key Industrial Applications of dental implant rate

| Industry/Sector | Specific Application of dental implant rate | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare | Dental Clinics and Oral Surgery Centers | Increased patient satisfaction and retention through improved treatment outcomes. | Compliance with local regulatory standards; quality certifications (e.g., ISO, CE). |

| Dental Prosthetics | Custom Implant Solutions for Prosthetic Devices | Enhanced product offerings and competitive advantage through innovative solutions. | Sourcing from reputable manufacturers with a proven track record in custom solutions. |

| Insurance | Coverage Plans for Dental Implant Procedures | Increased customer loyalty and market differentiation by offering comprehensive coverage. | Understanding regional regulations and reimbursement policies; partnerships with dental providers. |

| Medical Device Supply | Distribution of Dental Implant Components | Streamlined supply chain and reduced lead times for dental practices. | Reliability of suppliers; inventory management capabilities; ability to meet demand spikes. |

| Research & Development | Development of Advanced Implant Technologies | Opportunities for innovation and market leadership in dental technology. | Collaboration with research institutions; investment in R&D capabilities; intellectual property considerations. |

Healthcare Sector

In dental clinics and oral surgery centers, understanding the dental implant rate is crucial for planning and managing patient treatment schedules. A higher implant rate indicates a growing demand for procedures, allowing clinics to optimize staffing and inventory. Additionally, investing in high-quality implants can lead to improved patient outcomes, thereby enhancing satisfaction and retention rates. International buyers should ensure compliance with local regulatory standards, including necessary quality certifications, to maintain trust and credibility in their services.

Dental Prosthetics

The dental prosthetics industry benefits significantly from the dental implant rate through the development of custom implant solutions. As the demand for aesthetic and functional prosthetics rises, businesses can enhance their product offerings to meet specific patient needs. This innovation not only provides a competitive edge but also fosters partnerships with dental professionals. Buyers should prioritize sourcing from manufacturers known for their quality and reliability in custom solutions to ensure they meet the evolving demands of the market.

Insurance Sector

Insurance companies can leverage the dental implant rate to design comprehensive coverage plans that include implant procedures. By offering such plans, insurers can differentiate themselves in a competitive market and foster customer loyalty. Understanding regional regulations and reimbursement policies is vital for international buyers, as these factors can significantly impact the adoption of implant coverage among policyholders. Strategic partnerships with dental providers can also enhance the value proposition of insurance plans.

Medical Device Supply

In the medical device supply sector, the dental implant rate informs distributors about the demand for implant components. A higher rate indicates a need for efficient supply chain management to ensure timely delivery to dental practices. Streamlining operations can lead to reduced lead times and improved service levels. Buyers should focus on sourcing from reliable suppliers with strong inventory management capabilities, enabling them to respond swiftly to fluctuations in demand.

Research & Development

The growing dental implant rate opens avenues for research and development in advanced implant technologies. Companies investing in R&D can capitalize on this trend by creating innovative solutions that address specific challenges faced by dental professionals. Collaborating with research institutions can enhance the development process, while intellectual property considerations become crucial for protecting new innovations. International buyers should be prepared to invest in R&D capabilities to maintain a competitive edge in the evolving dental market.

Strategic Material Selection Guide for dental implant rate

When selecting materials for dental implants, international B2B buyers must consider various factors that influence product performance, regulatory compliance, and market preferences. Here, we analyze four common materials used in dental implants: Titanium, Zirconium, PEEK (Polyether Ether Ketone), and Stainless Steel. Each material has distinct properties, advantages, and limitations that can impact their suitability for specific applications.

Titanium

Key Properties:

Titanium is known for its excellent biocompatibility, corrosion resistance, and high strength-to-weight ratio. It can withstand significant mechanical stress and is stable under physiological conditions, making it ideal for long-term implantation.

Pros & Cons:

The durability of titanium implants is one of their greatest strengths, as they can last for many years without degradation. However, the manufacturing complexity can be high due to the need for specialized processes like CAD/CAM machining. While titanium implants are generally more expensive, their performance often justifies the cost.

