Introduction: Navigating the Global Market for dental implant gallery

In today’s competitive healthcare landscape, the demand for high-quality dental implants is surging, driven by an increasing awareness of oral health and advancements in dental technology. For international B2B buyers, particularly those operating in Africa, South America, the Middle East, and Europe, understanding the nuances of the dental implant market is crucial for making informed sourcing decisions. A well-curated dental implant gallery not only showcases a range of products but also serves as a vital resource for evaluating potential suppliers and materials.

This guide delves deep into the diverse landscape of dental implants, covering critical aspects such as types of implants, materials used, manufacturing processes, and quality control measures. Buyers will gain insights into cost structures and market trends that influence pricing and availability. Furthermore, we will address frequently asked questions that often arise during the procurement process, ensuring that you are well-equipped to navigate the complexities of this market.

By leveraging this comprehensive resource, international buyers can enhance their purchasing strategies, ensuring they select the best products for their specific needs while maintaining compliance with local regulations and standards. With a clear understanding of the dental implant gallery, you can confidently position your business to thrive in an increasingly interconnected global marketplace.

Understanding dental implant gallery Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Endosteal Implants | Placed within the jawbone; most common type | General dentistry, oral surgery | Pros: High success rate; durable. Cons: Requires sufficient bone density. |

| Subperiosteal Implants | Positioned under the gum but above the jawbone | Patients with insufficient bone | Pros: Suitable for patients with bone loss. Cons: More invasive; higher cost. |

| Zygomatic Implants | Anchored in the cheekbone; used for severe bone loss | Advanced reconstructive dentistry | Pros: Avoids bone grafting; immediate placement possible. Cons: Complex procedure; limited application. |

| Mini Dental Implants | Smaller diameter; less invasive | Temporary solutions, denture stabilization | Pros: Easier placement; lower cost. Cons: Limited strength; not suitable for all cases. |

| All-on-4 Implants | Four implants support an entire arch of teeth | Full-arch restoration | Pros: Reduces need for bone grafting; quick recovery. Cons: Requires precise planning; potential for implant failure if not done correctly. |

