Introduction: Navigating the Global Market for full upper dental implants

Navigating the global market for full upper dental implants is a critical endeavor for B2B buyers seeking reliable solutions in the dental healthcare sector. Full upper dental implants are not just a cosmetic enhancement; they are essential for restoring function, improving quality of life, and boosting self-confidence for patients who have lost multiple teeth. As the demand for these durable, natural-looking solutions continues to grow, understanding the intricacies of the market becomes imperative for international buyers, particularly those from Africa, South America, the Middle East, and Europe, including key markets like France and Turkey.

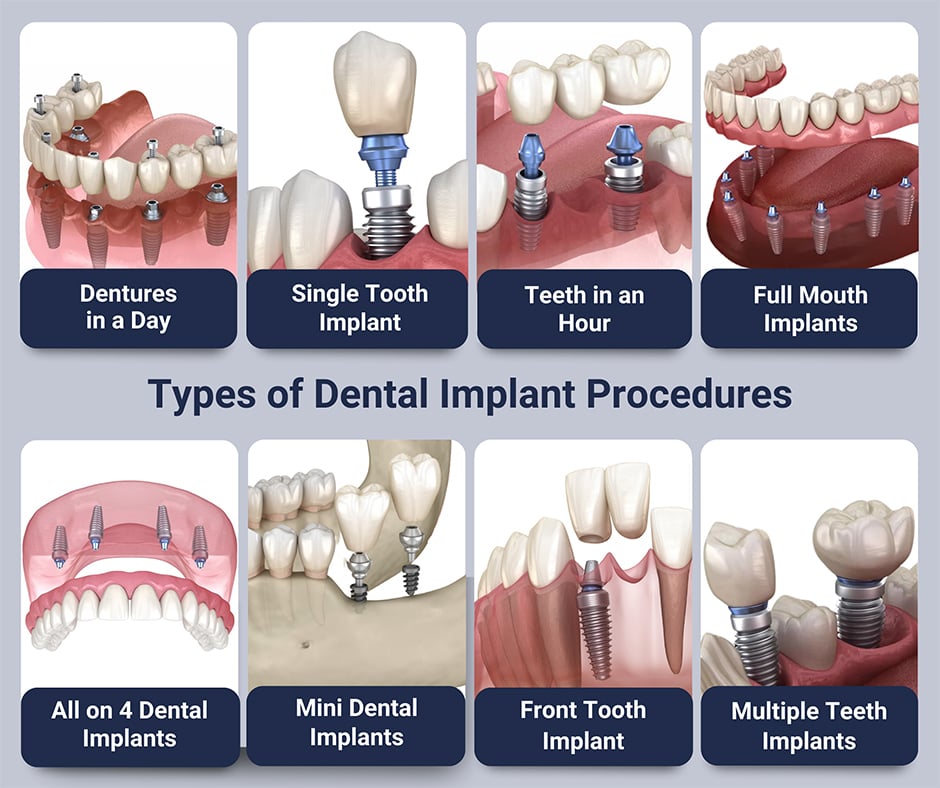

This comprehensive guide delves into various aspects of full upper dental implants, covering types such as All-on-4 and All-on-6, and materials like titanium and zirconia. Additionally, it addresses manufacturing and quality control processes, supplier evaluations, and cost considerations, ensuring that buyers are well-equipped to make informed decisions. The guide also tackles common FAQs, providing clarity on eligibility, procedures, and post-operative care.

By empowering B2B buyers with actionable insights and in-depth knowledge, this guide facilitates strategic sourcing decisions, enabling businesses to navigate the complexities of the dental implant market with confidence. As you explore the contents, you will find valuable information to enhance your procurement strategies and support your commitment to high-quality dental solutions.

