Introduction: Navigating the Global Market for dental implants versus crowns

In an increasingly interconnected world, the dental healthcare market is evolving rapidly, presenting unique opportunities for international B2B buyers. Understanding the differences between dental implants and crowns is crucial for making informed purchasing decisions that can significantly impact patient outcomes and operational efficiency. With varying applications, materials, and costs, the choice between these two dental solutions can define the success of dental practices and laboratories across diverse regions, including Africa, South America, the Middle East, and Europe.

This comprehensive guide will delve into the essential aspects of dental implants and crowns, exploring their types, material specifications, manufacturing processes, and quality control measures. We will also provide insights into supplier evaluations and cost considerations, tailored specifically for buyers in key markets such as Saudi Arabia and the UK.

As you navigate this complex landscape, the guide will address frequently asked questions and highlight best practices for sourcing, empowering you to make strategic decisions that align with your business needs. By equipping yourself with this knowledge, you will not only enhance your procurement strategies but also ensure that your offerings meet the highest standards of quality and innovation in dental care. Prepare to embark on a journey that will transform your approach to sourcing dental solutions and elevate your competitive edge in the global market.

Understanding dental implants versus crowns Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Endosteal Implants | Placed directly into the jawbone, most common type. | Oral surgery clinics, dental labs | Pros: High success rate, stable. Cons: Requires sufficient bone density. |

| Subperiosteal Implants | Positioned under the gum but above the jawbone. | Specialized dental practices | Pros: Good for patients with low bone density. Cons: More invasive, less common. |

| Dental Crowns | Caps placed over damaged teeth, can be made from various materials. | General dental practices, cosmetic dentistry | Pros: Restores functionality, aesthetic appeal. Cons: May require tooth reduction. |

| Zirconia Crowns | Made from zirconium oxide, highly aesthetic and durable. | High-end dental clinics | Pros: Biocompatible, excellent aesthetics. Cons: More expensive than traditional crowns. |

| Implant-Supported Crowns | Crowns attached to dental implants for stability. | Implantology-focused practices | Pros: Enhanced stability, ideal for edentulous patients. Cons: Longer treatment time. |

Endosteal Implants

Endosteal implants are the most prevalent type, designed for insertion into the jawbone. They are typically made from titanium and are favored for their high success rate and stability. For B2B buyers, key considerations include the availability of high-quality materials and the need for sufficient bone density in patients. Clinics should ensure they have the necessary surgical expertise for placement and assess the potential for additional procedures, such as bone grafting, when bone density is inadequate.

Subperiosteal Implants

Subperiosteal implants are used in cases where patients lack adequate bone height for endosteal implants. They are placed beneath the gum tissue but above the jawbone, making them a viable option for patients with significant bone loss. B2B buyers should consider the expertise required for placement and the potential for higher costs due to the complexity of the procedure. Additionally, understanding the patient demographics that may benefit from these implants is crucial for targeted marketing strategies.

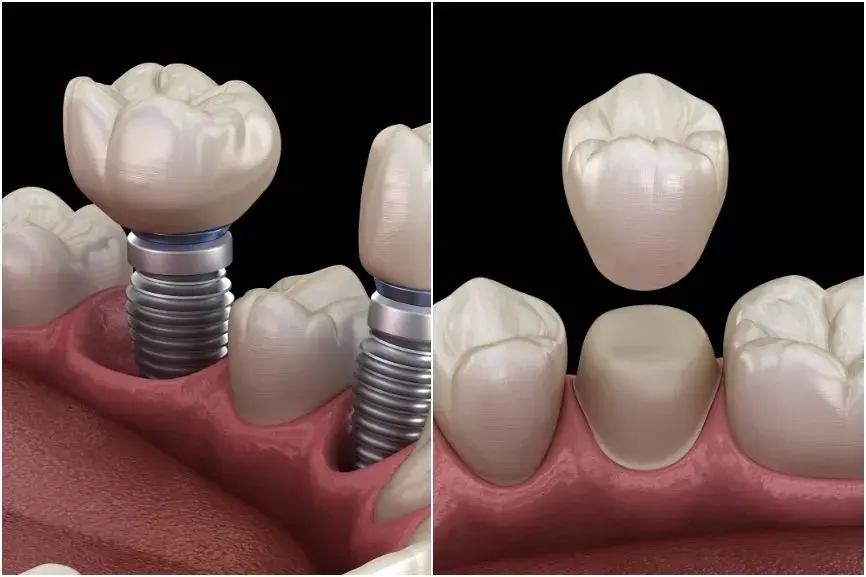

Illustrative Image (Source: Google Search)