Endosteal Implants

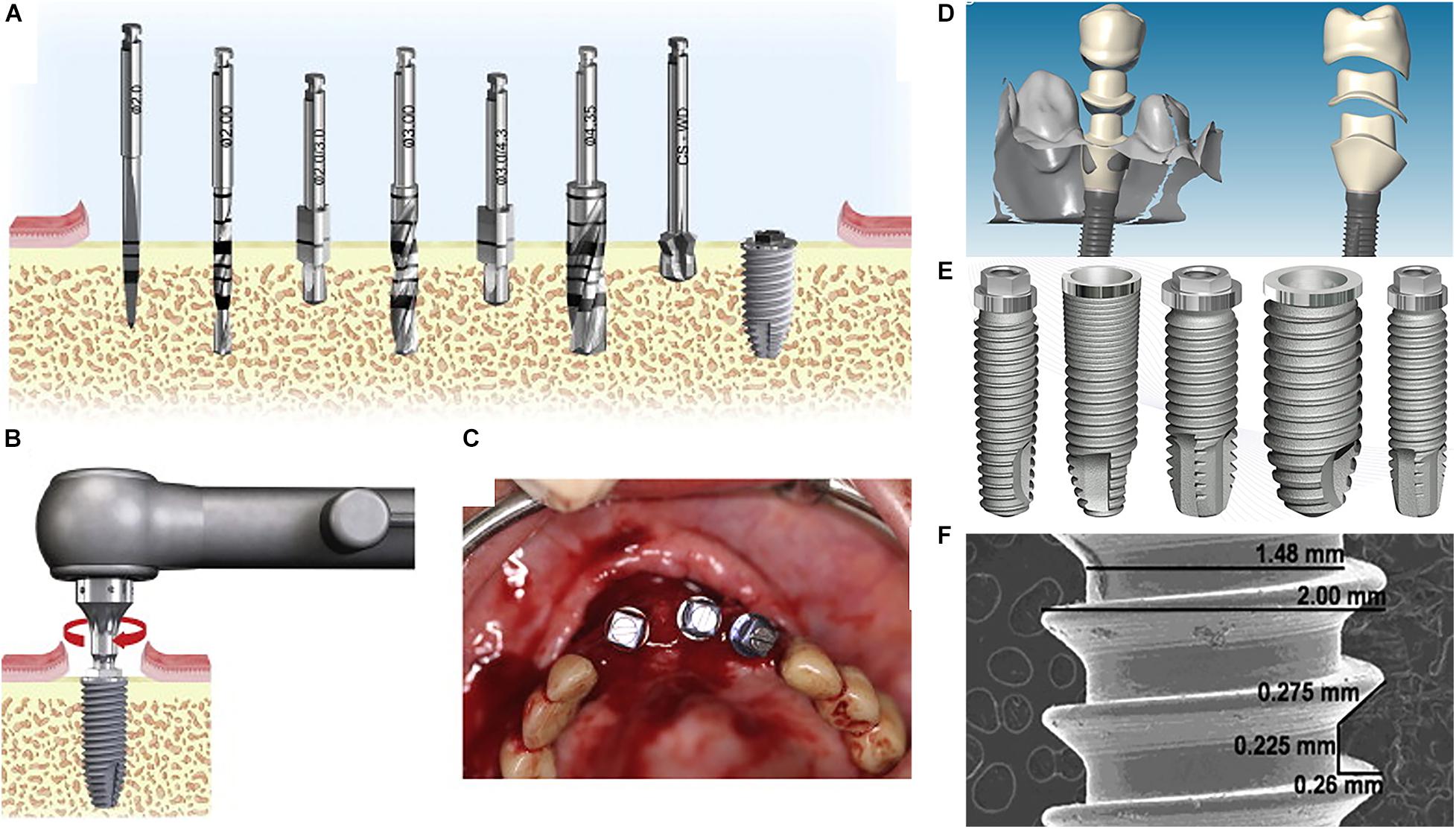

Endosteal implants are the most commonly used type, inserted directly into the jawbone. They come in various shapes, such as screws, cylinders, or blades, allowing for versatility in placement. For B2B buyers, it is essential to consider the patient’s bone density and the need for pre-implant procedures like bone grafting. Suppliers should ensure high-quality materials and provide comprehensive training for dental professionals to enhance success rates.

Subperiosteal Implants

Subperiosteal implants are designed for patients who lack sufficient jawbone height or width. These implants are placed under the gum tissue but above the jawbone, making them a viable option for those who cannot undergo bone grafting. For B2B buyers, it is crucial to assess the cost implications and the potential need for a more invasive procedure. Suppliers should focus on providing implants that offer a balance between durability and patient comfort.

Zygomatic Implants

Zygomatic implants are an advanced solution for patients with severe bone loss in the upper jaw. These implants are anchored in the zygomatic bone (cheekbone), allowing for immediate placement without the need for bone grafting. B2B buyers should evaluate the expertise required for placement and the potential for complications. Collaborating with experienced surgeons and offering comprehensive training can help ensure successful outcomes.

Mini Dental Implants

Mini dental implants are characterized by their smaller diameter, making them less invasive and easier to place. They are often used for denture stabilization or as temporary solutions. B2B buyers should consider their application in specific cases, as they may not provide the same strength as traditional implants. Suppliers can leverage this type’s affordability and ease of use to target markets with budget constraints.

All-on-4 Implants

All-on-4 implants provide a complete arch restoration using only four strategically placed implants. This approach minimizes the need for bone grafting and allows for quicker recovery. For B2B buyers, the precision in planning and placement is critical to avoid complications. Suppliers should emphasize the importance of training and support for dental professionals to maximize the success of this innovative solution.

Related Video: Which is better a dental bridge or implant?

Key Industrial Applications of dental implant gallery

| Industry/Sector | Specific Application of dental implant gallery | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Custom dental implant design and fabrication | Enhanced patient satisfaction through tailored solutions | Quality certifications, lead times, and customization options |

| Dental Laboratories | Prosthetic dental implant production | Increased efficiency and reduced turnaround time | Material sourcing, technology compatibility, and reliability |

| Healthcare Providers | Integration with digital imaging and planning tools | Improved treatment outcomes through precise planning | Software integration capabilities and training support |

| Research Institutions | Development of innovative dental implant materials | Contribution to cutting-edge dental solutions | Collaboration opportunities and access to advanced materials |

| Dental Distributors | Brokering dental implant products to clinics | Expanded product offerings and market reach | Supplier reliability, pricing structures, and shipping logistics |

Dental Clinics

In dental clinics, the dental implant gallery serves as a vital resource for custom dental implant design and fabrication. By showcasing a variety of implant options, clinics can tailor solutions to individual patient needs, enhancing satisfaction and outcomes. International buyers, particularly in regions like Africa and the Middle East, must prioritize suppliers with robust quality certifications and clear customization options to ensure they meet local regulatory standards and patient expectations.

