Introduction: Navigating the Global Market for dental implants diagram

Navigating the global market for dental implants requires a thorough understanding of the intricate landscape that defines this rapidly evolving sector. Dental implants diagrams serve as essential tools, visualizing the various components, types, and processes involved in implant technology. For B2B buyers from regions such as Africa, South America, the Middle East, and Europe, mastering these diagrams is crucial not only for sourcing the right products but also for making informed decisions that align with market demands and regulatory standards.

This comprehensive guide delves deep into the multifaceted world of dental implants, covering critical aspects such as types of implants, materials used, manufacturing processes, and quality control measures. Additionally, it provides insights into supplier evaluations, cost considerations, and the current market landscape, including regional trends and competitive analysis.

By engaging with this guide, international buyers can empower themselves to navigate the complexities of sourcing dental implants effectively. Whether it’s understanding the nuances of different implant types or evaluating supplier reliability, the actionable insights presented here will enable you to optimize your procurement strategies. Equip yourself with the knowledge to make strategic sourcing decisions that not only enhance your product offerings but also meet the evolving needs of your clientele across diverse markets.

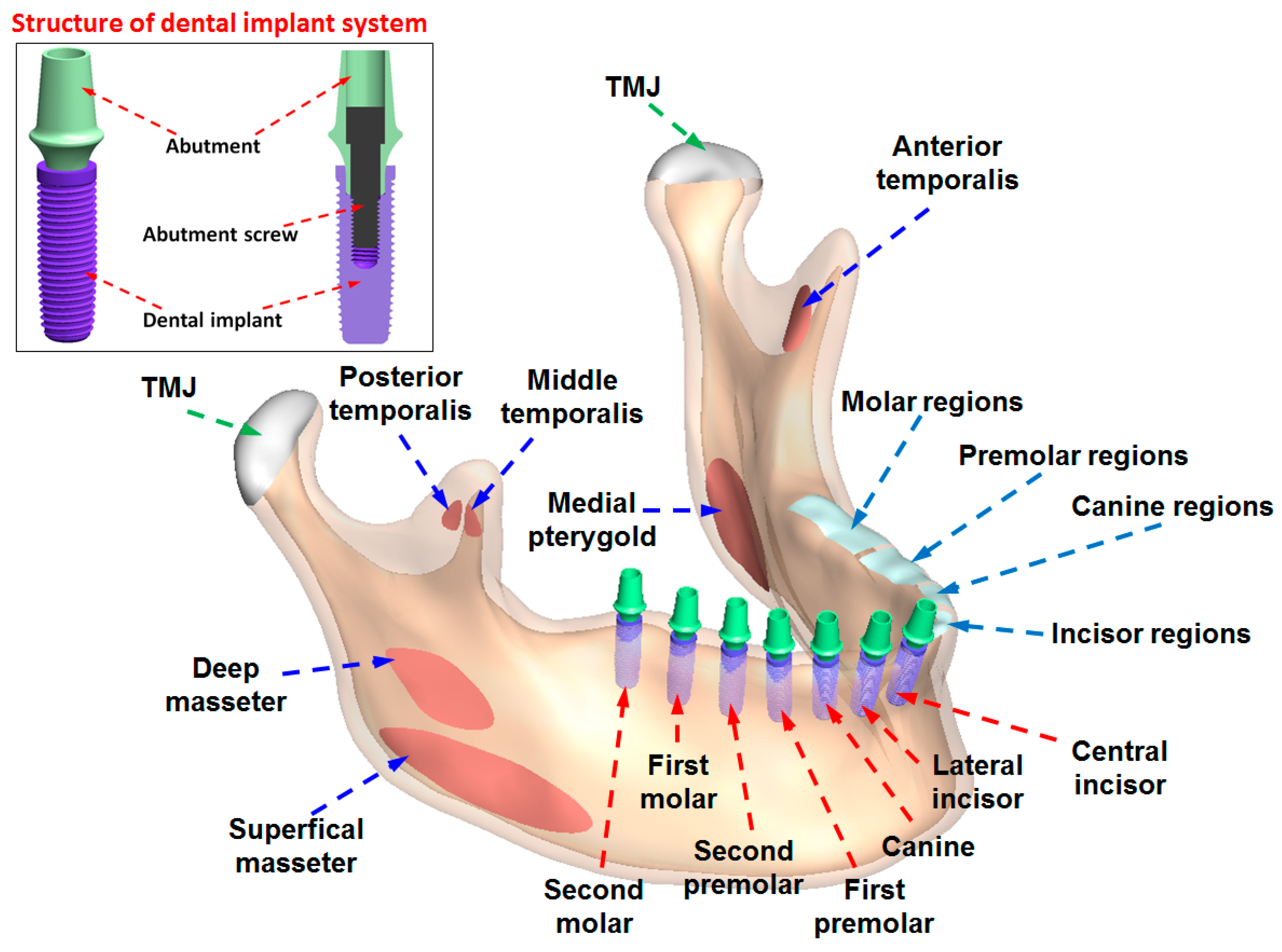

Illustrative Image (Source: Google Search)

Understanding dental implants diagram Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Endosteal Implants | Placed directly into the jawbone; most common type | General dentistry, oral surgery | Pros: High success rate; stable. Cons: Requires sufficient bone density. |

| Subperiosteal Implants | Rest on top of the jawbone, under the gum tissue | Patients with minimal bone height; custom cases | Pros: Suitable for patients with bone loss. Cons: More invasive; longer healing time. |

| Zygomatic Implants | Anchored in the zygomatic bone (cheekbone) | Complex cases with severe bone loss | Pros: Avoids bone grafting; immediate stability. Cons: Requires specialized skills. |

| Mini Dental Implants | Smaller diameter; less invasive | Temporary solutions, orthodontics | Pros: Quick placement; less discomfort. Cons: Limited application for permanent solutions. |

| All-on-4 Implants | Four implants support a full arch of prosthetic teeth | Full arch restorations; edentulous patients | Pros: Cost-effective for full restorations. Cons: Requires careful planning and execution. |

Endosteal Implants