Dental Crowns

Dental crowns are prosthetic devices that cover damaged teeth, restoring both functionality and aesthetics. They can be made from various materials, including metal, porcelain, or a combination of both. For B2B buyers, the choice of materials impacts cost, durability, and patient satisfaction. Clinics should evaluate their target market’s preferences for aesthetics versus functionality, as well as the implications of tooth reduction required for crown placement.

Zirconia Crowns

Zirconia crowns are increasingly popular due to their strength and aesthetic appeal, making them ideal for front teeth restorations. They are biocompatible and resistant to wear, which is attractive for patients seeking longevity in their dental work. B2B buyers should consider the higher cost associated with zirconia crowns and the need for specialized equipment for fabrication. Marketing these crowns effectively requires emphasizing their benefits in terms of aesthetics and durability.

Implant-Supported Crowns

Implant-supported crowns are designed for patients who have lost one or more teeth. These crowns are anchored to dental implants, providing enhanced stability and functionality. For B2B buyers, understanding the patient journey from implant placement to crown fitting is essential for effective service delivery. Clinics should also consider the implications of longer treatment times and the need for patient education throughout the process to ensure satisfaction and adherence to treatment plans.

Related Video: 3 Types of Dental Implants and Surface treatments explained!

Key Industrial Applications of dental implants versus crowns

| Industry/Sector | Specific Application of dental implants versus crowns | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Use of dental implants for tooth replacement | Higher patient satisfaction and retention rates | Quality certifications, biocompatibility, and warranty |

| Orthodontics | Crowns for correcting misaligned teeth | Improved treatment outcomes and patient referrals | Material durability, aesthetic appeal, and cost-effectiveness |

| Dental Laboratories | Manufacturing crowns and implants | Streamlined production processes and reduced costs | Access to advanced technology and skilled labor |

| Healthcare Providers | Offering comprehensive dental solutions | Increased service offerings and competitive advantage | Regulatory compliance, supply chain reliability, and customer support |

| Insurance Companies | Coverage for dental implants versus crowns | Enhanced policy offerings and customer satisfaction | Understanding market trends and consumer preferences |

Dental Clinics

In dental clinics, dental implants are increasingly favored for replacing missing teeth due to their durability and natural appearance. This application not only enhances patient satisfaction but also drives retention rates, as patients are more likely to return for additional treatments. International buyers should prioritize sourcing implants that meet stringent quality certifications and have a proven track record of biocompatibility. Additionally, warranties are crucial for long-term investments in dental equipment.

Orthodontics

Crowns play a significant role in orthodontics, particularly for correcting misaligned teeth. They serve as a reliable solution for restoring the function and aesthetics of teeth while improving overall treatment outcomes. This application can lead to higher patient referrals, making it a vital consideration for B2B buyers. When sourcing crowns, durability, aesthetic appeal, and cost-effectiveness are essential factors to assess, especially in regions with varying economic conditions.

Dental Laboratories

Dental laboratories benefit from the manufacturing of both crowns and implants, which allows for streamlined production processes and reduced costs. This sector requires access to advanced technology and skilled labor to maintain high-quality standards. B2B buyers in this industry should consider suppliers that offer innovative manufacturing solutions and reliable materials, which can significantly impact operational efficiency and product quality.

Healthcare Providers

Healthcare providers looking to offer comprehensive dental solutions can leverage the applications of dental implants and crowns to enhance their service offerings. This not only provides a competitive advantage but also improves patient care. Key sourcing considerations include ensuring regulatory compliance and establishing a reliable supply chain. Additionally, strong customer support from suppliers can facilitate smoother operations and better patient outcomes.