Understanding full upper dental implants Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| All-on-4 Dental Implants | Four implants per arch, minimal bone loss required | General dentistry, implant clinics | Pros: Faster recovery, lower cost. Cons: May not suit all bone types. |

| All-on-6 Dental Implants | Six implants for enhanced stability | Advanced dental practices, specialists | Pros: Increased durability, better for stronger bone. Cons: Higher cost. |

| Traditional Implant-Supported Dentures | 6-8 implants per arch, highly stable | Large dental facilities, prosthodontists | Pros: Maximum stability, natural feel. Cons: Higher initial investment. |

| Zygomatic Implants | Anchored in the cheekbone, used for severe bone loss | Oral surgeons, specialized clinics | Pros: Avoids bone grafting, suitable for complex cases. Cons: Requires specialized training. |

| Mini Dental Implants | Smaller diameter implants, less invasive procedure | Small dental practices, cost-sensitive markets | Pros: Lower cost, easier placement. Cons: Less stability compared to standard implants. |

All-on-4 Dental Implants

All-on-4 dental implants utilize four strategically placed implants to support a full arch of prosthetic teeth. This technique is particularly beneficial for patients with moderate bone loss, as it requires minimal surgical intervention and often avoids the need for extensive bone grafting. For B2B buyers, this option is appealing due to its cost-effectiveness and quicker recovery times, making it suitable for practices looking to offer a competitive yet efficient solution.

All-on-6 Dental Implants

All-on-6 implants involve the placement of six implants per arch, providing greater stability and durability. This option is ideal for patients with sufficient bone density and is often recommended for those seeking long-term solutions. For international buyers, particularly in regions with higher standards for dental care, investing in All-on-6 systems can enhance service offerings and cater to a more discerning clientele, despite the higher costs associated with this option.

Traditional Implant-Supported Dentures

Traditional implant-supported dentures require 6-8 implants per arch, ensuring maximum stability and a natural feel for the patient. This method is often favored by larger dental facilities and prosthodontists due to its proven effectiveness. Buyers in markets that prioritize longevity and quality of dental solutions may find this option appealing, although it comes with a higher initial investment and longer treatment timelines.

Zygomatic Implants

Zygomatic implants are designed for patients with severe bone loss in the upper jaw, anchoring directly into the cheekbone. This innovative solution eliminates the need for bone grafting, making it a preferred choice for complex cases. B2B buyers, particularly oral surgeons and specialized clinics, should consider zygomatic implants as part of their offerings to address a niche market of patients who require advanced solutions for significant bone loss.

Mini Dental Implants

Mini dental implants are a less invasive alternative, featuring a smaller diameter that allows for easier placement. They are particularly beneficial in cost-sensitive markets or for practices looking to provide affordable options. While they offer a lower upfront cost and simpler installation, the trade-off is reduced stability compared to traditional implants. This makes them a viable option for small dental practices aiming to attract budget-conscious patients while still providing a functional solution.

Related Video: Full Mouth Dental Implants: The Ultimate Guide

Key Industrial Applications of full upper dental implants

| Industry/Sector | Specific Application of full upper dental implants | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Full arch restoration for patients with extensive tooth loss | Enhances patient satisfaction and retention, leading to repeat business | Quality of materials, compliance with local regulations, and supplier reliability |

| Healthcare Providers | Treatment for geriatric patients needing stable dental solutions | Improves quality of life for patients, reducing the need for frequent adjustments | Understanding of patient demographics, availability of post-operative care solutions |

| Dental Laboratories | Custom fabrication of prosthetic arches for implants | Streamlines workflow and increases revenue through high-demand services | Access to advanced technology for precise manufacturing, and ability to meet varying client needs |

| Medical Device Suppliers | Distribution of implant components and tools | Expands product offerings, tapping into the growing dental implant market | Regulatory compliance, sourcing from certified manufacturers, and logistics capabilities |

| Insurance Companies | Coverage plans for dental implant procedures | Attracts more clients through comprehensive dental care offerings | Understanding of regional healthcare regulations and patient needs, competitive pricing strategies |

Detailed Applications

Dental Clinics

Full upper dental implants are primarily utilized in dental clinics to provide patients with a permanent solution for extensive tooth loss. By offering full arch restorations, clinics can significantly enhance patient satisfaction, leading to improved retention rates. International B2B buyers in this sector must prioritize sourcing high-quality implant materials that comply with local regulations and standards. Reliability of suppliers is critical to ensure timely delivery and the integrity of patient care.

Healthcare Providers

In the context of healthcare providers, full upper dental implants serve as an essential treatment option for geriatric patients who require stable and functional dental solutions. These implants can dramatically improve the quality of life for patients, reducing the need for frequent adjustments associated with traditional dentures. Buyers in this sector should focus on understanding their patient demographics and ensuring the availability of comprehensive post-operative care solutions to support recovery.