Endosteal implants are the most prevalent type of dental implant, inserted directly into the jawbone. Their design typically resembles small screws or cylinders. B2B buyers should consider the anatomical requirements, as these implants necessitate sufficient bone density for successful integration. When sourcing endosteal implants, evaluate the manufacturer’s reputation for quality and long-term success rates, as these factors significantly impact patient outcomes and satisfaction.

Subperiosteal Implants

Subperiosteal implants are placed beneath the gum tissue but above the jawbone, making them an option for patients with insufficient bone height. These implants are custom-made to fit the patient’s unique jaw structure. B2B buyers should assess the technological capabilities of suppliers, particularly in terms of imaging and customization processes. Understanding the implications for surgical time and recovery is crucial, as these factors can influence patient throughput and satisfaction in a clinical setting.

Zygomatic Implants

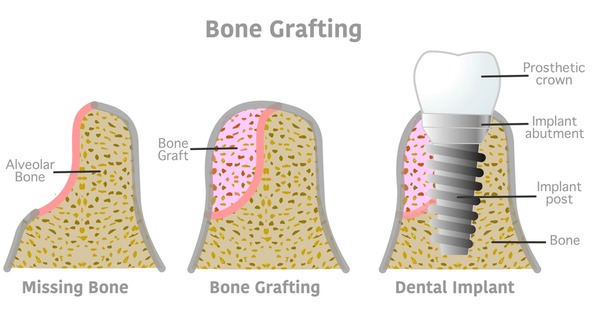

Zygomatic implants are anchored in the zygomatic bone, providing a solution for patients with severe bone loss in the upper jaw. This type of implant is particularly advantageous for complex cases where traditional implants would require extensive bone grafting. B2B buyers must consider the specialized training and experience required for practitioners to perform these procedures safely. Collaborating with suppliers who offer comprehensive training and support can enhance the success of zygomatic implant placements.

Mini Dental Implants

Mini dental implants are characterized by their smaller diameter and less invasive placement technique. They are often used for temporary solutions, such as stabilizing dentures or in orthodontics. For B2B buyers, the appeal lies in their ease of placement and quicker recovery times. However, it is essential to recognize that mini implants may not be suitable for all cases, particularly those requiring permanent fixtures. Suppliers should provide clear guidelines on the appropriate applications for these implants.

All-on-4 Implants

The All-on-4 implant technique utilizes four strategically placed implants to support a full arch of prosthetic teeth. This method is particularly cost-effective for patients who are fully edentulous. For B2B buyers, understanding the planning and execution involved in All-on-4 procedures is critical, as it affects both patient outcomes and clinic efficiency. Collaborating with manufacturers that offer robust support and resources can facilitate a smoother implementation of this innovative solution, ultimately enhancing patient care and practice profitability.