Insurance Companies

Insurance companies can benefit from understanding the differences between dental implants and crowns to enhance their policy offerings. By providing coverage options for both, they can improve customer satisfaction and attract a wider client base. B2B buyers in this sector should stay informed about market trends and consumer preferences, allowing them to tailor their insurance products to meet the evolving needs of dental patients.

Strategic Material Selection Guide for dental implants versus crowns

When selecting materials for dental implants and crowns, it is crucial to consider their properties, advantages, and limitations. This analysis focuses on four common materials: titanium, zirconia, porcelain-fused-to-metal (PFM), and resin composite. Each material presents unique characteristics that influence their performance in dental applications.

Titanium

Key Properties: Titanium is renowned for its excellent biocompatibility, corrosion resistance, and high strength-to-weight ratio. It can withstand the physiological conditions of the oral cavity, including temperature fluctuations and mechanical stress.

Pros & Cons: Titanium implants are highly durable and have a long track record of success in dental applications. However, they can be more expensive than other materials, and their metallic appearance may not be aesthetically pleasing for crowns. Manufacturing complexity is moderate, as titanium requires specialized techniques for shaping and surface treatment.

Impact on Application: Titanium is particularly suitable for dental implants due to its ability to osseointegrate with bone, providing a stable foundation. However, its metallic nature may not be compatible with certain imaging technologies, which could be a consideration for diagnostics.

Considerations for International Buyers: Compliance with international standards such as ASTM F136 for titanium alloys is critical. Buyers in regions like the Middle East and Europe should ensure that their suppliers adhere to these standards to guarantee quality and safety.

Zirconia

Key Properties: Zirconia is a ceramic material known for its high strength, aesthetic appeal, and excellent wear resistance. It is also biocompatible and resistant to corrosion.

Pros & Cons: The primary advantage of zirconia is its tooth-like appearance, making it ideal for crowns where aesthetics are paramount. However, it can be more brittle than titanium, which may limit its use in load-bearing applications like implants. The manufacturing process for zirconia can also be complex and costly.

Impact on Application: Zirconia crowns are highly compatible with various dental media, providing excellent performance in terms of wear and aesthetics. However, its brittleness may pose challenges in high-stress environments.

Considerations for International Buyers: Buyers should be aware of the specific standards for zirconia, such as ISO 6872, which outlines the requirements for dental ceramics. Understanding regional preferences for aesthetics can also guide material selection, especially in markets like Europe.

Porcelain-Fused-to-Metal (PFM)

Key Properties: PFM combines the strength of metal with the aesthetics of porcelain. The metal substructure provides durability, while the porcelain overlay offers a natural appearance.

Pros & Cons: PFM crowns are versatile and widely used due to their balance of strength and aesthetics. However, they may suffer from chipping of the porcelain layer and can be less biocompatible than other options. The manufacturing process is relatively straightforward but requires skilled labor to achieve a good aesthetic finish.

Impact on Application: PFM is suitable for both anterior and posterior crowns, providing a good compromise between durability and appearance. However, the metal core may cause issues with certain imaging techniques.

Considerations for International Buyers: Compliance with standards such as ISO 9693 for dental ceramics is essential. Buyers should also consider regional preferences for metal types, as some markets may favor non-noble metals for cost reasons.

Resin Composite

Key Properties: Resin composites are a blend of organic and inorganic materials, offering good aesthetics and moderate strength. They are easy to manipulate and bond well to tooth structure.

Pros & Cons: The primary advantage of resin composites is their aesthetic flexibility and cost-effectiveness. However, they are generally less durable than other materials and may require more frequent replacements. Manufacturing is less complex, making them accessible for various practices.

Impact on Application: Resin composites are ideal for anterior crowns and small restorations where aesthetics are crucial. Their lower strength limits their use in posterior applications.

Considerations for International Buyers: Buyers should ensure that the resin composites meet standards such as ISO 4049. Understanding local market demands for aesthetics versus durability can influence material choice.