Dental Laboratories

Dental laboratories play a crucial role in the custom fabrication of prosthetic arches for implants. By incorporating full upper dental implants into their offerings, these labs can streamline workflows and capitalize on the increasing demand for high-quality dental restorations. Key considerations for B2B buyers in this sector include access to advanced manufacturing technology that allows for precise and efficient production, as well as the capability to meet diverse client needs.

Medical Device Suppliers

Full upper dental implants present a lucrative opportunity for medical device suppliers looking to expand their product offerings. By distributing implant components and tools, suppliers can tap into the growing dental implant market, which is driven by increasing awareness and demand for dental aesthetics. Buyers must ensure that they source products from certified manufacturers who comply with regulatory standards, as well as develop robust logistics capabilities to meet market demands.

Insurance Companies

Insurance companies are increasingly recognizing the value of including coverage for dental implant procedures in their plans. By offering comprehensive dental care options, these firms can attract a broader client base. B2B buyers in this sector should focus on understanding regional healthcare regulations and patient needs to design competitive pricing strategies that appeal to both patients and dental professionals.

Strategic Material Selection Guide for full upper dental implants

When selecting materials for full upper dental implants, international B2B buyers must consider various factors, including biocompatibility, mechanical properties, cost, and regulatory compliance. Here, we analyze four common materials used in the manufacturing of dental implants: Titanium, Zirconia, PEEK (Polyether Ether Ketone), and Cobalt-Chromium Alloy. Each material offers distinct advantages and disadvantages that can significantly impact the performance and acceptance of dental implants in different markets.

Illustrative Image (Source: Google Search)

Titanium

Key Properties:

Titanium is renowned for its excellent strength-to-weight ratio, corrosion resistance, and biocompatibility. It can withstand significant mechanical stress and is resistant to oxidation, making it ideal for long-term implantation.

Pros & Cons:

The primary advantage of titanium is its durability and ability to integrate with bone (osseointegration). However, it can be more expensive than other materials, and its manufacturing process can be complex due to the need for specialized equipment to handle its properties.

Impact on Application:

Titanium is compatible with various media, including saliva and blood, making it suitable for dental applications. Its strength allows for the use of fewer implants in certain configurations, such as All-on-4.

Considerations for International Buyers:

Buyers from regions like Europe and the Middle East should ensure that titanium implants meet standards such as ISO 13485 and CE marking. In Africa and South America, understanding local regulations regarding titanium sourcing and implant safety is crucial.

Zirconia

Key Properties:

Zirconia is a ceramic material known for its aesthetic appeal, high strength, and excellent wear resistance. It is also highly biocompatible and does not corrode.

Pros & Cons:

The aesthetic advantage of zirconia makes it a preferred choice for visible dental applications. However, it is more brittle than titanium, which can lead to fracture under excessive stress. Additionally, zirconia implants tend to be more costly due to their manufacturing complexity.

Impact on Application:

Zirconia is particularly suitable for patients concerned about the appearance of their dental work, as it mimics the natural tooth color. However, its brittleness may limit its use in certain high-stress applications.

Considerations for International Buyers:

Compliance with ASTM standards is essential for zirconia implants. Buyers should also consider the availability of zirconia in their regions, as it may not be as widely produced as titanium.

PEEK (Polyether Ether Ketone)

Key Properties:

PEEK is a high-performance polymer that offers excellent mechanical properties, including high tensile strength and resistance to wear and chemicals. It is also lightweight and biocompatible.

Pros & Cons:

The main advantage of PEEK is its flexibility and lightweight nature, which can enhance patient comfort. However, it is less rigid than metals, which may not provide the same level of stability as titanium or zirconia in certain applications.

Impact on Application:

PEEK is suitable for use in areas where flexibility is advantageous, such as in hybrid dental prostheses. Its chemical resistance makes it compatible with various oral environments.

Considerations for International Buyers:

Buyers should verify that PEEK materials comply with ISO 10993 for biocompatibility. Additionally, understanding the local market’s acceptance of polymer-based implants is vital, especially in regions where traditional materials dominate.