Dental Laboratories

For dental laboratories, the gallery facilitates the production of prosthetic dental implants. By providing access to diverse implant designs and materials, laboratories can streamline their workflows and reduce turnaround times. This efficiency is crucial in competitive markets in South America and Europe, where timely service is a differentiator. Buyers should focus on sourcing from suppliers that offer reliable materials and have proven technology compatibility to ensure consistent quality.

Healthcare Providers

Healthcare providers utilize the dental implant gallery for its integration with digital imaging and planning tools. This integration allows for improved treatment outcomes, as precise planning leads to better surgical execution. Buyers in regions like Europe and the UAE should consider suppliers that offer comprehensive software solutions and adequate training support, as this will facilitate smoother implementation and enhance the overall quality of care provided.

Research Institutions

Research institutions benefit from the gallery through the development of innovative dental implant materials. By collaborating with suppliers showcasing cutting-edge technologies, these institutions can contribute to advancements in dental solutions. For international B2B buyers, especially in emerging markets, establishing partnerships with suppliers who can provide access to advanced materials and collaborative opportunities is essential for fostering innovation.

Dental Distributors

For dental distributors, the dental implant gallery represents an opportunity to broker a variety of implant products to clinics and laboratories. This expanded product offering can significantly enhance market reach and cater to diverse client needs. Buyers should prioritize suppliers known for their reliability, competitive pricing structures, and efficient shipping logistics to maintain a robust supply chain and meet the demands of their clients effectively.

Related Video: Dental Implant Procedure: A Step by Step Guide

Strategic Material Selection Guide for dental implant gallery

When selecting materials for dental implants, it is crucial to consider not only the properties of the materials but also how they align with the specific needs of different markets. Here, we analyze four common materials used in dental implants, focusing on their performance characteristics, advantages and disadvantages, and implications for international B2B buyers.

Titanium

Key Properties: Titanium is renowned for its excellent biocompatibility, strength-to-weight ratio, and corrosion resistance, making it ideal for dental applications. It can withstand the physiological conditions of the oral environment, including varying temperatures and pressures.

Pros & Cons: Titanium implants are durable and have a proven track record in clinical settings. However, they can be more expensive than other materials, and their manufacturing process may be complex, requiring specialized equipment. The suitability for end-products is high, given their long-term performance.

Impact on Application: Titanium is compatible with various media, including bone tissue and dental cements, which enhances its application in diverse dental procedures. Its established use in the industry also means it meets many international standards.

Considerations for International Buyers: Buyers from regions like Africa and the Middle East should ensure compliance with local regulations and standards, such as ASTM and ISO certifications. The high cost may be a consideration for budget-sensitive markets.

Zirconia

Key Properties: Zirconia is a ceramic material known for its aesthetic appeal and high strength. It exhibits excellent fracture toughness and is resistant to wear and corrosion.

Pros & Cons: The primary advantage of zirconia is its superior aesthetic qualities, making it a preferred choice for visible dental applications. However, it can be more brittle than titanium, which may limit its use in load-bearing situations. The manufacturing process can also be complex, potentially increasing costs.

Impact on Application: Zirconia is particularly compatible with soft tissues, promoting better integration and aesthetic outcomes. It is less suitable for areas requiring high mechanical strength.

Considerations for International Buyers: Buyers in Europe and South America may prioritize aesthetic outcomes, making zirconia an attractive option. However, they should be aware of the potential limitations in strength and ensure compliance with relevant dental material standards.

Stainless Steel

Key Properties: Stainless steel is a durable material with good corrosion resistance and tensile strength. It is often used in temporary implants or in pediatric dentistry.

Pros & Cons: The cost-effectiveness of stainless steel makes it an attractive option for budget-conscious buyers. However, it is less biocompatible than titanium and zirconia, which may affect long-term performance. Its aesthetic appeal is also lower, which may be a drawback in visible applications.

Impact on Application: Stainless steel is suitable for temporary applications and certain types of restorations. Its compatibility with various dental procedures is well-established, but it may not be suitable for permanent implants in adults.

Considerations for International Buyers: Buyers from regions with cost constraints may find stainless steel appealing. However, they must consider the potential trade-offs in biocompatibility and aesthetics, especially in markets like the UAE where high standards are expected.