Summary Table

| Material | Typical Use Case for dental implants versus crowns | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Dental implants | Excellent biocompatibility | Higher cost | High |

| Zirconia | Crowns | Aesthetic appeal | Brittle under stress | Med |

| Porcelain-Fused-to-Metal (PFM) | Crowns and bridges | Good balance of strength & aesthetics | Porcelain chipping | Med |

| Resin Composite | Anterior crowns and small restorations | Cost-effective and aesthetic | Less durable | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for dental implants versus crowns

Manufacturing dental implants and crowns involves distinct processes, each tailored to meet specific clinical requirements and patient needs. Understanding these processes, along with the associated quality assurance measures, is critical for B2B buyers, particularly in regions like Africa, South America, the Middle East, and Europe. Here, we explore the typical manufacturing stages, key techniques, and international standards that govern quality assurance for these products.

Manufacturing Processes

1. Material Preparation

The first step in the manufacturing of dental implants and crowns is material preparation.

-

Dental Implants: Typically made from biocompatible materials such as titanium or zirconia, the raw materials undergo stringent sourcing and testing to ensure they meet the necessary biocompatibility standards. The titanium is often treated to enhance its surface properties, promoting osseointegration.

-

Crowns: Common materials include porcelain, ceramic, and metal alloys. The choice of material depends on the required aesthetic and functional properties. Materials must be prepared through processes like milling or pressing to achieve the desired consistency and density.

2. Forming

Forming techniques vary between implants and crowns.

-

Dental Implants: Techniques like computer-aided design (CAD) and computer-aided manufacturing (CAM) are frequently used. The implant body is formed using methods such as powder metallurgy or additive manufacturing (3D printing), which allows for intricate designs that can accommodate anatomical variations.

-

Crowns: For crowns, the forming process often involves techniques like lost-wax casting or pressing ceramics. These methods allow for high precision in creating the crown’s shape and fit.

3. Assembly

While dental implants are typically single components, crowns may require assembly of multiple parts.

-

Dental Implants: The assembly process includes attaching components such as abutments and screws. This step must ensure that all parts fit precisely to maintain the integrity of the implant once placed in the patient.

-

Crowns: For multi-layer crowns, layers of materials are built up and bonded together. The assembly process is critical for ensuring that crowns achieve the desired aesthetic appearance and functional durability.

4. Finishing

The finishing stage is essential for both implants and crowns.

-

Dental Implants: Surface treatments, such as sandblasting or acid etching, enhance the surface characteristics to promote better integration with bone tissue. This step also includes polishing to ensure a smooth surface, reducing the risk of bacterial colonization.

-

Crowns: Finishing for crowns involves glazing and polishing to achieve the desired aesthetic. This not only enhances appearance but also improves wear resistance.

Quality Assurance

Quality assurance in dental manufacturing is crucial for ensuring the safety and efficacy of the products.

1. International Standards

B2B buyers should be aware of several international standards governing dental implant and crown manufacturing:

-

ISO 9001: This general quality management standard ensures consistent quality across manufacturing processes. Compliance indicates that a manufacturer has established processes for quality control.

-

ISO 13485: Specifically for medical devices, this standard outlines requirements for a comprehensive quality management system that demonstrates the ability to provide medical devices and related services that consistently meet customer and regulatory requirements.

-

CE Marking: In Europe, products must meet specific safety, health, and environmental protection standards to receive CE marking, allowing them to be sold within the European Economic Area.

2. Quality Control Checkpoints

Quality control (QC) checkpoints are critical throughout the manufacturing process:

-

Incoming Quality Control (IQC): This involves inspecting raw materials upon receipt. Buyers should ensure that suppliers conduct rigorous testing of incoming materials for compliance with specified standards.

-

In-Process Quality Control (IPQC): Ongoing inspections during manufacturing help catch defects early. Manufacturers should implement regular audits and checks to ensure adherence to production specifications.

-

Final Quality Control (FQC): Before products are shipped, FQC involves comprehensive testing to confirm that the final product meets all regulatory and quality standards.

3. Common Testing Methods

Various testing methods are employed to ensure quality:

-

Mechanical Testing: This assesses the strength and durability of implants and crowns under various load conditions.

