Introduction: Navigating the Global Market for components of dental implants

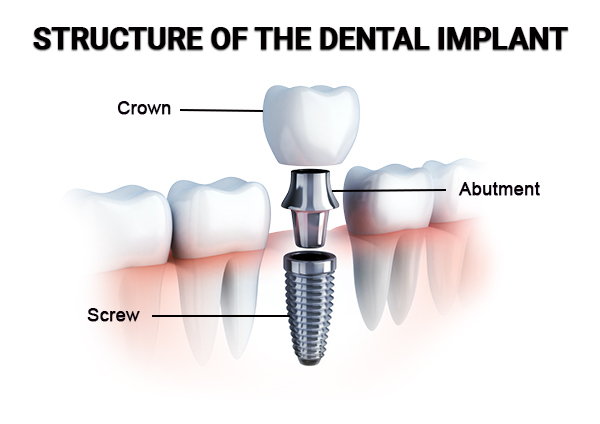

In today’s rapidly evolving dental industry, the demand for high-quality components of dental implants is at an all-time high. As an international B2B buyer, understanding the nuances of this market is essential to making informed sourcing decisions that can significantly impact your business’s success. Components such as implants, abutments, and prosthetics are not just products; they represent a critical investment in patient care and satisfaction.

This comprehensive guide provides a deep dive into the components of dental implants, covering a broad spectrum of essential topics. Buyers will explore various types of components, the materials used, and the latest advancements in manufacturing and quality control processes. Furthermore, we will examine key suppliers in the industry, cost considerations, and market trends that are shaping the landscape of dental implant components globally.

For buyers in Africa, South America, the Middle East, and Europe, this guide is tailored to empower you with actionable insights. By understanding the intricacies of sourcing dental implant components, you can navigate potential challenges and leverage opportunities in your respective markets. Whether you’re seeking to establish new supplier relationships or optimize your existing procurement strategies, this guide serves as a valuable resource to enhance your competitive edge in the global dental marketplace.

Understanding components of dental implants Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Endosteal Implants | Placed in the jawbone, most common type | General dentistry, oral surgery | Pros: High success rate, natural feel. Cons: Requires sufficient bone density. |

| Subperiosteal Implants | Positioned under the gum but above the jawbone | Patients with insufficient jawbone | Pros: No need for bone grafting. Cons: More invasive, limited use. |

| Zygomatic Implants | Anchored in the cheekbone, for severe bone loss | Complex cases, advanced dental practices | Pros: Suitable for patients with significant bone loss. Cons: Requires specialized training. |

| Mini Implants | Smaller diameter, less invasive | Temporary solutions, orthodontics | Pros: Easier placement, less recovery time. Cons: Lower stability compared to standard implants. |

| Dental Implant Abutments | Connects the implant to the crown or prosthetic | Customization in dental restorations | Pros: Versatile, tailored solutions. Cons: Potential for misalignment if not correctly fitted. |

Endosteal Implants

Endosteal implants are the most commonly used type of dental implants, placed directly into the jawbone. They are typically made from titanium and provide a robust foundation for crowns, bridges, or dentures. B2B buyers should consider the availability of high-quality titanium and the implant’s compatibility with various prosthetic options. Their high success rate makes them a preferred choice in general dentistry, but they require sufficient bone density, which can necessitate preliminary assessments or bone grafting procedures.

Subperiosteal Implants

Subperiosteal implants are designed for patients who lack adequate bone height or width to support traditional endosteal implants. These implants are placed under the gum tissue but above the jawbone, making them an alternative for those unable to undergo bone augmentation. For B2B buyers, it is essential to evaluate the potential for complications, as these implants are more invasive and may involve longer healing times. They are particularly useful in regions with limited bone availability, but their application is less common than endosteal implants.

Zygomatic Implants

Zygomatic implants are specialized implants anchored in the zygomatic bone (cheekbone) and are intended for patients with severe bone loss in the upper jaw. This type of implant allows for immediate loading and can significantly improve the patient’s quality of life. B2B buyers should assess the need for specialized training for their dental teams, as these implants require advanced surgical skills. While they offer a solution for challenging cases, the complexity and cost can be higher than traditional implants.