Impact on Application:

Titanium is compatible with various media, including bone and soft tissue, promoting osseointegration. This property is crucial for the longevity and success of the implant.

Considerations for B2B Buyers:

International buyers should ensure compliance with standards such as ASTM F136 for titanium alloys. In regions like Europe and the Middle East, CE marking and SFDA approvals are essential for market entry.

Zirconium

Key Properties:

Zirconium implants are characterized by their aesthetic appeal, as they are white and resemble natural teeth. They also exhibit excellent biocompatibility and corrosion resistance.

Pros & Cons:

The primary advantage of zirconium is its aesthetic quality, making it suitable for visible areas in the mouth. However, zirconium implants can be more brittle than titanium, which may limit their use in high-stress applications. Additionally, they are often more expensive than titanium.

Impact on Application:

Zirconium implants are particularly effective in anterior restorations where aesthetics are paramount. However, their brittleness can be a concern in posterior applications where chewing forces are greater.

Considerations for B2B Buyers:

Buyers should look for compliance with ISO 14781 standards for dental implants. In regions like Africa and South America, awareness of local preferences for aesthetics can influence purchasing decisions.

PEEK (Polyether Ether Ketone)

Key Properties:

PEEK is a high-performance polymer known for its excellent mechanical properties and biocompatibility. It is lightweight and has a high resistance to wear and fatigue.

Pros & Cons:

The main advantage of PEEK is its flexibility, which can reduce stress on the surrounding bone. However, it is less bioactive than titanium and zirconium, which may affect osseointegration. PEEK implants are generally less expensive than metal options.

Impact on Application:

PEEK is suitable for patients with metal allergies or sensitivities. Its non-metallic nature makes it a good choice for specific applications where magnetic resonance imaging (MRI) compatibility is required.

Considerations for B2B Buyers:

Compliance with ASTM F2026 for PEEK is crucial. Buyers in the Middle East and Europe should also consider local regulations regarding polymer implants.

Stainless Steel

Key Properties:

Stainless steel is known for its strength, corrosion resistance, and affordability. It is commonly used in temporary dental implants and orthodontic applications.

Pros & Cons:

The cost-effectiveness of stainless steel makes it attractive for budget-conscious buyers. However, its lower biocompatibility compared to titanium and zirconium limits its use in permanent implants. Additionally, it may corrode over time, leading to potential complications.

Impact on Application:

Stainless steel is primarily used in temporary applications where the implant is not intended for long-term use. Its mechanical properties make it suitable for orthodontic devices.

Considerations for B2B Buyers:

Buyers should ensure compliance with ASTM F138 for stainless steel used in medical applications. In regions like Africa, where cost is a significant factor, stainless steel may be preferred for temporary solutions.

Summary Table

| Material | Typical Use Case for dental implant rate | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Permanent dental implants | Excellent durability | High manufacturing complexity | High |

| Zirconium | Aesthetic dental restorations | Superior aesthetics | Brittle in high-stress areas | High |

| PEEK | Temporary implants, MRI-compatible | Lightweight and flexible | Less bioactive | Medium |

| Stainless Steel | Temporary dental implants | Cost-effective | Lower biocompatibility | Low |

This guide serves as a strategic resource for international B2B buyers, helping them make informed decisions when selecting materials for dental implants, considering both performance and regulatory factors.

In-depth Look: Manufacturing Processes and Quality Assurance for dental implant rate

Manufacturing Processes for Dental Implants

The manufacturing of dental implants is a highly specialized process that ensures the production of safe, effective, and durable devices. Understanding the various stages and key techniques involved is crucial for international B2B buyers looking to source these products effectively.

Main Stages of Manufacturing

-

Material Preparation

– Selection of Raw Materials: Titanium and zirconium are the primary materials used due to their biocompatibility and strength. The materials are sourced from certified suppliers to ensure quality.

– Material Treatment: The raw materials undergo various treatments, such as heat treatment, to enhance their mechanical properties and ensure they meet industry standards. -

Forming

– Machining: The prepared materials are machined using CNC (Computer Numerical Control) technology to create the desired shape and dimensions. This stage includes turning, milling, and drilling.