Related Video: Learn About The Different Parts Of A Dental Implant

Key Industrial Applications of dental implants diagram

| Industry/Sector | Specific Application of dental implants diagram | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare | Surgical Planning for Dental Implants | Enhanced precision in implant placement, improving patient outcomes and reducing surgery time. | Regulatory compliance, quality assurance, and training for staff on the use of the diagram. |

| Dental Manufacturing | Product Development for Implant Devices | Streamlined design processes and improved product innovation, leading to competitive advantage. | Access to advanced design software and integration with manufacturing systems. |

| Education & Training | Curriculum Development for Dental Programs | Improved educational tools for dental professionals, leading to better-trained practitioners. | Collaboration with educational institutions and adherence to accreditation standards. |

| Research & Development | Clinical Trials for New Implant Technologies | Data-driven insights for product improvement and market validation, facilitating faster go-to-market strategies. | Ethical considerations, patient recruitment strategies, and compliance with international research standards. |

| Insurance | Risk Assessment Models for Implant Procedures | Better risk management and cost control, leading to improved insurance offerings for dental procedures. | Collaboration with dental professionals to understand risk factors and claims data analysis. |

Healthcare

In the healthcare sector, dental implants diagrams are crucial for surgical planning. They provide detailed visuals that guide dental surgeons in the precise placement of implants. This not only enhances the accuracy of the procedure but also minimizes the time required for surgery, ultimately leading to better patient outcomes. For B2B buyers in this space, it is essential to ensure that the diagrams meet local regulatory standards and that staff are adequately trained in their use to maximize efficiency.

Dental Manufacturing

Within dental manufacturing, the application of dental implants diagrams plays a significant role in product development. These diagrams facilitate a more streamlined design process, allowing manufacturers to innovate and refine their implant devices effectively. For international buyers, especially in regions like Africa and South America, sourcing advanced design software that integrates well with existing manufacturing systems is critical to maintaining a competitive edge in the market.

Education & Training

In the realm of education and training, dental implants diagrams serve as vital tools for developing curricula for dental programs. They enhance the learning experience for dental students and professionals by providing clear, visual representations of complex procedures. For B2B buyers from the Middle East and Europe, collaborating with educational institutions to ensure that these diagrams meet accreditation standards is essential for creating effective training programs.

Research & Development

Dental implants diagrams are also instrumental in research and development, particularly during clinical trials for new implant technologies. They provide valuable data-driven insights that can lead to product improvements and faster market validation. Buyers in this sector should focus on ethical considerations and compliance with international research standards when sourcing these diagrams to ensure that their clinical trials are both effective and credible.

Insurance

Finally, in the insurance industry, dental implants diagrams are used to develop risk assessment models for implant procedures. By analyzing data from these diagrams, insurers can better manage risk and control costs, leading to improved offerings for dental procedures. B2B buyers should prioritize collaboration with dental professionals to gain a comprehensive understanding of risk factors associated with implant procedures, which is crucial for accurate claims data analysis.

Related Video: Step by Step Guide to Your Dental Implant Procedure

Strategic Material Selection Guide for dental implants diagram

When selecting materials for dental implants, international B2B buyers must consider various factors that influence product performance, regulatory compliance, and market preferences. Below is an analysis of four common materials used in dental implants, focusing on their properties, advantages, disadvantages, and specific considerations for buyers in Africa, South America, the Middle East, and Europe.

Titanium

Key Properties: Titanium is renowned for its excellent corrosion resistance and high strength-to-weight ratio. It can withstand the physiological conditions in the human body, including temperature fluctuations and mechanical stress.

Pros & Cons: Titanium implants are highly durable and biocompatible, making them suitable for long-term use. However, they can be more expensive to manufacture compared to other materials due to the complexity of machining and surface treatments.

Impact on Application: Titanium is compatible with various media, including bone and soft tissue, which is essential for osseointegration. Its properties make it ideal for both single and multiple implant applications.

Considerations for International Buyers: Buyers should ensure compliance with ASTM and ISO standards for titanium implants. In regions like the Middle East and Europe, there is a strong preference for certified materials that guarantee safety and efficacy.

Zirconia

Key Properties: Zirconia is a ceramic material known for its aesthetic appeal and excellent mechanical properties. It has a high fracture toughness and is resistant to wear and corrosion.