Mini Implants

Mini implants are smaller in diameter and are often used in less invasive procedures. They are ideal for temporary solutions or orthodontic applications where immediate stabilization is required. For B2B buyers, the advantages include easier placement and reduced recovery time, making them appealing for practices looking to offer quick solutions. However, their lower stability compared to standard implants may limit their use in permanent restorations, necessitating careful consideration of patient needs and treatment plans.

Dental Implant Abutments

Dental implant abutments serve as connectors between the implant and the prosthetic crown or bridge. They come in various shapes and sizes, allowing for customization based on the patient’s anatomical requirements. B2B buyers should focus on the versatility and compatibility of abutments with different implant systems, as misalignment can lead to complications. While they provide tailored solutions for dental restorations, the precision in fitting is critical to ensure optimal outcomes for patients.

Related Video: 3 Types of Dental Implants and Surface treatments explained!

Key Industrial Applications of components of dental implants

| Industry/Sector | Specific Application of components of dental implants | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Use of titanium implants for tooth replacement | Enhanced patient satisfaction and retention | Ensure compliance with local regulations and quality standards |

| Dental Laboratories | Custom abutments and prosthetics fabrication | Streamlined production processes and reduced costs | Source materials with high precision and biocompatibility |

| Orthodontics | Mini-screw implants for temporary anchorage | Improved treatment outcomes and efficiency | Look for suppliers with innovative designs and proven efficacy |

| Medical Device Manufacturers | Development of implantable devices for dental applications | Access to a growing market and diversification | Evaluate supplier certifications and R&D capabilities |

| Research Institutions | Clinical trials and studies on new implant technologies | Contribution to advancements in dental medicine | Collaborate with reputable manufacturers for materials sourcing |

Dental Clinics

Dental clinics utilize components of dental implants, such as titanium implants, to replace missing teeth. This application not only addresses the aesthetic concerns of patients but also restores functionality, allowing for better chewing and speaking. For international B2B buyers, it is crucial to ensure that the implants meet local regulations and quality standards, as this directly impacts patient safety and clinic reputation. Additionally, clinics must consider the warranty and support offered by suppliers to maintain long-term relationships.

Dental Laboratories

In dental laboratories, custom abutments and prosthetics are fabricated using various components of dental implants. This application enhances the precision of dental restorations, leading to improved fit and comfort for patients. For buyers, sourcing high-quality materials that comply with international standards is essential. Furthermore, establishing partnerships with suppliers who offer competitive pricing and timely delivery can significantly reduce operational costs and improve overall efficiency.

Orthodontics

Mini-screw implants serve as temporary anchorage devices in orthodontics, allowing for more effective tooth movement. By integrating these components, orthodontic practices can achieve better treatment outcomes while minimizing patient discomfort. International buyers should focus on suppliers that provide innovative designs and demonstrate a track record of clinical efficacy. Understanding the specific needs of the orthodontic sector, such as the need for rapid turnaround times and flexibility in ordering, is also vital.

Medical Device Manufacturers

Medical device manufacturers are increasingly developing implantable devices for dental applications, utilizing components of dental implants to enhance their product offerings. This presents a significant opportunity for businesses looking to diversify their portfolios. Buyers in this sector should evaluate supplier certifications and research and development capabilities to ensure they are partnering with manufacturers that prioritize innovation and quality. Additionally, understanding market trends and regulatory requirements in different regions can help in making informed sourcing decisions.

Research Institutions

Research institutions conduct clinical trials and studies on new implant technologies, often relying on components of dental implants for their experiments. This application plays a crucial role in advancing the field of dental medicine and improving patient outcomes. Collaborating with reputable manufacturers for sourcing materials is essential for ensuring the reliability and validity of research findings. Buyers should also consider the ethical implications and compliance with local and international regulations when selecting suppliers for research purposes.