– Surface Treatment: After machining, surface treatments such as sandblasting and acid etching are applied to enhance osseointegration, which is the process where the implant fuses with the bone.

Illustrative Image (Source: Google Search)

-

Assembly

– Component Assembly: This stage involves assembling different parts of the implant system, including the abutment and screw, if applicable. Precision is key to ensure a perfect fit.

– Sterilization: All components are sterilized using methods such as autoclaving or gamma radiation to eliminate any microbial contamination before packaging. -

Finishing

– Quality Checks: The final product undergoes various quality checks to ensure compliance with specifications. This includes visual inspections and measurements.

– Packaging: Implants are packaged in sterile conditions, often using vacuum sealing, to maintain sterility until they reach the end-user.

Quality Assurance in Dental Implant Manufacturing

Quality assurance (QA) is critical in the dental implant manufacturing process. It ensures that products are safe and effective for end-users. B2B buyers should be familiar with the relevant standards and practices to verify the quality of the products they are sourcing.

Relevant International Standards

- ISO 9001: This standard focuses on quality management systems and is applicable across various industries, including medical devices. Compliance indicates that a manufacturer has a robust quality management system in place.

- ISO 13485: Specifically for medical devices, this standard outlines the requirements for a quality management system that demonstrates an organization’s ability to provide medical devices and related services that consistently meet customer and regulatory requirements.

- CE Marking: In Europe, dental implants must bear the CE mark, which indicates conformity with health, safety, and environmental protection standards.

- FDA Approval: In the United States, dental implants must be approved by the FDA, demonstrating their safety and effectiveness.

Quality Control Checkpoints

-

Incoming Quality Control (IQC)

– Raw materials are inspected upon arrival to ensure they meet specifications. This includes verifying certifications from suppliers and conducting material tests. -

In-Process Quality Control (IPQC)

– Continuous monitoring during the manufacturing process helps identify defects early. This includes inspections at various stages of machining and assembly. -

Final Quality Control (FQC)

– The finished products undergo comprehensive testing, including dimensional checks, surface integrity assessments, and sterilization validation.

Common Testing Methods

- Mechanical Testing: Includes tensile strength, fatigue testing, and hardness testing to ensure the materials can withstand operational stress.

- Biocompatibility Testing: Ensures that the materials used do not elicit adverse reactions when implanted in the human body.

- Sterility Testing: Verifies that the sterilization process was effective and that the product is free from microbial contamination.

Verifying Supplier Quality Control

For B2B buyers, verifying the quality control processes of potential suppliers is essential to ensure product reliability and compliance with international standards. Here are actionable strategies:

- Supplier Audits: Conduct regular audits of suppliers’ manufacturing facilities. This helps assess compliance with quality standards and identify potential issues before they affect product quality.

- Review Quality Assurance Reports: Request detailed QA reports from suppliers that outline their quality control processes, testing results, and compliance with relevant standards.

- Third-Party Inspections: Engage third-party inspection services to evaluate suppliers’ quality control processes and product quality. This adds an additional layer of assurance.

Quality Control Nuances for International Buyers

International buyers, particularly from Africa, South America, the Middle East, and Europe, face unique challenges in sourcing dental implants. Here are some nuances to consider:

- Regulatory Compliance: Different regions have varying regulatory requirements. Buyers should ensure that their suppliers are compliant with local regulations, such as those from the Saudi Food and Drug Authority (SFDA) in Saudi Arabia or the National Agency for Food and Drug Administration and Control (NAFDAC) in Nigeria.

- Cultural and Language Barriers: Effective communication is crucial. Buyers should establish clear lines of communication with suppliers to ensure mutual understanding of quality expectations and compliance requirements.

- Supply Chain Considerations: Geopolitical factors and trade regulations can impact the supply chain. Buyers should evaluate the stability and reliability of suppliers in their respective regions to mitigate risks.