Cobalt-Chromium Alloy

Key Properties:

Cobalt-chromium alloys are known for their high strength, wear resistance, and corrosion resistance. They are often used in dental applications where durability is paramount.

Pros & Cons:

These alloys offer excellent mechanical properties, making them suitable for high-stress applications. However, they can be more challenging to work with during manufacturing, and their aesthetic qualities are inferior to those of zirconia.

Impact on Application:

Cobalt-chromium is often used in implant-supported prosthetics where strength is critical. However, the metallic appearance may not be suitable for all patients.

Considerations for International Buyers:

Compliance with international standards like ISO 5832 is essential for cobalt-chromium alloys. Buyers should also assess the availability and cost-effectiveness of these materials in their respective markets.

Summary Table

| Material | Typical Use Case for full upper dental implants | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Standard dental implants, All-on-4 configurations | Excellent osseointegration | Higher manufacturing complexity | High |

| Zirconia | Aesthetic implants, anterior teeth replacements | Superior aesthetics | Brittle under stress | High |

| PEEK | Hybrid prosthetics, flexible applications | Lightweight and comfortable | Less rigidity than metals | Medium |

| Cobalt-Chromium Alloy | High-stress implant-supported prosthetics | Exceptional strength and durability | Poor aesthetics | Medium |

This analysis provides essential insights for international B2B buyers looking to select the most appropriate materials for full upper dental implants, taking into account performance, cost, and compliance with regional standards.

In-depth Look: Manufacturing Processes and Quality Assurance for full upper dental implants

Manufacturing Processes for Full Upper Dental Implants

The manufacturing of full upper dental implants involves several critical stages designed to ensure the highest quality and reliability of the final product. Understanding these processes allows international B2B buyers to make informed decisions when selecting suppliers.

1. Material Preparation

The first step in the manufacturing process is the selection and preparation of materials. Full upper dental implants are typically made from titanium or zirconia due to their biocompatibility, strength, and resistance to corrosion.

- Material Selection: Titanium is favored for its strength and durability, while zirconia is chosen for its aesthetic properties and lower thermal conductivity.

- Preparation Techniques: Materials undergo rigorous cleaning to remove any contaminants. This may involve ultrasonic cleaning or acid etching, ensuring a sterile surface for optimal osseointegration.

2. Forming

The forming stage includes several techniques to shape the implants accurately.

- CNC Machining: Computer Numerical Control (CNC) machining is widely used to create precise implant shapes. This technique allows for intricate designs that accommodate various anatomical requirements.

- Additive Manufacturing: 3D printing technology is increasingly being adopted to produce complex implant geometries that enhance fit and function. This method also facilitates customization based on patient-specific needs.

3. Assembly

Once individual components are formed, they are assembled into the final product.

- Component Integration: The assembly process involves fitting the titanium or zirconia posts with abutments and prosthetic arches. This step requires precision to ensure that each component aligns correctly for optimal function.

- Quality Checks: During assembly, initial quality checks are performed to identify any defects or inconsistencies before moving to the finishing stage.

4. Finishing

The finishing stage involves polishing and coating to enhance the implant’s surface properties.

- Surface Treatment: Techniques such as sandblasting and acid etching improve the surface roughness, promoting better integration with the bone.

- Coatings: Some manufacturers apply bioactive coatings to enhance osseointegration. These coatings can include hydroxyapatite or titanium plasma spray.

Quality Assurance Standards

Quality assurance (QA) is paramount in dental implant manufacturing, given the critical nature of these medical devices. Compliance with international standards ensures safety and efficacy.

1. International Standards

- ISO 9001: This standard focuses on quality management systems and is applicable to all manufacturing processes, ensuring consistent quality in production.

- ISO 13485: Specifically for medical devices, this standard outlines requirements for a quality management system that demonstrates the ability to provide medical devices and related services that consistently meet customer and regulatory requirements.

2. Industry-Specific Certifications

- CE Marking: Required for products marketed in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- FDA Approval: In the United States, manufacturers must secure FDA approval for their dental implants, which involves rigorous testing and validation processes.