Polyether Ether Ketone (PEEK)

Key Properties: PEEK is a high-performance thermoplastic known for its excellent mechanical properties and biocompatibility. It offers good resistance to chemicals and is lightweight.

Pros & Cons: PEEK is highly durable and can be customized for specific applications, making it versatile. However, its cost is generally higher than metals, and it may not be as widely accepted in traditional dental practices.

Impact on Application: PEEK is compatible with various dental procedures and can be used in conjunction with other materials. Its flexibility allows for better adaptation in certain clinical scenarios.

Considerations for International Buyers: Buyers should assess the acceptance of PEEK in their markets, particularly in Europe where innovative materials are increasingly embraced. Compliance with international standards is essential, as is consideration of the higher cost.

Summary Table

| Material | Typical Use Case for dental implant gallery | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Permanent implants | Excellent biocompatibility and durability | Higher cost and complex manufacturing | High |

| Zirconia | Aesthetic restorations | Superior aesthetic qualities | Brittle and less suitable for load-bearing | Med |

| Stainless Steel | Temporary implants | Cost-effective | Lower biocompatibility and aesthetics | Low |

| PEEK | Custom implants | High durability and customization | Higher cost and variable acceptance | High |

This guide provides a comprehensive overview of material selection for dental implants, equipping international B2B buyers with the insights needed to make informed decisions based on performance, cost, and market preferences.

In-depth Look: Manufacturing Processes and Quality Assurance for dental implant gallery

Manufacturing dental implants involves a meticulous process that ensures both functionality and safety. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding these manufacturing processes and quality assurance measures is crucial to making informed purchasing decisions. Below is a detailed exploration of the typical manufacturing stages, quality control (QC) standards, and actionable insights for buyers.

Manufacturing Processes

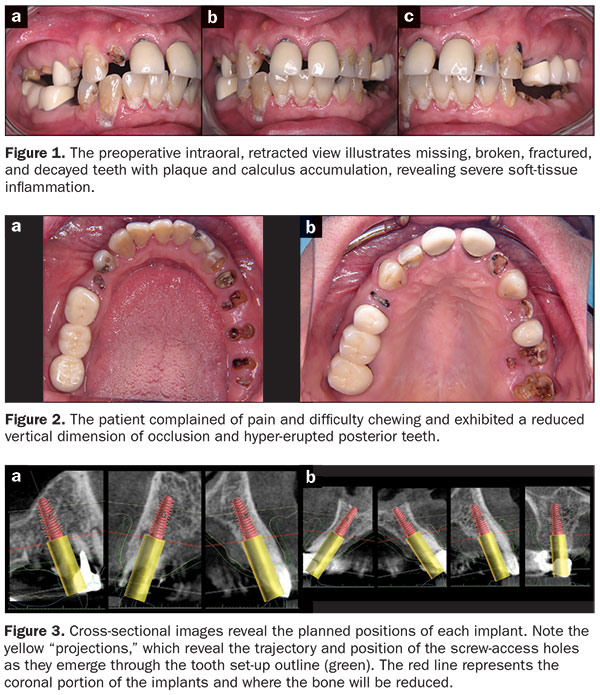

Material Preparation

The foundation of any dental implant lies in the selection of high-quality materials. Common materials include titanium, zirconia, and biocompatible alloys. The material preparation stage involves:

- Material Selection: Choosing the right material based on the specific requirements of the implant, including strength, corrosion resistance, and biocompatibility.

- Cleaning and Sterilization: Ensuring that all materials are free from contaminants through processes like ultrasonic cleaning and autoclaving.

Forming

The forming process shapes the raw materials into the desired implant configurations. Key techniques include:

- CNC Machining: This precision method involves computer-controlled tools to carve out the implant shape from solid blocks of material. It ensures high accuracy and repeatability.

- Additive Manufacturing: Also known as 3D printing, this technique is gaining popularity for creating complex geometries that mimic natural bone structure, enhancing integration with the jaw.

Assembly

Once the components are formed, they undergo assembly, where various parts are joined to create a complete implant system. This stage may involve:

- Component Integration: Attaching the abutment to the implant body, ensuring secure fitment for prosthetic attachments.

- Quality Checks: Conducting initial inspections to verify the integrity and alignment of assembled parts.

Finishing

The finishing process enhances the surface characteristics of the implants. Important activities include:

- Surface Treatment: Techniques like sandblasting or acid etching improve osseointegration by increasing surface roughness.

- Coating Applications: Applying bioactive coatings can enhance the implant’s interaction with bone tissue, promoting faster healing and stability.