Pros & Cons: The primary advantage of zirconia implants is their tooth-like appearance, making them ideal for visible areas in the mouth. However, they are generally less durable than titanium and can be more expensive due to manufacturing challenges.

Impact on Application: Zirconia is particularly suitable for patients with metal allergies or sensitivities. Its compatibility with soft tissue promotes good integration, but it may not be as effective in load-bearing situations as titanium.

Considerations for International Buyers: Buyers in Europe and South America should be aware of the increasing demand for aesthetic solutions in dental implants. Compliance with local regulations and standards is crucial, especially in markets where patient preferences lean towards metal-free options.

PEEK (Polyether Ether Ketone)

Key Properties: PEEK is a high-performance polymer that offers excellent mechanical strength, chemical resistance, and biocompatibility. It can withstand high temperatures and is stable under various conditions.

Pros & Cons: PEEK implants are lightweight and can be manufactured at a lower cost compared to titanium and zirconia. However, they may not provide the same level of osseointegration as metal implants, which could affect long-term stability.

Impact on Application: PEEK is often used in applications where flexibility and comfort are important, such as in temporary implants or in patients who may require future adjustments.

Considerations for International Buyers: Buyers should consider the regulatory landscape for polymer-based implants, as standards may vary significantly between regions. In the Middle East and Africa, there may be a growing interest in innovative materials like PEEK, but compliance with local health regulations is paramount.

Stainless Steel

Key Properties: Stainless steel is known for its strength, corrosion resistance, and affordability. It is often used in temporary implants and surgical tools.

Pros & Cons: The cost-effectiveness of stainless steel makes it an attractive option for many manufacturers. However, it is less biocompatible than titanium and zirconia, which may limit its use in permanent implants.

Impact on Application: Stainless steel is suitable for temporary applications, such as healing abutments or in pediatric dentistry. Its mechanical properties make it effective for short-term use but not ideal for long-term implants.

Considerations for International Buyers: Buyers in South America and Africa should be aware of the limitations of stainless steel in permanent applications. Compliance with ASTM standards is essential, and there may be a preference for more biocompatible materials in certain markets.

Summary Table

| Material | Typical Use Case for dental implants diagram | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Permanent implants | High durability and biocompatibility | Higher manufacturing complexity | High |

| Zirconia | Aesthetic implants | Excellent aesthetic properties | Less durable than titanium | High |

| PEEK | Temporary implants | Lightweight and cost-effective | Lower osseointegration potential | Medium |

| Stainless Steel | Temporary applications | Cost-effective | Limited biocompatibility | Low |

This analysis provides a comprehensive overview of the materials commonly used in dental implants, highlighting their properties, advantages, disadvantages, and considerations for international B2B buyers. Understanding these factors is crucial for making informed purchasing decisions in the dental implant market.

In-depth Look: Manufacturing Processes and Quality Assurance for dental implants diagram

The manufacturing of dental implants is a complex process that requires precision, adherence to international standards, and rigorous quality assurance to ensure patient safety and product efficacy. This section outlines the key stages of the manufacturing process, relevant quality control measures, and actionable insights for international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe.

Manufacturing Process Overview

The manufacturing process of dental implants typically involves several critical stages, each essential for producing high-quality, reliable products.

1. Material Preparation

Material Selection: The first step involves selecting biocompatible materials, predominantly titanium or titanium alloys, known for their strength and corrosion resistance. Some manufacturers may also use zirconia for aesthetic applications.

Preparation Techniques: Materials undergo rigorous cleaning and sterilization to remove contaminants. Techniques such as acid etching or sandblasting may be used to enhance surface roughness, which is vital for osseointegration.

2. Forming

Molding and Machining: The forming stage can involve both machining and molding processes. CNC machining is commonly used for creating precise shapes and dimensions, while injection molding may be employed for specific components.

Surface Treatment: Post-forming, implants often undergo surface treatments to improve integration with bone. Techniques like anodization or plasma spraying can enhance the implant’s surface properties.

3. Assembly

Component Integration: Dental implants are typically composed of multiple components, including the implant body, abutment, and screw. The assembly process must ensure that these parts fit accurately to maintain structural integrity.

Robotic Assistance: Advanced manufacturers may utilize robotics in the assembly process to minimize human error and increase efficiency, particularly in high-volume production settings.