Quality Control Checkpoints

Effective quality control (QC) is crucial at each stage of the manufacturing process. Key checkpoints include:

- Incoming Quality Control (IQC): Verification of raw materials upon receipt to ensure they meet specified standards.

- In-Process Quality Control (IPQC): Ongoing inspections during the manufacturing process to catch defects early and ensure adherence to design specifications.

- Final Quality Control (FQC): Comprehensive testing of finished implants before they are packaged and distributed, including functional and biocompatibility tests.

Common Testing Methods

B2B buyers should be aware of the testing methods employed to ensure product quality:

- Mechanical Testing: Evaluates the strength and durability of the implants under simulated physiological conditions.

- Microbiological Testing: Ensures that implants are free from harmful bacteria and pathogens.

- Biocompatibility Testing: Assesses how the implant material interacts with bodily tissues, ensuring safety for end-users.

Verifying Supplier Quality Control

When selecting suppliers, B2B buyers should conduct thorough due diligence to verify the quality control measures in place:

- Audits: Regular audits of suppliers’ manufacturing facilities can reveal compliance with international standards and internal quality protocols.

- Documentation Review: Buyers should request and review quality management system documentation, including ISO certifications and previous audit reports.

- Third-Party Inspections: Engaging third-party inspection agencies can provide an unbiased assessment of a supplier’s quality control processes.

Regulatory Nuances for International Buyers

International buyers, particularly from Africa, South America, the Middle East, and Europe, should be aware of specific regulatory nuances:

- Local Regulations: Different regions may have varying regulatory requirements for dental implants, necessitating a thorough understanding of local compliance standards.

- Certification Recognition: Ensure that certifications obtained in one region (e.g., CE in Europe) are recognized in your target market to facilitate smoother import processes.

- Cultural Considerations: Understanding local market preferences and legal requirements can help in selecting the right products that meet customer expectations.

Conclusion

Navigating the manufacturing processes and quality assurance protocols for full upper dental implants is essential for international B2B buyers. By focusing on the stages of manufacturing, adhering to quality standards, and implementing effective quality control measures, buyers can ensure that they procure high-quality products that meet their specific needs. Understanding these dynamics not only enhances buyer confidence but also fosters successful long-term partnerships with suppliers.

Related Video: Process of Fabricating Full Mouth Implant Restorations

Comprehensive Cost and Pricing Analysis for full upper dental implants Sourcing

Analyzing the cost structure and pricing for full upper dental implants is crucial for international B2B buyers seeking to optimize their procurement processes. Understanding the components that drive costs and the factors influencing pricing can lead to better negotiation outcomes and overall cost efficiency.

Cost Components of Full Upper Dental Implants

-

Materials: The choice of materials significantly impacts the overall cost. Titanium and zirconia are the most common materials for implant posts, with zirconia typically being more expensive due to its aesthetic qualities and biocompatibility. The prosthetic arch, whether a denture or a bridge, also adds to the material costs.

-

Labor: Skilled labor is required for the manufacturing process, including surgical placement and post-operative care. The labor cost varies by region, with countries in Europe generally having higher labor costs compared to regions in Africa or South America.

-

Manufacturing Overhead: This includes costs related to factory operations, utilities, and administrative expenses. Efficient manufacturing processes can help keep overhead low, impacting the final pricing of implants.

-

Tooling: Specialized equipment and tools are necessary for creating precise dental implants. The initial investment in tooling can be substantial, but these costs are amortized over production volume, affecting the unit price.

-

Quality Control (QC): Rigorous testing and quality assurance processes are vital to ensure that implants meet health and safety standards. The costs associated with QC can vary depending on regulatory requirements in different countries.

-

Logistics: Shipping and handling costs are often overlooked but can significantly affect the total cost of ownership. Factors such as distance, shipping method, and customs duties play a crucial role, especially for international buyers.

-

Margin: Suppliers typically include a profit margin in their pricing, which can vary based on market competition and supplier reputation. Understanding this margin can help buyers gauge whether they are receiving a fair price.

Influencers on Pricing

Several factors influence the pricing of full upper dental implants:

-

Volume/MOQ: Purchasing larger quantities can lead to significant discounts. Establishing long-term contracts with suppliers may also yield better pricing structures.