Quality Assurance

Maintaining high standards of quality is paramount in the dental implant industry. International B2B buyers should familiarize themselves with relevant standards and quality control measures.

International Standards

Key standards that govern the manufacturing and quality assurance of dental implants include:

- ISO 9001: This standard focuses on quality management systems, ensuring that manufacturers consistently provide products that meet customer and regulatory requirements.

- ISO 13485: A specific standard for medical devices, it outlines the requirements for a quality management system that demonstrates the manufacturer’s ability to provide medical devices and related services.

Industry-Specific Certifications

In addition to international standards, various certifications are critical for dental implants:

- CE Marking: Required in Europe, this indicates that the implant complies with health, safety, and environmental protection standards.

- API (Active Pharmaceutical Ingredient): This certification is relevant for products that may contain pharmaceutical elements, ensuring compliance with safety regulations.

Quality Control Checkpoints

Quality control throughout the manufacturing process involves several checkpoints:

- Incoming Quality Control (IQC): This initial stage involves inspecting raw materials upon arrival to ensure they meet specified standards.

- In-Process Quality Control (IPQC): During production, continuous monitoring is necessary to detect deviations from quality standards in real-time.

- Final Quality Control (FQC): After assembly, a thorough inspection ensures that the final product meets all specifications before shipping.

Common Testing Methods

Several testing methods are employed to verify the quality and safety of dental implants:

- Mechanical Testing: Includes tensile strength, fatigue, and wear testing to assess the durability of materials.

- Biocompatibility Testing: Evaluates how well the implant interacts with biological tissues, ensuring safety for patients.

- Sterility Testing: Confirms that the implants are free from microbial contamination, an essential factor for medical devices.

Verifying Supplier Quality Control

For international B2B buyers, verifying a supplier’s quality control measures is essential for mitigating risks. Here are actionable steps to consider:

- Audits: Conducting regular supplier audits can provide insights into their manufacturing processes and adherence to quality standards.

- Documentation Review: Requesting and reviewing quality management system documentation, including ISO certifications and quality control reports, can help assess a supplier’s commitment to quality.

- Third-Party Inspections: Engaging third-party inspection agencies to perform independent evaluations can enhance confidence in the supplier’s quality assurance processes.

QC and Certification Nuances

International buyers, particularly those from regions like Africa, South America, the Middle East, and Europe, should be aware of specific nuances related to QC and certification:

- Regional Regulations: Understand the regulatory landscape in your region, as it may differ significantly from international standards. For instance, the FDA in the U.S. has different requirements compared to the CE marking in Europe.

- Documentation Language: Ensure that all quality-related documents are available in the preferred language to avoid misinterpretation.

- Cultural Differences: Be mindful of cultural differences in business practices and communication styles when engaging with suppliers from different regions.

Conclusion

Navigating the complexities of manufacturing processes and quality assurance for dental implants requires a thorough understanding of industry standards and practices. By being well-informed and proactive in verifying supplier quality, B2B buyers can ensure they are making sound investments in dental implants that meet both regulatory requirements and patient needs.

Related Video: SMART Quality Control for Manufacturing

Comprehensive Cost and Pricing Analysis for dental implant gallery Sourcing

When sourcing dental implant galleries, understanding the comprehensive cost structure and pricing dynamics is crucial for international B2B buyers. This section delves into the various cost components and price influencers, providing actionable insights that can help optimize sourcing strategies, particularly for buyers from Africa, South America, the Middle East, and Europe.

Cost Components

-

Materials: The cost of raw materials is a significant portion of the overall expense. Dental implants typically utilize titanium or zirconia, which can vary in price based on market fluctuations and sourcing locations. Buyers should be aware of the quality and certification of materials, as these factors can impact both price and performance.

-

Labor: Labor costs vary widely by region. In countries with higher labor costs, such as those in Europe, you may find that this significantly influences the final price of dental implants. Conversely, sourcing from regions with lower labor costs can provide savings, but it’s essential to balance cost with the quality of craftsmanship.

-

Manufacturing Overhead: This includes costs associated with the facility, utilities, and indirect labor. Understanding the overhead structure of potential suppliers can offer insights into their pricing strategies. Suppliers with higher overhead costs may charge more, so it’s worth exploring their operational efficiencies.

-

Tooling: Custom tooling for specific implant designs can add to the initial costs. For high-volume orders, these costs can be amortized over a larger number of units, lowering the per-unit price. Buyers should consider the long-term benefits of investing in custom tooling for specialized needs.