4. Finishing

Final Processing: The finishing stage involves cleaning, sterilization, and packaging. Implants must be sterilized using methods such as gamma radiation or ethylene oxide gas to ensure they are free from microbial contamination.

Quality Checks: Each finished product undergoes a series of inspections to verify dimensions, surface finish, and overall quality before packaging.

Quality Assurance Practices

Quality assurance in dental implant manufacturing is vital for compliance with international standards and ensuring product reliability. Several key components of quality control are outlined below.

International Standards

ISO 9001 Certification: This standard outlines the criteria for a quality management system (QMS) and is essential for manufacturers to demonstrate their commitment to quality.

CE Marking: In Europe, dental implants must have CE marking, indicating compliance with EU safety and performance standards. This is particularly important for B2B buyers in Europe who seek reliable products.

API Standards: In regions like the Middle East, adherence to American Petroleum Institute (API) standards for manufacturing can enhance credibility and ensure quality.

Quality Control Checkpoints

Incoming Quality Control (IQC): This involves inspecting raw materials upon arrival. B2B buyers should ensure suppliers have stringent IQC procedures to prevent defective materials from entering the production process.

In-Process Quality Control (IPQC): During manufacturing, real-time monitoring and testing of processes and products are conducted to catch defects early. This could include dimensional checks and surface inspections.

Final Quality Control (FQC): Before products are shipped, a thorough inspection, including functional testing, is performed to ensure that the implants meet specified standards.

Common Testing Methods

B2B buyers should be aware of several testing methods that manufacturers employ to ensure product quality:

- Mechanical Testing: Includes tensile strength and fatigue testing to ensure implants can withstand the forces encountered in the oral environment.

- Biocompatibility Testing: Conducted to ensure that materials do not provoke adverse reactions in patients.

- Sterility Testing: Ensures that the sterilization process effectively eliminates all microbial life.

Verifying Supplier Quality Control

When sourcing dental implants, B2B buyers should consider the following actionable strategies to verify supplier quality control:

-

Supplier Audits: Conduct regular audits of potential suppliers to evaluate their manufacturing processes, quality control measures, and compliance with international standards.

-

Request Quality Reports: Ask for detailed quality control reports, including IQC, IPQC, and FQC data, to assess the supplier’s commitment to quality.

-

Third-party Inspections: Engage independent third-party organizations to conduct inspections and audits of suppliers, providing an unbiased assessment of their quality assurance practices.

Quality Control and Certification Nuances

International B2B buyers must navigate varying quality control requirements across regions:

- Africa: Regulatory frameworks may be less stringent, making it imperative for buyers to conduct thorough due diligence on suppliers.

- South America: Buyers should verify that suppliers meet local regulatory requirements and international standards to ensure product safety and efficacy.

- Middle East: Understanding the specific certifications required for different markets within the region can be beneficial.

- Europe: Buyers should prioritize suppliers with CE marking and ISO certifications, as these indicate adherence to strict quality and safety standards.

By understanding the manufacturing processes and quality assurance practices for dental implants, international B2B buyers can make informed decisions when sourcing products, ensuring they partner with reliable manufacturers who prioritize quality and compliance.

Related Video: SMART Quality Control for Manufacturing

Comprehensive Cost and Pricing Analysis for dental implants diagram Sourcing

Understanding the Cost Structure of Dental Implants Diagrams

When sourcing dental implants diagrams, a comprehensive understanding of the cost components is crucial for international B2B buyers. The primary cost components include:

-

Materials: The quality of materials significantly impacts the overall cost. Premium materials may increase initial costs but can lead to better long-term performance and patient satisfaction.

-

Labor: Skilled labor is essential for the precision required in dental implants diagrams. Labor costs can vary widely depending on the region, with countries in Europe generally having higher wages than those in Africa or South America.

-

Manufacturing Overhead: This encompasses the indirect costs associated with production, such as utilities, rent, and equipment maintenance. These costs can fluctuate based on the supplier’s location and operational efficiency.

-

Tooling: The initial investment in tooling for creating dental implants diagrams can be substantial. It’s important to consider whether the supplier has the necessary tooling to meet your specifications without incurring additional costs.

-

Quality Control (QC): Rigorous QC processes are vital to ensure compliance with international standards. Suppliers with robust QC systems may charge more but can save buyers from costly returns and compliance issues.

-

Logistics: Shipping costs, including freight and insurance, must be accounted for. The choice of Incoterms can greatly influence these costs, affecting who bears the risk and responsibility during transportation.