-

Specifications/Customization: Custom implants tailored to specific patient needs or unique designs will generally cost more. Clear communication of requirements is essential to avoid unexpected costs.

-

Materials Quality/Certifications: Implants that meet international quality standards (e.g., ISO, CE, FDA approvals) may command higher prices, but they also ensure reliability and safety.

-

Supplier Factors: The reputation and reliability of suppliers can influence pricing. Established suppliers may offer higher-quality products but at a premium.

-

Incoterms: Understanding the Incoterms (International Commercial Terms) is vital for determining who bears shipping costs and risks, impacting the overall cost for buyers.

Buyer Tips for Cost-Efficiency

-

Negotiation: Engage suppliers in discussions about pricing and terms. Leverage volume commitments or long-term relationships to negotiate better prices.

-

Total Cost of Ownership (TCO): Consider not just the purchase price but also maintenance, logistics, and potential downtime costs. A lower upfront price may lead to higher TCO if quality is compromised.

-

Market Research: Conduct thorough market research to understand price ranges across different regions. This knowledge can empower buyers to make informed decisions and avoid overpaying.

-

Supplier Diversification: Avoid dependence on a single supplier. Exploring multiple options can enhance bargaining power and reduce risks associated with supply chain disruptions.

-

Stay Informed on Regulatory Changes: Regulatory landscapes can affect pricing and availability. Keeping abreast of changes in regulations can help in timely procurement decisions.

Disclaimer

The prices for full upper dental implants can vary widely based on numerous factors, including geographic location, supplier, and specific patient requirements. The figures mentioned in this analysis are indicative and should be validated through direct supplier negotiations and market comparisons.

Spotlight on Potential full upper dental implants Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘full upper dental implants’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for full upper dental implants

Key Technical Properties of Full Upper Dental Implants

Understanding the technical specifications of full upper dental implants is crucial for B2B buyers to ensure quality and compatibility with their requirements. Here are several essential properties to consider:

-

Material Grade

– Definition: The primary materials used in dental implants are typically titanium and zirconia. Titanium is favored for its strength and biocompatibility, while zirconia offers aesthetic benefits due to its tooth-like color.

– Importance: Selecting the right material impacts durability, patient comfort, and the longevity of the implants. Buyers should evaluate material certifications to ensure they meet international standards. -

Surface Treatment

– Definition: The surface of an implant can be treated through various methods (e.g., sandblasting, acid etching) to enhance osseointegration—the process by which the bone grows around the implant.

– Importance: Surface treatments influence the speed and effectiveness of integration with the jawbone, directly affecting implant success rates. Understanding these treatments can help buyers choose implants that align with patient needs. -

Implant Length and Diameter

– Definition: Full upper dental implants come in various lengths (typically ranging from 8mm to 16mm) and diameters (usually between 3.3mm to 5.0mm).

– Importance: The choice of length and diameter is critical for stability, especially in cases of bone loss. This specification helps ensure the implant can support the prosthetic effectively, minimizing the risk of failure. -

Tensile Strength

– Definition: This measures the maximum amount of tensile (pulling) stress that the material can withstand before failure.

– Importance: A high tensile strength is essential for dental implants to endure the forces of biting and chewing. Buyers must consider tensile strength ratings when assessing product quality and performance. -

Tolerance Levels

– Definition: Tolerance refers to the permissible limit of variation in the dimensions of the implant components.

– Importance: Accurate tolerances are crucial for the fit and stability of the implants. Poor tolerance can lead to complications, including misalignment or implant failure, making it a key factor in procurement decisions.

Common Trade Terms in Dental Implant Procurement

Familiarity with industry jargon is vital for effective communication and negotiation in the dental implant market. Here are several important terms:

-

OEM (Original Equipment Manufacturer)

– Definition: A company that produces parts or equipment that may be marketed by another manufacturer.

– Importance: Understanding OEM relationships can help buyers assess product quality and reliability, as well as identify potential sourcing options. -

MOQ (Minimum Order Quantity)

– Definition: The smallest quantity of a product that a supplier is willing to sell.

– Importance: Knowing the MOQ helps buyers manage inventory costs and ensure they can meet patient demand without overstocking. -

RFQ (Request for Quotation)

– Definition: A document used to invite suppliers to bid on specific products or services.