-

Quality Control (QC): Rigorous QC processes ensure that implants meet necessary standards, which is vital for safety and effectiveness. However, enhanced QC can increase costs. Buyers should evaluate the level of QC necessary for their target markets to balance quality with cost.

-

Logistics: Shipping and handling are often overlooked in pricing discussions. Factors such as shipping distance, mode of transport, and customs duties can substantially influence total costs. Understanding Incoterms is crucial for clarifying responsibilities and costs associated with logistics.

-

Margin: Suppliers will typically apply a margin to cover their expenses and profit. This margin can vary significantly based on competition, market demand, and supplier positioning. Buyers should explore multiple suppliers to gauge typical margins and identify the best value.

Illustrative Image (Source: Google Search)

Price Influencers

-

Volume/MOQ (Minimum Order Quantity): Higher volumes often lead to reduced per-unit costs. Buyers should negotiate for better pricing by consolidating orders when possible.

-

Specifications/Customization: Custom implants or specialized designs may incur higher costs. Buyers should weigh the necessity of customization against potential cost savings from standard products.

-

Quality/Certifications: The presence of certifications (e.g., ISO, CE marking) can increase costs but is essential for ensuring compliance with local regulations and maintaining a reputation for quality.

-

Supplier Factors: Relationships with suppliers can influence pricing. Established partnerships may yield better terms and pricing flexibility.

-

Incoterms: Understanding Incoterms is vital for determining who bears the cost and risk at each stage of the shipping process. This knowledge can help buyers avoid unexpected expenses.

Buyer Tips

-

Negotiation: Always negotiate terms and pricing. Leverage market research to understand typical costs and use this information to advocate for more favorable terms.

-

Cost-Efficiency: Consider not just the purchase price, but also the Total Cost of Ownership (TCO), which includes logistics, maintenance, and lifecycle costs. This holistic view can lead to better long-term decisions.

-

Pricing Nuances: Be aware of regional pricing differences. For instance, dental implants may be more competitively priced in certain regions due to local manufacturing capabilities or economic conditions.

-

Market Research: Conduct thorough market research to understand prevailing prices and identify potential suppliers. This knowledge can empower buyers to make informed decisions and negotiate effectively.

Disclaimer

Prices can fluctuate based on market conditions, supplier capabilities, and geopolitical factors. It is advisable to obtain updated quotes and conduct due diligence before making purchasing decisions.

Essential Technical Properties and Trade Terminology for dental implant gallery

Key Technical Properties of Dental Implants

When selecting dental implants, understanding essential technical properties is critical for B2B buyers. Here are some of the most significant specifications that influence performance, compatibility, and longevity.

-

Material Grade

– Dental implants are primarily made from titanium or titanium alloys, known for their biocompatibility and strength. The material grade (e.g., Grade 4 titanium) indicates the purity and mechanical properties of the implant. Higher grades typically offer better corrosion resistance and strength, which are crucial for long-term performance. -

Tolerance

– Tolerance refers to the allowable variation in dimensions during manufacturing. In dental implants, tight tolerances are crucial to ensure proper fit and function with the surrounding bone and gum tissue. A tolerance of ±0.1 mm is often expected, as it affects the implant’s stability and the success of the overall procedure. -

Surface Treatment

– The surface treatment of dental implants affects osseointegration—the process by which bone integrates with the implant. Treatments such as sandblasting or acid etching enhance the surface roughness, promoting better bone attachment. For B2B buyers, understanding these treatments is essential when evaluating product performance and clinical outcomes. -

Length and Diameter

– Implants come in various lengths and diameters to accommodate different patient anatomies and treatment needs. A standard diameter ranges from 3.3 mm to 5.0 mm, while lengths can vary from 6 mm to 15 mm. Choosing the appropriate size is critical for achieving optimal stability and aesthetic results. -

Load-Bearing Capacity

– This property indicates the maximum load the implant can withstand without failure. Load-bearing capacity is essential for ensuring that the implant can support the forces exerted during chewing. Implants with higher load-bearing capacities are generally preferred for posterior applications where greater forces are expected. -

Corrosion Resistance

– Corrosion resistance is vital for dental implants, especially in the oral environment where exposure to saliva and food can lead to degradation. High corrosion resistance ensures the longevity of the implant and reduces the risk of failure. Buyers should look for implants with proven corrosion resistance to maintain patient safety and device integrity.