Related Video: Dental Implant Components and Functions in detail

Strategic Material Selection Guide for components of dental implants

When selecting materials for dental implant components, international B2B buyers must consider several factors, including mechanical properties, biocompatibility, cost, and regulatory compliance. Below is an analysis of four common materials used in dental implants, providing insights into their properties, advantages, disadvantages, and specific considerations for buyers from diverse regions such as Africa, South America, the Middle East, and Europe.

Titanium

Key Properties:

Titanium is renowned for its excellent strength-to-weight ratio, corrosion resistance, and biocompatibility. It can withstand high temperatures and pressures, making it suitable for various dental applications. Its natural ability to osseointegrate with bone enhances its performance in dental implants.

Pros & Cons:

The durability of titanium is one of its significant advantages, as it can last for many years in the oral environment. However, titanium can be more expensive than other materials, and its manufacturing complexity may increase costs. Additionally, while titanium is highly effective, it may not be the best choice for patients with metal allergies.

Impact on Application:

Titanium is compatible with a wide range of dental media, including saliva and bone tissue. Its resistance to corrosion ensures longevity even in the harsh oral environment.

Considerations for Buyers:

International buyers should ensure compliance with standards such as ASTM F136 for titanium alloys. Understanding regional regulations regarding metal implants is crucial, particularly in Europe where stringent medical device regulations apply.

Zirconia

Key Properties:

Zirconia is a ceramic material known for its high strength, toughness, and aesthetic appeal. It exhibits excellent biocompatibility and is resistant to wear and corrosion, making it suitable for dental applications.

Pros & Cons:

One of zirconia’s key advantages is its aesthetic quality, which closely resembles natural tooth enamel. However, it can be more brittle than titanium, leading to potential fracture in high-stress applications. The manufacturing process for zirconia can be complex and costly, impacting overall pricing.

Impact on Application:

Zirconia is particularly effective in aesthetic applications, such as visible implant components, due to its tooth-like appearance. However, it may not be suitable for load-bearing applications where flexibility is required.

Considerations for Buyers:

Buyers should consider compliance with international standards like ISO 6872 for dental ceramics. In regions with a high demand for aesthetic solutions, such as Europe and parts of South America, zirconia may be preferred despite its higher cost.

Cobalt-Chromium Alloys

Key Properties:

Cobalt-chromium alloys offer excellent mechanical properties, including high strength and resistance to wear and corrosion. These alloys can withstand high temperatures, making them suitable for various dental applications.

Pros & Cons:

The durability and strength of cobalt-chromium alloys make them ideal for load-bearing components. However, they can be more expensive than titanium and zirconia, and their manufacturing process can be complex. Additionally, some patients may have sensitivities to cobalt.

Impact on Application:

Cobalt-chromium alloys are particularly effective in environments that require high wear resistance, such as in implant-supported prosthetics. Their corrosion resistance also makes them suitable for long-term use in the oral cavity.

Considerations for Buyers:

Compliance with standards such as ASTM F75 is essential for cobalt-chromium alloys. Buyers should be aware of regional sensitivities to cobalt, especially in markets like Europe where metal allergies are a growing concern.

Polyether Ether Ketone (PEEK)

Key Properties:

PEEK is a high-performance thermoplastic known for its excellent mechanical properties, chemical resistance, and biocompatibility. It can withstand high temperatures and has a low density, making it lightweight.

Pros & Cons:

PEEK is highly durable and offers good wear resistance. Its lightweight nature can lead to increased patient comfort. However, its cost can be relatively high, and it may not provide the same aesthetic appeal as ceramics or metals.

Impact on Application:

PEEK is suitable for various dental applications, particularly in cases where flexibility and comfort are required. Its chemical resistance makes it compatible with different oral media.

Considerations for Buyers:

International buyers should ensure that PEEK products comply with standards such as ISO 10993 for biocompatibility. Understanding the regional acceptance of thermoplastics in dental applications is essential, particularly in markets like Africa and the Middle East.