-

Biocompatibility Testing: Essential for implants, this testing ensures that materials used do not provoke adverse biological reactions.

-

Aesthetic Testing: For crowns, color matching and surface finish tests ensure that the final product meets aesthetic expectations.

Verifying Supplier Quality Control

B2B buyers must take proactive measures to verify the quality control processes of suppliers:

-

Audits: Conducting regular audits of suppliers can help ensure compliance with international standards and internal quality benchmarks. This includes reviewing their quality management systems and production processes.

-

Quality Reports: Requesting detailed quality reports that outline testing results and QC measures can provide insights into a supplier’s commitment to quality.

-

Third-Party Inspections: Engaging independent third-party inspectors can validate a supplier’s claims regarding their quality control processes and product safety.

Quality Control and Certification Nuances

B2B buyers from regions such as Africa, South America, the Middle East, and Europe should be aware of specific nuances regarding quality control and certifications:

-

Regulatory Variations: Different regions may have unique regulatory requirements. It’s essential for buyers to understand local regulations and ensure that suppliers comply with these when exporting products.

-

Cultural Considerations: Communication and cultural differences may impact the understanding of quality standards. Establishing clear expectations and maintaining open lines of communication can help bridge these gaps.

-

Supply Chain Transparency: Buyers should prioritize suppliers who provide transparency in their supply chains. This includes documentation of compliance with quality standards and traceability of materials used.

By understanding the manufacturing processes and quality assurance measures for dental implants and crowns, B2B buyers can make informed decisions, ensuring they select reliable suppliers that meet international standards. This not only enhances patient outcomes but also fosters long-term partnerships in the dental industry.

Related Video: SMART Quality Control for Manufacturing

Comprehensive Cost and Pricing Analysis for dental implants versus crowns Sourcing

When sourcing dental implants and crowns, understanding the comprehensive cost structure is essential for international B2B buyers. Both products have unique cost components that affect overall pricing, and being aware of these factors can lead to more informed purchasing decisions.

Cost Components

-

Materials: The choice of materials significantly impacts the cost of both dental implants and crowns. Implants are often made from titanium or zirconia, while crowns can be crafted from porcelain, resin, or metal alloys. The quality and source of these materials can vary greatly, affecting the price.

-

Labor: Skilled labor is required for both manufacturing and fitting dental implants and crowns. Labor costs can differ by region; for example, labor might be less expensive in some parts of South America compared to Europe. Understanding local labor costs can provide insights into overall pricing.

-

Manufacturing Overhead: This includes costs related to factory operations, utilities, and equipment maintenance. Efficient production processes can reduce overhead, but this often requires investment in advanced manufacturing technologies.

-

Tooling: Initial tooling costs can be significant, especially for custom implants or crowns. These costs are often amortized over larger production runs, meaning that higher volumes can lead to lower per-unit costs.

-

Quality Control (QC): Rigorous QC processes are essential in the dental industry to ensure product reliability and safety. Enhanced QC measures can increase costs but are necessary for compliance with international standards.

-

Logistics: Shipping costs can vary depending on the distance, mode of transport, and customs regulations. Buyers should account for logistics when calculating the total cost of ownership, especially when sourcing from different continents.

-

Margin: Suppliers typically include a profit margin in their pricing. Understanding market trends and average margins in specific regions can help buyers negotiate better deals.

Price Influencers

Several factors can influence the pricing of dental implants and crowns:

-

Volume/MOQ (Minimum Order Quantity): Larger orders usually lead to discounts. Buyers should consider their anticipated usage to negotiate better terms.

-

Specifications/Customization: Custom implants or crowns that meet specific patient needs often come at a premium. Buyers must weigh the benefits of customization against cost.

-

Material Quality/Certifications: Higher quality materials and certifications (like ISO or CE marking) often justify higher prices. Buyers should ensure that the products meet required standards in their region.

-

Supplier Factors: The reputation and reliability of the supplier can influence pricing. Established suppliers with a track record of quality may charge more but provide greater assurance.

-

Incoterms: Understanding the terms of shipping can help buyers manage costs effectively. Incoterms dictate who is responsible for shipping costs, insurance, and customs clearance.