-

Margin: Suppliers will typically add a margin to cover their costs and profit. Understanding the typical margins in different regions can provide insight into potential negotiation points.

Key Price Influencers in Sourcing

Several factors can influence the pricing of dental implants diagrams:

-

Volume/MOQ: Bulk orders often lead to lower prices per unit. Negotiating minimum order quantities (MOQs) can yield better pricing.

-

Specifications/Customization: Custom designs can significantly impact pricing. Be clear about your requirements to avoid unexpected costs.

-

Materials and Quality Certifications: Suppliers that use higher-quality materials and hold relevant certifications may charge more. However, these investments can pay off in reliability and performance.

-

Supplier Factors: The reputation and experience of the supplier can also affect pricing. Established suppliers may charge a premium for their reliability and track record.

-

Incoterms: Understanding the implications of Incoterms is essential for determining who is responsible for costs at various stages of shipping. This can help in calculating the total cost of ownership.

Buyer Tips for Effective Sourcing

For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, consider the following actionable tips:

-

Negotiate Wisely: Leverage your volume and long-term partnership potential to negotiate better pricing. Suppliers may be more flexible with pricing if they see a long-term relationship.

-

Evaluate Total Cost of Ownership (TCO): Look beyond the initial purchase price. Consider maintenance, potential downtime, and replacement costs when evaluating suppliers.

-

Understand Pricing Nuances: Be aware of regional pricing differences. For example, suppliers in Europe may have higher prices due to labor costs, while those in South America may offer more competitive pricing but could lack certain certifications.

-

Conduct Market Research: Stay informed about market trends, material costs, and competitor pricing to make informed sourcing decisions.

-

Request Samples: Before committing to a large order, request samples to assess quality and fit with your needs.

Disclaimer

The pricing discussed in this analysis is indicative and subject to change based on market conditions, supplier negotiations, and specific project requirements. Always obtain quotes directly from suppliers for the most accurate and current pricing.

Spotlight on Potential dental implants diagram Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘dental implants diagram’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for dental implants diagram

Key Technical Properties of Dental Implants

When evaluating dental implants, understanding their essential technical properties is crucial for B2B buyers. Here are some of the most critical specifications:

-

Material Grade

– Definition: Dental implants are typically made from titanium or titanium alloys due to their biocompatibility and strength.

– B2B Importance: Choosing the right material grade affects the longevity and performance of the implant. Buyers should verify that the material meets international standards (e.g., ISO 13485) to ensure quality and safety. -

Tolerance

– Definition: Tolerance refers to the allowable deviation from a specified dimension in the manufacturing process.

– B2B Importance: High precision is vital for the fitting of implants. A tolerance of ±0.1 mm is often standard in the industry. Ensuring proper tolerances can prevent complications during the surgical procedure and enhance patient outcomes. -

Surface Treatment

– Definition: This property pertains to the process applied to the implant surface to enhance osseointegration (the integration of the implant with the bone).

– B2B Importance: Different surface treatments (e.g., sandblasting, acid etching) can significantly influence the implant’s success. Buyers should inquire about surface treatment methods as they can affect healing times and overall implant stability. -

Load Capacity

– Definition: This refers to the maximum weight or force that an implant can withstand without failure.

– B2B Importance: Understanding load capacity is crucial for ensuring that the implant can support the intended function, especially in cases of multiple implants or those under significant stress. Buyers should look for implants that have been tested for load-bearing performance. -

Corrosion Resistance

– Definition: The ability of the implant material to resist degradation from bodily fluids.

– B2B Importance: Corrosion can lead to implant failure and complications. Buyers should confirm that the implants are manufactured from materials with high corrosion resistance, particularly in regions with high humidity or saline environments. -

Biocompatibility

– Definition: This property indicates how well the implant material interacts with the body without causing an adverse reaction.

– B2B Importance: Ensuring biocompatibility is essential for the success of dental implants. Buyers must verify that the implants are certified biocompatible to prevent complications during and after the procedure.

Common Trade Terminology in the Dental Implant Industry

Understanding industry jargon is equally important for effective communication and negotiation in B2B transactions. Here are some common terms:

-

OEM (Original Equipment Manufacturer)

– Definition: A company that produces parts and equipment that may be marketed by another manufacturer.