Summary Table

| Material | Typical Use Case for components of dental implants | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Load-bearing implants | Excellent strength-to-weight ratio | Higher cost, potential allergies | High |

| Zirconia | Aesthetic components | Tooth-like appearance | Brittle, complex manufacturing | High |

| Cobalt-Chromium Alloys | Load-bearing prosthetics | High strength and wear resistance | Expensive, potential allergies | High |

| Polyether Ether Ketone | Flexible implant components | Lightweight and durable | High cost, less aesthetic appeal | Medium |

This strategic material selection guide provides essential insights for international B2B buyers looking to make informed decisions regarding dental implant components. Understanding the properties, advantages, and limitations of each material is crucial for selecting the right components that meet both regulatory standards and market demands.

In-depth Look: Manufacturing Processes and Quality Assurance for components of dental implants

The manufacturing of dental implant components is a complex process that combines advanced technology with stringent quality assurance measures. For B2B buyers, understanding these processes is essential to ensure the procurement of high-quality products that meet international standards. This section delves into the key manufacturing stages, quality control protocols, and relevant standards that guide the production of dental implants.

Manufacturing Processes

The manufacturing of dental implant components involves several critical stages, each crucial for ensuring product integrity and performance.

Material Preparation

The first step in the manufacturing process is material preparation. Common materials used for dental implants include titanium and its alloys, zirconia, and occasionally, polymers.

- Material Selection: The choice of material is fundamental, as it affects biocompatibility and mechanical properties. Titanium, known for its strength and corrosion resistance, is the most widely used material.

- Pre-processing: Raw materials undergo processes such as cleaning, milling, and thermal treatment to enhance their properties before forming.

Forming

The forming stage involves shaping the prepared materials into the desired component geometry.

- Techniques: Common forming techniques include:

- CNC Machining: Computer Numerical Control (CNC) machining is widely used for precision shaping. It allows for the creation of complex geometries that are essential for implant fit and function.

- Additive Manufacturing: Also known as 3D printing, this technique is gaining traction for producing intricate designs and customized implants.

- Casting and Forging: These traditional methods are also utilized, especially for larger components.

Assembly

After forming, components are assembled, particularly in cases where implants consist of multiple parts.

- Joining Methods: Techniques such as welding, adhesive bonding, or mechanical fastening may be employed depending on the design and materials involved.

- Component Integration: Ensuring that all components fit together seamlessly is critical for the performance of the final product.

Finishing

The finishing stage enhances the surface properties and prepares the implant for clinical use.

- Surface Treatments: Techniques such as sandblasting, acid etching, and anodization improve the surface roughness and promote osseointegration.

- Quality Inspection: Each finished component undergoes rigorous inspection to confirm adherence to specifications and standards.

Quality Assurance

Quality assurance (QA) is pivotal in the dental implant manufacturing process, ensuring that products meet regulatory standards and customer expectations.

International Standards

B2B buyers should be familiar with relevant international standards that govern manufacturing practices:

- ISO 9001: This standard focuses on quality management systems and is applicable across various industries, including medical devices.

- ISO 13485: Specifically tailored for medical devices, it outlines requirements for a comprehensive quality management system, ensuring consistent design, development, production, and delivery.

Industry-Specific Certifications

In addition to general quality standards, specific certifications may be required:

- CE Marking: Essential for products sold within the European Economic Area, CE marking indicates compliance with EU safety and health regulations.

- FDA Approval: For suppliers in the United States, FDA clearance or approval is necessary for dental implants to ensure safety and efficacy.

Quality Control Checkpoints

Quality control (QC) checkpoints throughout the manufacturing process help identify issues early:

- Incoming Quality Control (IQC): Inspection of raw materials upon arrival to ensure they meet specified criteria.

- In-Process Quality Control (IPQC): Ongoing checks during the manufacturing process to monitor compliance with specifications.

- Final Quality Control (FQC): Comprehensive testing of finished products before they are released for distribution.