Buyer Tips

-

Negotiation: Engage suppliers in discussions about pricing, especially if you are ordering in bulk. Highlighting your long-term purchasing potential can lead to better deals.

-

Cost-Efficiency: Consider all aspects of cost, not just the upfront price. Evaluate the Total Cost of Ownership (TCO), which includes maintenance, shipping, and disposal costs.

-

Pricing Nuances: International buyers should be aware of currency fluctuations, tariffs, and trade regulations that can affect pricing. Conduct thorough market research to understand the local pricing landscape in regions like Africa, South America, the Middle East, and Europe.

-

Stay Informed: Regularly review market trends and supplier performance to adapt your sourcing strategies. Join industry groups or forums to exchange insights with other buyers.

Disclaimer

The prices and cost structures discussed are indicative and can vary significantly based on specific circumstances, supplier relationships, and market conditions. Always conduct due diligence and obtain multiple quotes to ensure competitive pricing.

Spotlight on Potential dental implants versus crowns Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘dental implants versus crowns’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for dental implants versus crowns

Key Technical Properties of Dental Implants and Crowns

Understanding the essential technical properties of dental implants and crowns is crucial for B2B buyers aiming to make informed procurement decisions. Here are some critical specifications to consider:

-

Material Grade

The material grade refers to the composition and quality of the materials used in dental implants and crowns. Common materials include titanium for implants due to its strength and biocompatibility, and porcelain or zirconia for crowns, valued for aesthetics and durability. Selecting the right material grade is essential for ensuring longevity and reducing the risk of complications, which can ultimately affect patient satisfaction and brand reputation. -

Tolerance

Tolerance indicates the permissible limit of variation in dimensions during manufacturing. High precision is crucial for dental implants and crowns to ensure a proper fit and function. Tighter tolerances lead to better outcomes in clinical settings, reducing the need for adjustments post-placement, which can save time and resources for dental practitioners. -

Surface Treatment

The surface treatment of dental implants, such as sandblasting or acid-etching, enhances osseointegration—the process by which the implant fuses with the jawbone. For crowns, surface treatments can improve adhesion and aesthetics. Understanding different surface treatments helps buyers assess the performance and clinical outcomes associated with various products. -

Fatigue Strength

Fatigue strength is the ability of a material to withstand repeated loading over time without failure. This property is particularly important for dental implants, which experience significant stress during chewing. Assessing fatigue strength ensures that the chosen implants can endure the demands of daily use, thereby preventing early failures and the associated costs of replacements. -

Color Stability

For crowns, particularly those made from ceramic materials, color stability is a vital property. It refers to the ability of the material to maintain its color over time, even when exposed to various foods and beverages. Color stability is essential for aesthetic reasons, as it ensures that crowns blend seamlessly with natural teeth throughout their lifespan.

Common Trade Terminology in Dental Procurement

Familiarity with industry-specific terminology can significantly enhance the procurement process. Here are some essential trade terms:

-

OEM (Original Equipment Manufacturer)

An OEM refers to a company that produces parts or equipment that may be marketed by another manufacturer. In the dental industry, OEMs often provide dental implants and crowns to dental practices and labs. Understanding OEM relationships helps buyers identify reliable suppliers and ensure product quality. -

MOQ (Minimum Order Quantity)

MOQ indicates the smallest quantity of a product that a supplier is willing to sell. This term is crucial for B2B buyers to understand their purchasing limits and manage inventory effectively. Knowing the MOQ can help buyers negotiate better terms and plan their budgets accordingly. -

RFQ (Request for Quotation)

An RFQ is a standard business process used to invite suppliers to bid on specific products or services. In the dental sector, issuing an RFQ allows buyers to compare prices and specifications from multiple suppliers, ensuring they make cost-effective decisions while meeting quality standards. -

Incoterms

Incoterms (International Commercial Terms) are a series of pre-defined commercial terms published by the International Chamber of Commerce. They clarify the responsibilities of buyers and sellers in international trade, such as delivery points and who bears shipping costs. Familiarity with Incoterms helps buyers navigate international procurement logistics, particularly when sourcing products from regions like Europe or the Middle East. -