– Importance: Buyers often deal with OEMs to source high-quality dental implants. Knowing the OEM can help evaluate the reliability and reputation of the product. -

MOQ (Minimum Order Quantity)

– Definition: The smallest quantity of a product that a supplier is willing to sell.

– Importance: Understanding MOQ helps buyers plan their inventory and budget. In many cases, lower MOQs are preferable, especially for new entrants or smaller clinics. -

RFQ (Request for Quotation)

– Definition: A document that a buyer sends to suppliers to solicit price quotes for specific products.

– Importance: An RFQ is a critical step in the procurement process. Buyers should be clear and detailed in their RFQs to receive accurate and competitive quotes. -

Incoterms (International Commercial Terms)

– Definition: A set of rules that define responsibilities of sellers and buyers in international transactions.

– Importance: Familiarity with Incoterms (like FOB, CIF, etc.) is essential for understanding shipping responsibilities and costs, impacting the total landed cost of dental implants. -

Lead Time

– Definition: The amount of time that passes from the initiation of a process until its completion.

– Importance: Buyers should be aware of lead times to manage patient treatment schedules effectively. Long lead times can disrupt operations, so it’s vital to factor this into procurement planning. -

Certification

– Definition: A formal verification that a product meets specified standards, often required for regulatory compliance.

– Importance: Certifications (such as CE marking in Europe) indicate that the dental implants meet safety and quality standards. Buyers should prioritize suppliers who can provide relevant certifications to ensure compliance and trustworthiness.

By familiarizing themselves with these technical properties and industry terms, B2B buyers can make informed decisions that enhance their procurement strategy and ultimately improve patient care.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dental implants diagram Sector

Market Overview & Key Trends

The dental implants sector is witnessing significant growth driven by increasing oral health awareness and technological advancements. The global market is projected to expand due to rising demand for cosmetic dentistry and an aging population, particularly in regions such as Africa, South America, the Middle East, and Europe. Key drivers include enhanced product offerings, with innovations in materials and techniques leading to improved implant success rates and patient satisfaction.

Emerging B2B sourcing trends are reshaping the landscape. Digital transformation is at the forefront, with many suppliers adopting e-commerce platforms and digital marketing strategies to reach international buyers. This shift allows for streamlined procurement processes and enhanced product visibility. Additionally, the integration of artificial intelligence (AI) and data analytics is enabling suppliers to forecast demand more accurately and optimize their inventory management, ultimately reducing costs for buyers.

International B2B buyers should also be aware of the regulatory dynamics affecting the market. Compliance with varying international standards, such as ISO 13485 for medical devices, is crucial. Buyers in regions like the Middle East and Africa should prioritize partnerships with manufacturers who demonstrate compliance and transparency in their operations. This focus will not only mitigate risks but also enhance product reliability.

Sustainability & Ethical Sourcing in B2B

As global awareness of environmental issues rises, sustainability is becoming a crucial consideration in the dental implants sector. The impact of manufacturing processes on the environment has prompted a shift towards more sustainable practices. B2B buyers should actively seek suppliers committed to reducing their carbon footprint through eco-friendly manufacturing processes and waste reduction strategies.

Ethical sourcing is equally important. Buyers are encouraged to evaluate their supply chains for ethical compliance, ensuring that materials used in dental implants are sourced responsibly. Certifications such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety) are indicators of a supplier’s commitment to sustainable practices. Additionally, the use of biocompatible and recyclable materials in dental implants not only meets regulatory requirements but also appeals to environmentally conscious consumers.

Illustrative Image (Source: Google Search)

Investing in suppliers that prioritize sustainability can enhance a buyer’s brand reputation, particularly in regions like Europe, where eco-consciousness is a significant purchasing factor. By fostering partnerships with ethical suppliers, B2B buyers can contribute to a more sustainable future while ensuring high-quality products.

Brief Evolution/History

The dental implants sector has evolved significantly since the early 20th century, transitioning from rudimentary solutions to advanced, biocompatible materials and sophisticated surgical techniques. Early implants made from materials like ivory and metals have paved the way for titanium and zirconia, which are now standard due to their strength and compatibility with human tissue.

The introduction of digital technologies in the late 20th century, including computer-aided design (CAD) and computer-aided manufacturing (CAM), revolutionized the industry. These technologies have enhanced precision in implant design and placement, leading to improved outcomes and greater patient satisfaction. As the market continues to evolve, understanding this history is vital for B2B buyers aiming to make informed sourcing decisions and capitalize on future innovations.