Common Testing Methods

Testing methods used to ensure quality include:

- Mechanical Testing: Assessing properties such as tensile strength, fatigue resistance, and hardness.

- Biocompatibility Testing: Conducted to ensure that materials do not provoke adverse reactions when implanted in the body.

- Sterility Testing: Ensures that the products are free from viable microorganisms.

Verifying Supplier Quality Control

B2B buyers must take proactive steps to verify the quality control processes of their suppliers. Here are some actionable insights:

- Conduct Audits: Regular audits of suppliers’ manufacturing facilities can provide insights into their processes, compliance with standards, and overall quality culture.

- Request Quality Reports: Suppliers should provide documentation that demonstrates compliance with international standards and internal QC processes.

- Engage Third-Party Inspectors: Utilizing third-party inspection services can offer an unbiased assessment of the supplier’s quality assurance practices and product integrity.

QC and Certification Nuances for International Buyers

For international buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding the nuances of quality control and certification is essential:

- Regulatory Variations: Different countries have distinct regulatory requirements. Buyers should familiarize themselves with local regulations that might affect importation and use of dental implants.

- Certification Recognition: Not all certifications are recognized globally. Buyers should verify that the certifications held by suppliers are valid in their target markets.

- Cultural and Logistical Considerations: Understanding the cultural context and logistical challenges in different regions can help buyers navigate the complexities of sourcing quality dental implant components.

Conclusion

Navigating the manufacturing processes and quality assurance protocols for dental implant components requires careful consideration and due diligence. By understanding the stages of manufacturing, relevant quality standards, and verification methods, B2B buyers can make informed decisions that ensure the procurement of high-quality products. This knowledge not only enhances supplier relationships but also ensures compliance with regulatory requirements, ultimately leading to better patient outcomes.

Related Video: Full Mouth Dental Implants: Everything You Need to Know and Cost

Comprehensive Cost and Pricing Analysis for components of dental implants Sourcing

Understanding the cost and pricing structure of dental implant components is crucial for international B2B buyers. This analysis delves into the various elements that contribute to the overall cost, as well as the factors that can influence pricing, providing actionable insights for buyers from Africa, South America, the Middle East, and Europe.

Cost Components of Dental Implant Components

-

Materials: The choice of materials significantly impacts the cost. Titanium and zirconia are commonly used due to their biocompatibility and strength. Prices can vary based on material quality and market demand. Sourcing high-grade materials is essential for ensuring product reliability.

-

Labor: Labor costs vary by region and manufacturing practices. Countries with lower labor costs may offer competitive pricing, but this can sometimes compromise quality. It’s important for buyers to assess the labor standards and skill levels in the supplier’s country.

-

Manufacturing Overhead: This includes indirect costs associated with production, such as utilities, rent, and administrative expenses. Efficient manufacturing processes can help lower overhead costs, which can be reflected in the pricing of dental implant components.

-

Tooling: Initial tooling costs can be significant, especially for custom components. Buyers should consider these costs in relation to their order volumes. Investing in high-quality tooling can lead to better product consistency and lower long-term costs.

-

Quality Control (QC): Rigorous QC processes ensure that components meet necessary standards and certifications. While this adds to the cost, it is a critical investment for ensuring patient safety and satisfaction.

-

Logistics: Transportation costs can vary significantly based on the distance between the supplier and the buyer, as well as the chosen shipping methods. Efficient logistics planning can mitigate costs, especially for international shipments.

-

Margin: Suppliers typically include a margin that reflects their operational costs and desired profit. Understanding the margin expectations in different markets can help buyers negotiate better pricing.

Price Influencers

-

Volume/MOQ: Minimum order quantities (MOQs) can influence pricing. Higher order volumes often lead to lower per-unit costs. Buyers should evaluate their purchasing strategy to maximize cost efficiency.

-

Specifications/Customization: Custom components often come at a premium. Clearly defining specifications upfront can help avoid unexpected costs later in the process.