– Importance: An RFQ enables buyers to compare prices and terms from multiple suppliers, ensuring they secure the best possible deal. -

Incoterms (International Commercial Terms)

– Definition: A set of predefined international trade terms that clarify the responsibilities of buyers and sellers.

– Importance: Understanding Incoterms is critical for managing shipping costs, risk, and logistics, especially for international transactions. -

Biocompatibility

– Definition: The property of a material to perform with an appropriate host response when applied in a medical context.

– Importance: Biocompatibility is essential for dental implants to minimize rejection and complications, making it a vital factor in product selection.

By mastering these technical properties and trade terms, international B2B buyers can make informed decisions that enhance their procurement strategies and ultimately improve patient outcomes in the dental implant sector.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the full upper dental implants Sector

Market Overview & Key Trends

The global market for full upper dental implants is driven by a combination of increasing dental health awareness, a growing aging population, and advancements in dental technology. Regions like Africa, South America, the Middle East, and Europe are witnessing a surge in demand as more consumers seek permanent solutions to tooth loss. Notably, the trend towards minimally invasive procedures, such as All-on-4 and All-on-6 implants, is gaining traction due to their cost-effectiveness and reduced recovery time.

Emerging B2B technologies are transforming sourcing dynamics within the dental implant sector. Digital dentistry, including 3D printing and CAD/CAM technologies, allows for more precise and personalized implant solutions, reducing lead times and enhancing product quality. Additionally, the adoption of telemedicine in dental consultations is streamlining patient assessments and follow-ups, making it easier for international buyers to engage with suppliers regardless of geographic constraints.

Market dynamics are also shifting towards value-based purchasing, where buyers prioritize quality and long-term performance over initial costs. This trend emphasizes the importance of establishing partnerships with reputable manufacturers that can demonstrate compliance with international quality standards, such as ISO 13485 and CE marking. For international B2B buyers, this means focusing on suppliers with a robust track record of delivering high-quality, innovative solutions that meet evolving consumer expectations.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a critical consideration in the full upper dental implants sector. The environmental impact of dental materials, particularly titanium and zirconia, underscores the need for responsible sourcing practices. As awareness of environmental issues grows, buyers are increasingly seeking suppliers who prioritize sustainability in their manufacturing processes. This includes the use of recycled materials and energy-efficient production methods.

Ethical sourcing is equally important, as buyers look for suppliers who uphold fair labor practices and transparent supply chains. Certifications such as ISO 14001 for environmental management and ISO 26000 for social responsibility are becoming essential benchmarks for evaluating potential partners. By choosing suppliers with these certifications, international buyers can ensure their procurement practices align with global sustainability goals.

Moreover, the use of ‘green’ materials in the production of dental implants is gaining traction. Innovations in biocompatible materials and coatings that minimize environmental impact while maintaining performance standards are increasingly available. Buyers should prioritize manufacturers who are investing in research and development to improve the sustainability of their products.

Brief Evolution/History

The evolution of full upper dental implants began in the 1960s with the introduction of titanium as a biocompatible material. Over the decades, the technology has advanced significantly, leading to the development of various implant systems designed to address different patient needs. Innovations such as the All-on-4 technique emerged in the early 2000s, allowing for faster, more effective treatments for patients with extensive tooth loss.

Today, the focus has shifted not only to improving the functionality and aesthetics of dental implants but also to ensuring that the processes involved in their production are sustainable and ethically sound. As the market continues to evolve, B2B buyers must stay informed about these developments to make strategic purchasing decisions that reflect both quality and corporate social responsibility.

Related Video: Ramsey Amin Review by Patient – Full Upper Dental Implants

Frequently Asked Questions (FAQs) for B2B Buyers of full upper dental implants

-

What criteria should I use to vet suppliers of full upper dental implants?

When vetting suppliers, focus on their certifications, quality assurance processes, and experience in the dental implant industry. Look for compliance with international standards such as ISO 13485 and CE marking, which indicate adherence to safety and quality regulations. Additionally, request references or case studies from other international buyers, particularly those in your region, to gauge their reliability and service quality. A thorough audit of their manufacturing processes and facilities can also provide insights into their operational capabilities. -

Can I customize full upper dental implants according to my specific needs?