Related Video: Global Trends Chapter 2 | Part 1 | Video Posted!

Frequently Asked Questions (FAQs) for B2B Buyers of dental implants diagram

-

What criteria should I use to vet suppliers of dental implants diagrams?

When vetting suppliers, focus on their industry experience, certifications (ISO, CE marking), and client testimonials. Investigate their manufacturing processes and quality control measures to ensure they meet international standards. It is also beneficial to check their financial stability and past performance in international markets, especially in regions like Africa and the Middle East, where regulatory compliance can vary significantly. -

Can dental implants diagrams be customized to meet specific requirements?

Yes, many suppliers offer customization options for dental implants diagrams to cater to specific client needs. This may include alterations in design, size, or material specifications. When discussing customization, ensure you communicate your requirements clearly and verify the supplier’s capability to fulfill them. It is also advisable to request a prototype before finalizing the order to ensure that the product meets your expectations. -

What are the typical minimum order quantities (MOQs) and lead times for dental implants diagrams?

MOQs can vary widely among suppliers, often influenced by manufacturing capabilities and the complexity of the product. Generally, expect MOQs to range from 100 to 500 units. Lead times can also differ based on the supplier’s location and production capacity, usually ranging from 4 to 12 weeks. Always confirm these details upfront to align your inventory and procurement strategies effectively. -

What payment terms are commonly accepted in international transactions for dental implants diagrams?

Payment terms can vary by supplier and region. Common methods include letters of credit, bank transfers, and payment through escrow services. It’s advisable to negotiate terms that minimize risk, such as partial payments upon order confirmation and the balance upon delivery. Ensure that you understand any currency exchange implications and factor in potential tariffs or duties that may affect overall costs. -

How can I ensure the quality assurance (QA) and certifications of dental implants diagrams?

Request copies of relevant certifications and quality assurance documentation from your supplier. Look for compliance with international standards such as ISO 13485 for medical devices. It’s also beneficial to inquire about their quality control processes and whether they conduct regular audits. Consider engaging a third-party inspection service for additional assurance, particularly when sourcing from regions with varying regulatory frameworks. -

What logistics considerations should I keep in mind when importing dental implants diagrams?

Logistics are crucial in international B2B transactions. Assess shipping options, including air freight versus sea freight, based on cost and urgency. Verify that the supplier can provide necessary shipping documentation and that they have experience in handling customs clearance in your region. Additionally, consider the implications of local regulations and tariffs that could affect delivery timelines and costs. -

How should I handle disputes with suppliers of dental implants diagrams?

To manage disputes effectively, establish clear communication channels and document all transactions and agreements. It is advisable to include a dispute resolution clause in your contracts, specifying arbitration or mediation as preferred methods. Should disputes arise, address them promptly and professionally, focusing on finding mutually beneficial solutions. Engaging a legal expert familiar with international trade can also provide invaluable guidance. -

What are the trends in the dental implants market that I should be aware of?

The dental implants market is witnessing a shift towards digital solutions, including 3D printing and CAD/CAM technologies, which enhance precision and customization. Sustainability is becoming increasingly important, with many suppliers exploring eco-friendly materials and processes. Additionally, the demand for dental implants is rising in emerging markets in Africa and South America, presenting opportunities for international buyers to source innovative products that cater to growing consumer needs.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for dental implants diagram

In conclusion, the strategic sourcing of dental implants is pivotal for international B2B buyers aiming to enhance their procurement processes and product offerings. By prioritizing quality, reliability, and cost-effectiveness, businesses can forge strong partnerships with reputable suppliers, ensuring a steady supply of high-quality dental implants. Understanding regional market dynamics—whether in Africa, South America, the Middle East, or Europe—enables buyers to tailor their sourcing strategies effectively, minimizing risks and maximizing value.

Key Takeaways:

– Supplier Evaluation: Conduct thorough assessments of potential suppliers to ensure they meet industry standards and regulatory requirements.

– Market Trends: Stay informed about emerging trends in dental technology and patient preferences to align product offerings with market demands.

– Cost Management: Leverage bulk purchasing and negotiate favorable terms to optimize costs while maintaining quality.

As you navigate the evolving landscape of dental implants, consider this an opportunity to redefine your sourcing strategies. Embrace innovation and collaboration to secure a competitive edge in your markets. The future of dental implant sourcing is bright; now is the time to act decisively and invest in relationships that will propel your business forward.