-

Quality/Certifications: Components that meet international standards (e.g., ISO, CE) may be priced higher due to the associated costs of compliance. Buyers should assess the importance of certifications based on their target markets.

-

Supplier Factors: The reputation and reliability of the supplier can impact pricing. Established suppliers may charge a premium for their experience and customer service.

-

Incoterms: The terms of shipping and delivery (e.g., FOB, CIF) can significantly affect the total landed cost. Understanding these terms is essential for budgeting and negotiating pricing.

Buyer Tips

-

Negotiation: Effective negotiation can lead to better pricing. Buyers should prepare by researching market rates and understanding the supplier’s cost structure.

-

Cost-Efficiency: Evaluate the Total Cost of Ownership (TCO), which includes purchase price, shipping, taxes, and potential warranty costs. This comprehensive view can help in making informed purchasing decisions.

-

Pricing Nuances: Buyers from different regions may encounter varying pricing structures influenced by local economic conditions, currency fluctuations, and trade tariffs. Staying informed about these factors can enhance negotiation power.

-

Supplier Relationships: Building long-term relationships with suppliers can lead to better pricing and priority service. Regular communication and feedback can foster trust and collaboration.

Disclaimer

The prices and cost structures discussed are indicative and can vary based on market conditions, supplier capabilities, and specific buyer requirements. It is advisable for buyers to conduct thorough research and engage in discussions with multiple suppliers to obtain accurate quotes tailored to their needs.

Spotlight on Potential components of dental implants Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘components of dental implants’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for components of dental implants

Key Technical Properties of Dental Implant Components

Understanding the technical properties of dental implant components is crucial for international B2B buyers. These properties not only ensure the quality and performance of the implants but also impact the overall success of dental procedures. Here are some essential specifications:

Illustrative Image (Source: Google Search)

-

Material Grade

Dental implants are typically made from titanium or titanium alloys due to their biocompatibility and strength. Material grade indicates the specific composition and mechanical properties of the titanium used. Higher-grade materials (e.g., Grade 5 titanium) offer superior strength and corrosion resistance, making them preferable for long-term implants. Buyers should prioritize suppliers who can provide detailed material certifications to ensure compliance with international standards. -

Tolerance

Tolerance refers to the allowable deviation from a specified dimension. In dental implants, tight tolerances (often in the range of ±0.01 mm) are critical for ensuring a proper fit and optimal performance. Poor tolerances can lead to complications such as implant failure or discomfort for the patient. B2B buyers should inquire about the manufacturing processes and quality control measures in place to maintain strict tolerances. -

Surface Treatment

The surface of dental implants often undergoes various treatments (e.g., sandblasting, acid etching) to enhance osseointegration—the process by which the implant bonds with the jawbone. Different surface treatments can affect the implant’s stability and longevity. Understanding the benefits and drawbacks of various treatments can help buyers select the right products for their market needs. -

Coating

Some implants are coated with materials such as hydroxyapatite or bioactive glass to promote bone growth. These coatings can significantly influence the success rate of implants. Buyers should consider the specific applications of coated implants and their acceptance in different regions, as regulatory standards may vary. -

Load-Bearing Capacity

This property defines how much weight an implant can support without failure. It is vital for ensuring that the implant can withstand the forces exerted during chewing and other oral functions. Buyers should assess load-bearing specifications when selecting implants, especially for patients with specific needs, such as those requiring multi-tooth restorations.