Common Trade Terminology in the Dental Implant Industry

Familiarity with industry-specific terminology is essential for effective communication and negotiation. Here are some common terms that B2B buyers should understand:

-

OEM (Original Equipment Manufacturer)

– This term refers to a company that produces parts or equipment that may be marketed by another manufacturer. In the dental implant industry, OEMs are crucial for ensuring quality components and can provide custom solutions for specific needs. -

MOQ (Minimum Order Quantity)

– MOQ is the smallest quantity of a product that a supplier is willing to sell. Understanding MOQ is vital for budgeting and inventory management. Buyers should negotiate MOQs to align with their needs while ensuring cost-effectiveness. -

RFQ (Request for Quotation)

– An RFQ is a document sent to suppliers to request pricing and terms for specific products. For dental implants, issuing an RFQ can help buyers compare options and negotiate better deals. It is an essential step in the procurement process. -

Incoterms

– Incoterms (International Commercial Terms) are standardized trade terms that define the responsibilities of buyers and sellers in international transactions. Familiarity with Incoterms helps buyers understand shipping costs, delivery responsibilities, and risk management in cross-border transactions. -

Sterilization

– This term refers to the process of eliminating all forms of bacteria and viruses from the implants before they are used in surgical procedures. Understanding sterilization methods (e.g., gamma radiation, ethylene oxide) is critical for ensuring patient safety and compliance with health regulations. -

CE Marking

– CE marking indicates that a product meets European Union safety, health, and environmental requirements. For dental implants sold in Europe, CE marking is essential for market access and signifies compliance with industry standards.

By understanding these essential technical properties and trade terms, B2B buyers can make informed decisions, ensuring they procure the best dental implants for their needs while navigating the complexities of international trade.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dental implant gallery Sector

Market Overview & Key Trends

The dental implant gallery sector is witnessing significant growth driven by several global factors. Increased awareness of oral health and advancements in dental technology are propelling demand, particularly in regions such as Africa, South America, the Middle East, and Europe. Notably, the rise in cosmetic dentistry and an aging population seeking restorative dental solutions are key contributors to market dynamics.

B2B buyers should note the emerging trends in sourcing technologies, including digital implant planning and 3D printing, which are revolutionizing how implants are designed and produced. These innovations not only enhance precision but also reduce lead times and costs. Additionally, there is a marked shift towards integrated supply chains that leverage data analytics for better inventory management and demand forecasting. Buyers should seek partners that utilize these technologies to stay competitive.

Moreover, the market is increasingly influenced by regional regulatory frameworks that prioritize patient safety and product efficacy. Buyers in the Middle East and Europe must navigate these regulations while sourcing materials and equipment. In Africa and South America, local partnerships can facilitate compliance and ensure access to high-quality products. Understanding these dynamics will enable international B2B buyers to make informed sourcing decisions that align with both market demands and regulatory requirements.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a cornerstone of the dental implant gallery sector, with buyers increasingly prioritizing environmentally responsible practices. The environmental impact of dental materials—particularly in terms of waste and resource consumption—is significant. Therefore, B2B buyers are urged to consider suppliers who adopt sustainable practices, such as using biodegradable or recyclable materials in their products.

Ethical sourcing is equally crucial. Buyers should ensure that their supply chains are transparent and that materials are sourced responsibly, particularly in regions where labor practices may be under scrutiny. Certifications such as ISO 14001 (Environmental Management) and ISO 9001 (Quality Management) can serve as indicators of a supplier’s commitment to sustainability and ethical practices. Additionally, look for ‘green’ certifications that validate the use of eco-friendly materials in dental implants, as these can enhance your brand’s reputation and meet the growing consumer demand for sustainable products.

Engaging with suppliers who prioritize sustainability not only mitigates environmental impact but can also lead to cost savings through efficient resource use and waste reduction. This alignment with sustainable practices is increasingly seen as a competitive advantage in the global market.

Brief Evolution/History

The dental implant sector has evolved significantly over the past few decades, transitioning from rudimentary solutions to highly advanced, biocompatible implants. Initially, dental implants were made of materials like dental gold or stainless steel; however, the introduction of titanium in the 1980s marked a pivotal moment, as its biocompatibility and strength revolutionized the field.

As technology advanced, the integration of digital tools and imaging techniques transformed the planning and placement of implants, improving outcomes and patient satisfaction. Today, the focus is on customization and precision, with digital workflows allowing for the creation of tailored implants that meet the specific needs of patients. For B2B buyers, understanding this evolution is essential for sourcing the latest innovations and ensuring they remain competitive in an ever-changing landscape.