CE Marking

CE marking indicates that a product complies with European health, safety, and environmental protection standards. For dental implants and crowns sold in Europe, CE marking is crucial for regulatory compliance and market access. Buyers should verify the CE status of products to ensure they meet necessary legal requirements. -

ISO Certification

ISO certification signifies that a company adheres to international standards for quality management systems. For dental products, ISO certification assures buyers of a supplier’s commitment to quality and consistency. Understanding the importance of ISO certification can help buyers select trustworthy manufacturers and reduce the risk of product failures.

By grasping these technical properties and trade terms, B2B buyers can make more informed decisions, ultimately leading to better patient outcomes and enhanced business success.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dental implants versus crowns Sector

Market Overview & Key Trends

The dental implants and crowns market is experiencing significant growth, driven by an increasing prevalence of dental diseases, an aging population, and rising consumer awareness of dental aesthetics. According to industry reports, the global dental implants market alone is projected to reach USD 12.8 billion by 2026, growing at a CAGR of 7.4%. B2B buyers in regions such as Africa, South America, the Middle East, and Europe should be aware of several key trends shaping this landscape.

Technological Advancements: The integration of digital technologies, such as 3D printing and CAD/CAM systems, is revolutionizing the production and customization of dental implants and crowns. These innovations enable faster turnaround times and improved accuracy in fittings, which are essential for enhancing patient satisfaction. International buyers should consider suppliers that invest in such technologies to ensure they remain competitive.

Emerging Markets: Countries in Africa and South America are witnessing a surge in demand for dental solutions, spurred by economic growth and increased healthcare investments. For B2B buyers, this presents opportunities for sourcing high-quality products at competitive prices. Establishing partnerships with local manufacturers can facilitate easier market entry and reduce logistics costs.

Regulatory Landscape: Compliance with international standards, such as ISO and CE marking, is crucial for product acceptance in different regions. Buyers should prioritize suppliers that adhere to these regulations to mitigate risks associated with non-compliance.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a central theme in the dental sector, driven by both regulatory pressures and consumer demand for environmentally friendly practices. The production of dental implants and crowns can have significant environmental impacts, including waste generation and resource consumption. B2B buyers are encouraged to assess the sustainability practices of their suppliers.

Importance of Ethical Supply Chains: Sourcing from suppliers that prioritize ethical practices ensures that materials are obtained responsibly, reducing the risk of human rights violations and environmental degradation. Buyers should seek suppliers who are transparent about their sourcing practices and demonstrate a commitment to sustainability.

Green Certifications and Materials: Look for suppliers that offer products certified by recognized standards, such as ISO 14001 for environmental management or those that utilize biocompatible and recyclable materials. These certifications not only improve the sustainability profile of dental products but also enhance brand reputation among environmentally conscious consumers.

Brief Evolution/History

The dental implants versus crowns landscape has evolved significantly over the past few decades. Initially, dental crowns were the predominant solution for restoring damaged teeth, utilizing materials like porcelain and gold. However, with advancements in implant technology in the 1980s, implants began to gain popularity due to their durability and aesthetic appeal. The shift toward implants has been further accelerated by technological innovations, such as minimally invasive surgical techniques and improved materials that enhance integration with the jawbone. Today, both options coexist in the market, catering to diverse patient needs and preferences, while offering B2B buyers a range of sourcing options.

By understanding these dynamics, international B2B buyers can make informed decisions that align with market demands and sustainability goals, ensuring a competitive edge in the dental sector.

Related Video: Specialization and Trade: Crash Course Economics #2

Frequently Asked Questions (FAQs) for B2B Buyers of dental implants versus crowns

-

What key factors should I consider when vetting suppliers of dental implants and crowns?

When vetting suppliers, prioritize their manufacturing certifications, such as ISO or CE marks, which indicate compliance with international standards. Investigate their production capacity and lead times to ensure they can meet your demand. Review customer testimonials and request case studies to assess their reliability and product quality. Additionally, consider the supplier’s experience in international trade, particularly in your target regions, to ensure smooth logistics and compliance with local regulations. -

Can dental implants and crowns be customized for specific patient needs?