Common Trade Terminology in the Dental Implant Industry

Familiarity with industry-specific terminology is essential for effective communication and negotiation in the B2B space. Here are several key terms:

-

OEM (Original Equipment Manufacturer)

This term refers to companies that manufacture products or components that are sold under another company’s brand. Understanding OEM relationships can help buyers identify reliable suppliers who adhere to quality standards and can customize products to meet specific needs. -

MOQ (Minimum Order Quantity)

MOQ indicates the smallest number of units a supplier is willing to sell. For B2B buyers, knowing the MOQ is essential for budgeting and inventory management. Suppliers with lower MOQs can provide flexibility, especially for businesses just entering the dental implant market. -

RFQ (Request for Quotation)

An RFQ is a formal process where buyers request pricing and terms from suppliers for specific products or services. This process helps in comparing different suppliers and negotiating better terms. B2B buyers should prepare comprehensive RFQs to receive accurate and competitive quotes. -

Incoterms (International Commercial Terms)

Incoterms are standardized trade terms that define the responsibilities of buyers and sellers in international transactions. They clarify issues such as shipping costs, insurance, and risk transfer. B2B buyers must understand these terms to avoid misunderstandings and ensure smooth logistics. -

Certification

In the dental implant industry, certifications (e.g., ISO 13485, CE marking) indicate compliance with international quality and safety standards. Buyers should prioritize suppliers who can provide relevant certifications to ensure that products meet regulatory requirements in their respective markets.

By grasping these technical properties and trade terminologies, international B2B buyers can make informed decisions, ensuring they select high-quality dental implant components that meet the needs of their clientele.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the components of dental implants Sector

Market Overview & Key Trends

The components of the dental implants sector are experiencing significant growth driven by an aging global population, increasing awareness of oral health, and technological advancements in implantology. International B2B buyers should note that emerging markets in Africa, South America, the Middle East, and Europe are witnessing heightened demand for dental implants, fueled by improving healthcare infrastructure and rising disposable incomes.

Key trends shaping the market include the integration of digital technologies, such as 3D printing and computer-aided design (CAD), which streamline the production process and enhance customization. These innovations not only reduce lead times but also lower costs, making implants more accessible. Additionally, there is a growing preference for minimally invasive procedures, which is reshaping the types of components demanded by dental professionals.

B2B buyers must also consider the impact of regulatory changes and market dynamics, including fluctuating raw material prices and supply chain disruptions. As the global landscape evolves, establishing strong partnerships with reliable suppliers is crucial. Buyers should prioritize suppliers who can demonstrate agility and resilience in their operations to mitigate risks associated with market volatility.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

The dental implant sector is increasingly recognizing the importance of sustainability and ethical sourcing. Environmental concerns, such as the carbon footprint of manufacturing processes and the disposal of medical waste, are prompting companies to adopt greener practices. B2B buyers should actively seek out suppliers who prioritize sustainable sourcing of materials, such as titanium and zirconia, known for their biocompatibility and durability.

Moreover, ethical supply chains are becoming a critical consideration. Buyers should evaluate potential partners based on their adherence to social responsibility standards, including fair labor practices and transparency in sourcing. Certifications such as ISO 14001 (Environmental Management) and ISO 13485 (Quality Management for Medical Devices) can serve as indicators of a supplier’s commitment to sustainability and ethical practices.

Adopting a sustainable approach not only enhances corporate social responsibility but also appeals to the growing segment of eco-conscious consumers. This trend is particularly relevant for buyers in Europe, where regulatory frameworks are increasingly stringent regarding environmental impact.

Brief Evolution/History

The dental implant industry has evolved significantly over the past few decades, transitioning from rudimentary designs to sophisticated, highly engineered components. The introduction of titanium implants in the 1960s marked a pivotal moment, as this material offered superior osseointegration properties. Since then, advancements in materials science, digital technology, and surgical techniques have propelled the sector forward.

In recent years, the focus has shifted towards patient-centric solutions, emphasizing customization and improved outcomes. The integration of digital workflows has further transformed the landscape, allowing for enhanced precision and efficiency in implant procedures. Understanding this evolution is essential for B2B buyers aiming to navigate the current market effectively and capitalize on emerging opportunities.

Frequently Asked Questions (FAQs) for B2B Buyers of components of dental implants

1. How can I effectively vet suppliers of dental implant components?

Vetting suppliers is crucial to ensure quality and reliability. Start by reviewing their certifications, such as ISO 13485, which indicates compliance with international standards for medical devices. Request references from other B2B clients, and consider their experience in the dental implant industry. Additionally, conduct on-site visits, if possible, to assess manufacturing capabilities and quality control processes. Using platforms like Alibaba or Global Sources can also provide insights into supplier ratings and reviews.