Yes, many suppliers offer customization options for full upper dental implants, including variations in material (titanium vs. zirconia), size, and design. Discuss your specific requirements during the initial consultation to ensure the supplier can meet your needs. Be prepared to provide detailed specifications and possibly collaborate on design prototypes. Customization may also affect lead times and costs, so clarify these aspects upfront to avoid delays in your procurement process. -

What is the typical minimum order quantity (MOQ) for full upper dental implants, and how does it affect pricing?

The MOQ for full upper dental implants can vary significantly by supplier, typically ranging from 10 to 50 units per order. Suppliers often set MOQs to ensure cost-effectiveness in production and logistics. Ordering below the MOQ may lead to higher per-unit costs or additional fees. When negotiating, consider discussing flexibility in MOQs, especially if you are testing the market or entering a new region, as this could help manage your initial investment more effectively. -

What are the lead times for delivery once I place an order for dental implants?

Lead times can vary based on factors such as the supplier’s location, the complexity of the order, and the level of customization required. Generally, expect delivery timelines to range from 4 to 12 weeks. Suppliers should provide a clear timeline during the ordering process, including any potential delays due to customs or logistics. It’s advisable to build in extra time for unforeseen delays, especially when sourcing from international suppliers, to ensure timely availability for your clients. -

How do I ensure quality assurance and compliance with international standards?

To ensure quality assurance, request documentation of the supplier’s quality management systems, including certifications like ISO 13485. You can also ask for reports from recent audits and inspections. Implement a sampling process for incoming goods to verify quality upon receipt. Establishing a clear communication channel with the supplier for ongoing quality checks can help address any issues proactively and maintain compliance with the relevant regulations in your market. -

What logistics considerations should I keep in mind when importing dental implants?

Logistics considerations include understanding customs regulations, shipping methods, and potential tariffs or duties. Ensure your supplier is well-versed in international shipping practices and can provide necessary documentation for customs clearance. It’s also wise to work with logistics partners who specialize in medical devices to navigate the complexities of international transport. Consider the shipping timeline and whether you require expedited services, especially if you have tight deadlines for client projects. -

What steps can I take to resolve disputes with suppliers over product quality or delivery issues?

To resolve disputes effectively, maintain clear documentation of all communications, contracts, and agreements with the supplier. Establish a formal dispute resolution process, ideally outlined in your contract, which may include mediation or arbitration. Open communication is key; address issues promptly and professionally, seeking to understand the supplier’s perspective while clearly stating your concerns. If necessary, involve third-party quality inspectors to provide an unbiased assessment of the situation. -

Are there specific payment terms I should negotiate when sourcing dental implants?

Yes, payment terms are critical in international transactions. Common practices include a deposit upon order confirmation (typically 30-50%) and the balance upon delivery or after inspection. Negotiate terms that protect your interests, such as letters of credit or escrow arrangements, especially for larger orders. Consider discussing bulk purchase discounts or flexible payment options to enhance your cash flow management. Ensure that payment methods are secure and comply with international regulations to mitigate risks.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for full upper dental implants

In summary, strategic sourcing for full upper dental implants is not merely a procurement activity; it is a critical investment in quality, patient satisfaction, and long-term profitability. By understanding the diverse options available—ranging from All-on-4 to zygomatic implants—international buyers can tailor their sourcing strategies to meet specific market needs.

Key takeaways include:

- Cost Variability: Be aware of how geographic location and implant type affect pricing. Countries like Turkey and Brazil offer competitive pricing without compromising quality.

- Regulatory Compliance: Ensure that suppliers meet local and international regulatory standards, such as CE or FDA approvals, to mitigate risks associated with product liability.

- Supplier Relationships: Establish strong partnerships with manufacturers who can provide ongoing support, training, and innovation in implant technology.

As the demand for dental implants continues to grow, particularly in emerging markets, now is the time to refine your sourcing strategies. Invest in reliable suppliers who can deliver quality products while providing exceptional service. Engage with industry experts and consider attending relevant trade shows to stay ahead of trends. By doing so, you position your business for success in a competitive landscape, ultimately enhancing patient care and boosting your bottom line.