By understanding the manufacturing processes and quality assurance practices in dental implant production, international B2B buyers can make informed decisions, ensuring they source high-quality products that meet both regulatory standards and customer needs.

Related Video: SMART Quality Control for Manufacturing

Comprehensive Cost and Pricing Analysis for dental implant rate Sourcing

Analyzing the cost structure and pricing dynamics of dental implants is crucial for international B2B buyers aiming to optimize their sourcing strategies. Understanding the components of cost, the factors influencing prices, and effective negotiation tactics can lead to significant savings and better procurement decisions.

Cost Components

-

Materials: The primary materials for dental implants typically include titanium and zirconium. Titanium is favored for its biocompatibility and strength, while zirconium offers aesthetic advantages. The cost of these materials can fluctuate based on global supply chains and market demand.

-

Labor: Skilled labor is essential for manufacturing dental implants. Labor costs vary significantly by region; for instance, countries with lower labor costs may offer competitive pricing. However, the quality of craftsmanship is crucial, as it directly impacts the implant’s performance.

-

Manufacturing Overhead: This includes expenses related to facility maintenance, utilities, and administrative costs. Efficient manufacturing processes can lower overhead costs, which in turn can affect pricing.

-

Tooling: Custom tooling for specific implant designs can be a significant upfront cost. However, economies of scale can be achieved with higher production volumes, spreading the tooling costs over more units.

-

Quality Control (QC): Rigorous quality control processes are necessary to ensure compliance with international standards (e.g., ISO 13485, CE marking). QC costs are critical in maintaining product integrity and minimizing returns or failures.

-

Logistics: Transportation and handling costs can vary based on shipping methods and distance. International buyers should consider logistics as a vital component of the total cost, especially when importing products from different continents.

-

Margin: Supplier margins will vary based on market positioning, brand reputation, and product differentiation. Understanding the typical margin in your target market can help in evaluating supplier pricing.

Price Influencers

-

Volume/MOQ: Minimum order quantities (MOQs) can significantly impact pricing. Larger orders often lead to volume discounts, making it economically advantageous for buyers to negotiate bulk purchases.

-

Specifications/Customization: Custom-designed implants may incur additional costs. While standard products may be less expensive, customization can provide a competitive edge by addressing specific market needs.

-

Materials: The choice of materials not only influences the cost but also impacts the performance and longevity of the implants. Buyers should weigh the benefits of higher-quality materials against budget constraints.

-

Quality/Certifications: Implants with recognized certifications may command higher prices due to the assurance of quality. Buyers should prioritize certifications that align with their market’s regulatory requirements.

-

Supplier Factors: Supplier reliability, production capacity, and reputation can affect pricing. Established suppliers may offer premium products but at a higher cost, while emerging suppliers might provide competitive pricing to gain market share.

-

Incoterms: The terms of delivery can influence overall costs. Understanding Incoterms (e.g., FOB, CIF) is essential for managing shipping costs and responsibilities effectively.

Buyer Tips

-

Negotiation: Establish clear communication with suppliers regarding pricing expectations. Be prepared to negotiate terms, especially for larger orders or long-term contracts.

-

Cost-Efficiency: Analyze the total cost of ownership (TCO), which includes purchase price, shipping, and potential future costs (e.g., warranty claims, replacements). This comprehensive approach can reveal hidden expenses.

-

Pricing Nuances: International buyers must be aware of currency fluctuations and how they can impact costs. Consider hedging strategies or negotiate fixed pricing in contracts to mitigate risks.

-

Market Research: Stay informed about market trends, competitor pricing, and emerging suppliers. This knowledge can empower buyers to make informed decisions and leverage competitive pricing.

-

Regulatory Compliance: Ensure that all products meet the necessary regulatory requirements in your region. Non-compliance can lead to costly penalties and product recalls.

Disclaimer: Prices mentioned in this analysis are indicative and can vary based on numerous factors, including market conditions and supplier negotiations. Always conduct thorough research and engage with multiple suppliers to obtain the best pricing and terms.