2. Are customization options available for dental implant components?

Many suppliers offer customization to meet specific clinical needs or preferences. Discuss your requirements early in the negotiation process, including material types, sizes, and designs. Ensure that the supplier has the capability and experience to deliver customized products. A formal agreement outlining the specifications, timelines, and costs associated with customization will help prevent misunderstandings down the line.

3. What are the typical minimum order quantities (MOQ) and lead times for dental implant components?

Minimum order quantities can vary widely depending on the supplier and the component. Generally, MOQs can range from 50 to several hundred units. Lead times typically range from 4 to 12 weeks, depending on the complexity of the order and the supplier’s production schedule. Always confirm these details upfront and factor in additional time for potential customs delays, especially when importing from overseas.

4. What payment terms should I expect when sourcing dental implant components internationally?

Payment terms can differ significantly between suppliers. Common practices include upfront payments, partial payments, or letters of credit. It’s advisable to negotiate terms that mitigate risk, such as paying a deposit with the balance due upon delivery. Be cautious of suppliers requesting full payment upfront, especially if you are unfamiliar with their reputation. Utilizing escrow services can also provide additional security in transactions.

5. How do I ensure quality assurance and certification compliance for dental implant components?

To ensure quality, request documentation that verifies compliance with relevant standards, such as CE marking in Europe or FDA approval in the U.S. Conduct thorough inspections of samples before committing to larger orders. Additionally, consider third-party quality audits or certifications to verify the supplier’s quality management systems. Establishing a clear quality assurance process in your contract will help maintain standards throughout the supply chain.

6. What logistics considerations should I keep in mind when importing dental implant components?

Logistics play a critical role in international sourcing. Assess the supplier’s ability to handle shipping logistics, including packaging, customs clearance, and delivery times. Choose reliable freight forwarders experienced in medical device shipments to minimize delays and ensure compliance with regulations. It’s also essential to understand the import duties and taxes applicable to your country to accurately calculate total costs.

7. How can I handle disputes with international suppliers?

Disputes can arise from misunderstandings or unmet expectations. To manage these effectively, establish a clear communication protocol in your contract, specifying how disputes will be resolved. Consider including mediation or arbitration clauses to avoid lengthy litigation. Maintaining good relationships with suppliers can also help in resolving issues amicably. If problems persist, document all communications and agreements to support your case.

8. What are the trends affecting the dental implant component supply chain?

The dental implant industry is witnessing trends such as increased demand for biocompatible materials and advancements in digital dentistry. Suppliers are also adopting more sustainable practices to meet global standards. International buyers should stay informed about these trends, as they can influence product availability and pricing. Engaging in industry forums and trade shows can provide valuable insights into market dynamics and emerging technologies.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for components of dental implants

In conclusion, the strategic sourcing of dental implant components is crucial for international B2B buyers aiming to enhance their product offerings and operational efficiencies. By prioritizing quality, cost-effectiveness, and supplier reliability, companies can better position themselves in competitive markets across Africa, South America, the Middle East, and Europe.

Key takeaways include:

- Supplier Diversification: Engaging with a diverse range of suppliers can mitigate risks and foster innovation in product development.

- Quality Assurance: Implementing stringent quality control measures ensures that the components meet international standards, ultimately enhancing patient outcomes.

- Cost Management: A thorough analysis of total cost of ownership versus initial purchase price can lead to more informed sourcing decisions, optimizing overall expenditure.

As the dental implant market continues to evolve with technological advancements and shifting consumer demands, B2B buyers must remain agile and proactive. Embrace strategic sourcing not just as a procurement function, but as a critical component of your overall business strategy. By doing so, you will not only secure a competitive edge but also contribute to the growth and sustainability of the dental industry. Start evaluating your sourcing strategies today to prepare for the future landscape of dental implants.