Yes, many suppliers offer customization options for both dental implants and crowns. This can include variations in material, size, and color to match the patient’s natural teeth. When engaging with suppliers, inquire about their capabilities for customization and the associated costs. Custom solutions can enhance patient satisfaction and differentiate your offerings in the market, making it a valuable selling point for your business. -

What are the typical minimum order quantities (MOQs) and lead times for dental implants and crowns?

MOQs for dental implants and crowns can vary significantly among suppliers, typically ranging from 50 to 500 units, depending on the product type and supplier capabilities. Lead times can also differ, generally spanning from two to six weeks. To optimize your inventory management, negotiate terms that align with your business needs, and consider establishing a relationship with suppliers who can offer flexibility in MOQs and faster lead times to accommodate fluctuations in demand. -

What payment terms should I expect when sourcing dental implants and crowns internationally?

Payment terms for international transactions can vary widely, but common options include upfront payments, letters of credit, and staggered payments based on shipment milestones. It’s crucial to negotiate terms that protect your cash flow while ensuring supplier commitment. Consider using escrow services for larger transactions to mitigate risks. Additionally, familiarize yourself with the currency exchange rates and potential fees involved in international payments to avoid unexpected costs. -

How can I ensure the quality of dental implants and crowns before purchasing?

To ensure quality, request detailed quality assurance (QA) documentation from suppliers, including certificates of compliance and product testing results. Conduct on-site inspections or third-party audits if feasible, especially for large orders. Additionally, consider ordering samples before committing to a full order, allowing you to evaluate the product firsthand. Establishing a quality control protocol in your procurement process will help mitigate risks associated with subpar products. -

What logistics considerations should I keep in mind when importing dental products?

Logistics play a crucial role in the timely delivery of dental implants and crowns. Consider factors such as shipping methods, customs clearance processes, and potential tariffs that could affect overall costs. Partner with a freight forwarder experienced in medical supplies to navigate complex international shipping regulations. Additionally, ensure your suppliers have reliable shipping practices to minimize delays and protect the integrity of the products during transit.

Illustrative Image (Source: Google Search)

-

How should I handle disputes with suppliers regarding product quality or delivery issues?

Establish clear communication channels and documentation protocols from the outset to address potential disputes efficiently. In the event of a quality issue, promptly notify the supplier with evidence, such as photos or test results, and refer to your contract’s terms regarding returns or replacements. Engaging a neutral third party for mediation can also be beneficial if negotiations stall. Consider including arbitration clauses in contracts to streamline dispute resolution processes. -

What certifications should I look for in dental implants and crowns to ensure compliance?

Look for certifications such as ISO 13485 for quality management systems and CE marking, which indicates compliance with European health and safety standards. In regions like the Middle East and Africa, ensure that products meet local regulatory requirements, which may vary significantly. Request documentation from suppliers proving their adherence to these standards, as this not only ensures product safety but also enhances your business’s credibility in the marketplace.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for dental implants versus crowns

As the dental market continues to evolve, the strategic sourcing of dental implants and crowns presents a unique opportunity for international B2B buyers. Key takeaways from our analysis highlight that while dental implants offer long-term solutions with superior durability, crowns remain a viable option for cost-conscious practices aiming to meet immediate patient needs.

Value of Strategic Sourcing: By leveraging strategic sourcing practices, buyers can optimize their procurement processes, ensuring they select high-quality products that meet both clinical standards and budgetary constraints. Establishing relationships with reputable suppliers from diverse regions, including Africa, South America, the Middle East, and Europe, can also enhance supply chain resilience and foster innovation in product offerings.

Looking ahead, the demand for advanced dental solutions will likely increase, driven by factors such as an aging population and rising aesthetic expectations. International buyers are encouraged to stay informed about emerging trends and technologies in the dental sector, as this knowledge will empower them to make informed purchasing decisions. Embrace the future of dental care by aligning your sourcing strategies with the evolving needs of your market, ensuring you remain competitive in a dynamic landscape.