Essential Technical Properties and Trade Terminology for dental implant rate

Key Technical Properties of Dental Implants

Understanding the essential technical properties of dental implants is critical for B2B buyers, particularly when selecting products that meet specific clinical requirements. Here are some of the most crucial specifications:

-

Material Grade

Dental implants are typically made from titanium or zirconia. Titanium, particularly grade 5 titanium (Ti-6Al-4V), is known for its strength, biocompatibility, and resistance to corrosion. Zirconia implants offer an aesthetic alternative due to their tooth-like color and are less likely to cause allergic reactions. Buyers must evaluate the material to ensure it aligns with their market’s preferences and regulatory requirements. -

Surface Treatment

The surface of dental implants can significantly affect osseointegration—the process by which the implant fuses with the jawbone. Treatments may include sandblasting, acid etching, or coating with hydroxyapatite. Understanding surface treatments helps buyers assess the implant’s long-term stability and success rates in clinical settings. -

Tolerance

Tolerance refers to the allowable deviation in the dimensions of the implant. Precise tolerances are essential for ensuring that implants fit securely and function correctly within the oral cavity. Poor tolerance can lead to complications, impacting patient satisfaction and increasing the likelihood of implant failure. Buyers should seek suppliers who adhere to stringent manufacturing tolerances. -

Diameter and Length

Implants come in various diameters and lengths to accommodate different anatomical conditions. These specifications are critical for achieving optimal placement and achieving successful outcomes. Buyers should ensure that their suppliers offer a range of sizes to meet the diverse needs of their clients. -

Load-Bearing Capacity

The load-bearing capacity of an implant determines its ability to withstand forces during chewing. This property is essential in selecting implants for patients with varying levels of bone density. Buyers must understand the load specifications to choose implants suitable for their target demographics. -

Regulatory Compliance

Compliance with international standards and local regulations (like FDA in the U.S., CE marking in Europe, or SFDA in Saudi Arabia) is non-negotiable. This ensures the safety and effectiveness of the implants. Buyers should verify that their suppliers possess the necessary certifications and comply with the relevant guidelines.

Common Trade Terminology

Familiarity with industry jargon can enhance communication and negotiation processes. Below are essential trade terms relevant to dental implants:

-

OEM (Original Equipment Manufacturer)

An OEM refers to a company that manufactures products that are then sold under another company’s brand. Understanding the OEM landscape is crucial for buyers looking to source implants that meet specific quality and branding standards. -

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. This term is vital for buyers to understand their purchasing limits and how it affects inventory management and cash flow. -

RFQ (Request for Quotation)

An RFQ is a formal request from a buyer to suppliers to provide pricing and terms for specific products. This process is essential for comparing costs and ensuring transparency in pricing. -

Incoterms

Incoterms are international commercial terms that define the responsibilities of buyers and sellers in international transactions. Understanding these terms helps buyers navigate shipping, insurance, and liability issues, minimizing risks in cross-border purchases. -

Lead Time

Lead time refers to the time taken from placing an order to receiving the goods. This is a critical factor in supply chain management, especially in the dental industry, where timely delivery can impact patient care. -

Warranty and After-Sales Support

Warranty terms and after-sales support are crucial for ensuring product reliability and customer satisfaction. Buyers should clarify these terms with suppliers to avoid future complications related to product performance.

By understanding these technical properties and trade terms, B2B buyers can make informed decisions that align with their operational needs and market expectations.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dental implant rate Sector