Related Video: Global Trends Tutorial: Chapter 3: IPE

Frequently Asked Questions (FAQs) for B2B Buyers of dental implant gallery

-

How can I vet potential suppliers for dental implants?

To ensure you partner with reputable suppliers, start by researching their industry reputation and history. Request references and check their certifications, such as ISO 13485 for medical devices. Utilize platforms like LinkedIn and industry-specific forums to gather insights from other buyers. Additionally, consider conducting on-site visits if feasible, or utilize third-party auditing services to assess their manufacturing practices, quality control processes, and compliance with international regulations. -

Are customization options available for dental implants, and how do I request them?

Most suppliers offer customization options to meet specific clinical needs. To request customization, clearly outline your requirements, including dimensions, materials, and any specific design features. Establish a dialogue with the supplier to discuss feasibility and timelines. It’s advisable to review their previous custom projects to gauge their capability. Ensure that any modifications comply with local regulations in your market to avoid future complications. -

What are the typical minimum order quantities (MOQ) and lead times for dental implants?

MOQs for dental implants can vary significantly based on the supplier and product type. Generally, expect MOQs to range from 50 to 500 units. Lead times can also vary, typically from 4 to 12 weeks depending on production schedules and customization requests. Discuss these details upfront with suppliers to align your inventory needs and avoid stock shortages. Additionally, consider establishing a long-term relationship to negotiate more favorable terms. -

What payment terms should I expect when sourcing dental implants internationally?

Payment terms can differ widely among suppliers. Common practices include upfront deposits (20-50%) with the balance due upon delivery or acceptance. For international transactions, consider using secure payment methods like letters of credit or escrow services to mitigate risk. Clarify the currency for transactions and any additional fees that may arise from currency conversion or international banking. Establishing clear payment terms upfront can help avoid disputes later. -

What quality assurance certifications should suppliers possess?

For dental implants, suppliers should ideally have certifications like ISO 13485, which indicates compliance with international quality management standards for medical devices. Additionally, look for CE marking in Europe and FDA approval in the U.S. These certifications demonstrate adherence to safety and efficacy standards. Request documentation and conduct audits if necessary to ensure that the products you are sourcing meet your quality expectations and regulatory requirements. -

How can I effectively manage logistics when sourcing dental implants internationally?

Managing logistics involves selecting reliable shipping partners and understanding import regulations in your country. Ensure that your supplier is experienced with international shipping and can provide necessary documentation such as invoices, packing lists, and certificates of origin. Utilize freight forwarders to streamline the process, and consider insurance options to protect against loss or damage during transit. Staying informed about customs duties and taxes will also help you manage costs effectively. -

What steps can I take to resolve disputes with suppliers?

To mitigate disputes, establish clear contracts outlining terms, responsibilities, and expectations. In case of a disagreement, start by communicating directly with the supplier to discuss the issue. Document all interactions and agreements in writing. If resolution is not achieved, consider mediation or arbitration as alternative dispute resolution methods. Joining industry associations can also provide resources and support for resolving conflicts and ensuring compliance with best practices. -

What should I do if the quality of the received dental implants does not meet expectations?

If the quality of the dental implants does not meet your expectations, immediately document the discrepancies with detailed photographs and notes. Contact the supplier to express your concerns and provide evidence. Most reputable suppliers will have a return or exchange policy in place. If the issue cannot be resolved satisfactorily, you may need to escalate the matter through formal channels or seek legal advice, depending on the severity of the quality issues and the contractual agreements in place.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for dental implant gallery

In conclusion, the dental implant market presents a wealth of opportunities for international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe. Strategic sourcing is paramount to navigating the complexities of this sector. By focusing on quality, supplier reliability, and innovative product offerings, buyers can enhance their competitive edge and ensure patient satisfaction.

Key takeaways include the importance of establishing long-term relationships with reputable suppliers, leveraging technology for better procurement processes, and understanding regional regulatory requirements to avoid compliance issues. Furthermore, engaging in continuous market research will enable businesses to adapt to evolving trends and consumer preferences effectively.

Looking ahead, the dental implant industry is poised for significant growth, driven by advancements in technology and increasing demand for dental care. International B2B buyers should seize this moment to streamline their sourcing strategies, invest in partnerships, and explore emerging markets. Now is the time to act—by aligning with the right suppliers and embracing innovation, your organization can capitalize on this expanding market and drive sustainable growth.