Market Overview & Key Trends

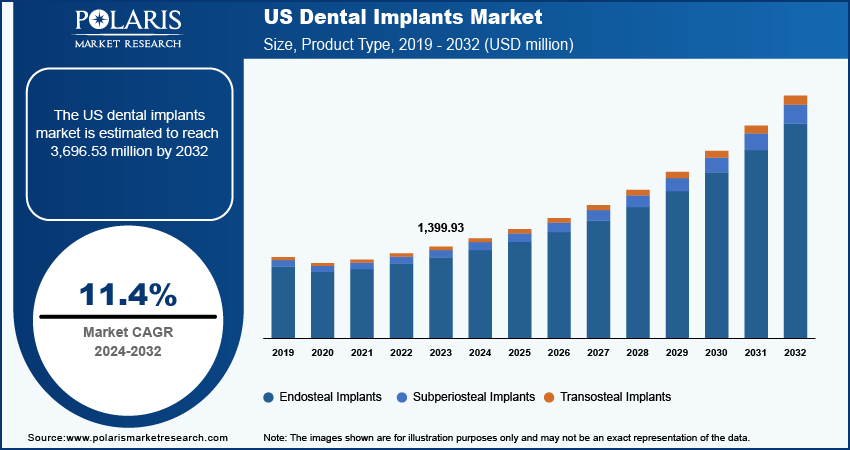

The global dental implant market is on a robust growth trajectory, with projections indicating an increase from USD 6.7 billion in 2024 to USD 10.48 billion by 2030, growing at a CAGR of 8.0%. Several factors are driving this expansion, including the rising incidence of dental diseases, an aging population, and a growing awareness of the advantages of dental implants over traditional prosthetics. For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding these dynamics is crucial for sourcing decisions.

Emerging trends in the market include the increasing adoption of digital dentistry technologies, such as CAD/CAM systems and 3D printing, which enhance precision and efficiency in implant manufacturing. Additionally, the demand for customized solutions is rising, with buyers seeking implants tailored to individual patient needs. Regulatory compliance remains a critical consideration, as stringent quality standards are enforced by authorities like the FDA, CE, and SFDA. Buyers must stay informed about these regulations to ensure that their sourcing practices align with market demands.

Another key trend is the shift towards minimally invasive procedures, which not only reduce recovery times but also improve patient outcomes. This shift is encouraging manufacturers to innovate and develop implants that facilitate these techniques, thus influencing purchasing decisions for B2B buyers seeking competitive advantages in their offerings.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a cornerstone of the dental implant sector, as stakeholders increasingly recognize the environmental impact of their sourcing decisions. The production of dental implants often involves materials that have significant ecological footprints, prompting a shift towards sustainable practices. B2B buyers are now prioritizing suppliers who demonstrate commitment to ethical sourcing and sustainability.

Illustrative Image (Source: Google Search)

The importance of ethical supply chains cannot be overstated. Buyers are encouraged to seek suppliers who adhere to rigorous standards for environmental management, such as ISO 14001 certification. Additionally, the use of biocompatible materials that are sustainably sourced can not only reduce environmental impact but also cater to the growing consumer demand for eco-friendly products.

Buyers should also consider suppliers that utilize green certifications or materials in their manufacturing processes. This includes using recycled materials or developing biodegradable implants, which can enhance a company’s reputation and appeal to a more environmentally conscious customer base. As sustainability continues to gain traction, aligning with suppliers who prioritize these values will be essential for long-term success in the dental implant market.

Brief Evolution/History

The dental implant sector has evolved significantly since the introduction of the first modern implants in the 1960s. Initially, implants were primarily made of titanium, known for its biocompatibility and strength. Over the decades, advancements in materials science have led to the introduction of zirconium implants, offering aesthetic benefits and reduced risk of allergic reactions.

As the market matured, the focus shifted towards improving implant designs and techniques, resulting in better patient outcomes and lower failure rates. The advent of digital technologies in the 21st century has further transformed the landscape, allowing for precise planning and execution of implant procedures. For B2B buyers, staying abreast of these historical advancements is critical for understanding current market offerings and anticipating future trends.

Related Video: Global Trends Tutorial: Chapter 3: IPE

Frequently Asked Questions (FAQs) for B2B Buyers of dental implant rate

-

What should I consider when vetting suppliers for dental implants?

When vetting suppliers, prioritize their certifications and compliance with international standards such as ISO 13485 and CE marking. Review their track record, including years in business, customer testimonials, and case studies. It’s crucial to assess their manufacturing capabilities, quality control processes, and responsiveness to inquiries. Additionally, consider whether they offer support for regulatory requirements specific to your region, such as FDA or CDSCO approvals, as this can significantly affect your import processes. -

Can dental implants be customized for specific needs?

Yes, many manufacturers offer customization options for dental implants, including variations in size, shape, and material (e.g., titanium or zirconium). Discuss your specific requirements with potential suppliers to determine their capacity for customization. Ensure they have the technology and expertise to produce implants tailored to your clinical specifications. It’s also advisable to request prototypes or samples before placing a bulk order to ensure that the products meet your quality standards. -

What are the typical minimum order quantities (MOQs) and lead times for dental implants?

Minimum order quantities can vary significantly between suppliers, often ranging from 50 to 500 units depending on the product line and customization options. Lead times generally range from 4 to 12 weeks, influenced by factors such as order complexity, supplier location, and production capacity. It’s essential to discuss these aspects upfront with suppliers to align expectations and ensure timely delivery, particularly if you have urgent patient needs. -

What payment terms should I expect when purchasing dental implants?

Payment terms can vary widely among suppliers. Common practices include upfront payments, partial payments upon order confirmation, or payment upon delivery. It’s essential to clarify these terms before finalizing any agreements. Some suppliers may offer credit terms for repeat customers or larger orders, which can facilitate cash flow management. Always ensure that payment methods are secure, and consider using escrow services for larger transactions to mitigate risks. -

How can I ensure the quality and certification of dental implants?

To ensure quality, request detailed documentation of certifications from suppliers, including ISO 13485, CE, or FDA certifications. Conduct audits or site visits if possible, to evaluate their manufacturing processes and quality control systems. Additionally, ask for batch test results or third-party testing reports to verify product reliability. Establishing a clear quality assurance agreement with suppliers can also help maintain standards throughout your partnership. -

What logistical considerations should I be aware of when sourcing dental implants internationally?

Logistics can be complex when sourcing internationally. Key considerations include shipping methods (air freight vs. sea freight), customs regulations, and potential tariffs or duties. Work with suppliers who have experience in international shipping to ensure compliance with export and import laws. It’s also advisable to explore insurance options for your shipments to protect against loss or damage during transit. Establish clear communication with your logistics partners to track shipments and address any issues promptly.

-

How should I handle disputes with suppliers regarding dental implants?

Establishing clear communication channels and having a well-defined contract can mitigate disputes. If issues arise, address them directly with the supplier as soon as possible, documenting all communications. If a resolution cannot be reached, refer to the terms outlined in your contract regarding dispute resolution methods, which may include mediation or arbitration. Maintaining a professional demeanor throughout the process can help preserve the business relationship, even in challenging situations. -

What trends should I be aware of in the dental implant market?

Stay informed about the latest trends, such as advancements in implant materials and technology, including 3D printing and bioactive coatings that enhance osseointegration. Additionally, monitor market growth projections, particularly in emerging regions like Africa and South America, where demand is increasing. Understanding these trends can help you make strategic purchasing decisions and position your business competitively in the marketplace. Networking with industry associations can also provide valuable insights and updates.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for dental implant rate

As the dental implant market continues to expand, international B2B buyers must prioritize strategic sourcing to navigate this dynamic landscape effectively. Key takeaways include recognizing the projected growth of the dental implants sector, which is expected to reach USD 10.48 billion by 2030, driven by increasing demand for prosthetics and innovative solutions. Buyers should focus on identifying reliable suppliers who adhere to stringent regulatory standards, such as CE and FDA approvals, to ensure product quality and compliance.

Understanding regional market trends is essential; for instance, the rising acceptance of dental implants in Africa and the Middle East presents lucrative opportunities for sourcing partnerships. Additionally, leveraging technology and data analytics can enhance procurement strategies, enabling buyers to make informed decisions that align with market demands.

Looking ahead, the call to action for international B2B buyers is clear: invest in strategic sourcing that not only enhances operational efficiency but also fosters relationships with innovative manufacturers. By doing so, businesses can position themselves at the forefront of the dental implant market, ready to meet the evolving needs of dental professionals and patients alike.