Introduction: Navigating the Global Market for tri dental implants

In an increasingly interconnected world, the demand for high-quality dental solutions is surging, particularly in emerging markets across Africa, South America, the Middle East, and Europe. Tri dental implants have emerged as a pivotal component in modern dentistry, offering enhanced stability, longevity, and aesthetics for patients. As a B2B buyer, understanding the nuances of tri dental implants is essential not only for ensuring patient satisfaction but also for maintaining a competitive edge in a rapidly evolving market.

This comprehensive guide delves into the multifaceted landscape of tri dental implants, covering key aspects such as types, materials, manufacturing processes, and quality control measures. It will also highlight reputable suppliers and provide insights into cost considerations and market trends. By addressing frequently asked questions, the guide aims to equip international buyers with actionable insights necessary for informed sourcing decisions.

For buyers in regions like South Africa and Argentina, where the dental market is expanding, leveraging the right information can significantly influence procurement strategies. This guide empowers you to navigate the complexities of sourcing tri dental implants, ultimately enhancing your business’s operational efficiency and patient outcomes. As you explore the content, you’ll find valuable resources to help you make strategic decisions that align with your organization’s goals and the needs of your clientele.

Understanding tri dental implants Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Implants | Cylindrical design, widely used, and versatile. | General dentistry, restorative work. | Pros: High availability, established track record. Cons: May not suit all bone types. |

| Mini Implants | Smaller diameter, less invasive, quicker to place. | Immediate load applications, denture stabilization. | Pros: Reduced recovery time, less bone required. Cons: Limited load-bearing capacity. |

| Zygomatic Implants | Anchored in the zygomatic bone, for severe atrophy. | Complex cases, maxillofacial surgery. | Pros: Suitable for patients with significant bone loss. Cons: Requires specialized training for placement. |

| All-on-4 Implants | Four implants supporting a full arch of teeth. | Full arch restorations, immediate function. | Pros: Cost-effective for full restorations. Cons: Potential for uneven load distribution. |

| Bone-Grafted Implants | Incorporates graft material for enhanced stability. | Cases with inadequate bone density. | Pros: Increases implant success rate. Cons: Longer treatment time and complexity. |

Standard Implants

Standard implants are the most common type used in dental practices, featuring a cylindrical design that provides versatility across various applications. They are suitable for a wide range of patients and can be used for both single tooth replacements and multiple restorations. For B2B buyers, it’s essential to consider the implant’s compatibility with different bone types and the availability of components for restorations. Established suppliers often provide comprehensive training and support for placement.

Mini Implants

Mini implants have gained popularity due to their smaller diameter, making them less invasive and quicker to place than standard implants. They are particularly useful for immediate load applications and stabilizing dentures, which can be a key selling point for practices focusing on geriatric patients or those with limited bone density. B2B buyers should evaluate the load-bearing capacity and the specific applications for which mini implants are intended, as they may not be suitable for all clinical situations.

Zygomatic Implants

Zygomatic implants are specialized implants anchored in the zygomatic bone, designed for patients with severe bone atrophy who may not be candidates for traditional implants. These implants are ideal for complex cases and require skilled practitioners for placement. B2B buyers should prioritize sourcing from manufacturers who offer training and support for these advanced procedures, as well as ensuring that they adhere to stringent quality standards.

All-on-4 Implants

The All-on-4 implant technique involves placing four implants to support a full arch of prosthetic teeth, making it a cost-effective solution for full arch restorations. This approach allows for immediate function, which can be appealing to practices looking to minimize patient downtime. Buyers should consider the potential for uneven load distribution and ensure that they work with suppliers who provide comprehensive guides and support for successful implementation.

Bone-Grafted Implants

Bone-grafted implants involve the use of graft material to enhance stability and success rates in patients with inadequate bone density. This type of implant is crucial in cases where standard or mini implants may fail due to insufficient bone structure. B2B buyers need to assess the complexity and treatment time associated with bone-grafted implants, as well as the need for specialized training and materials to ensure successful outcomes.

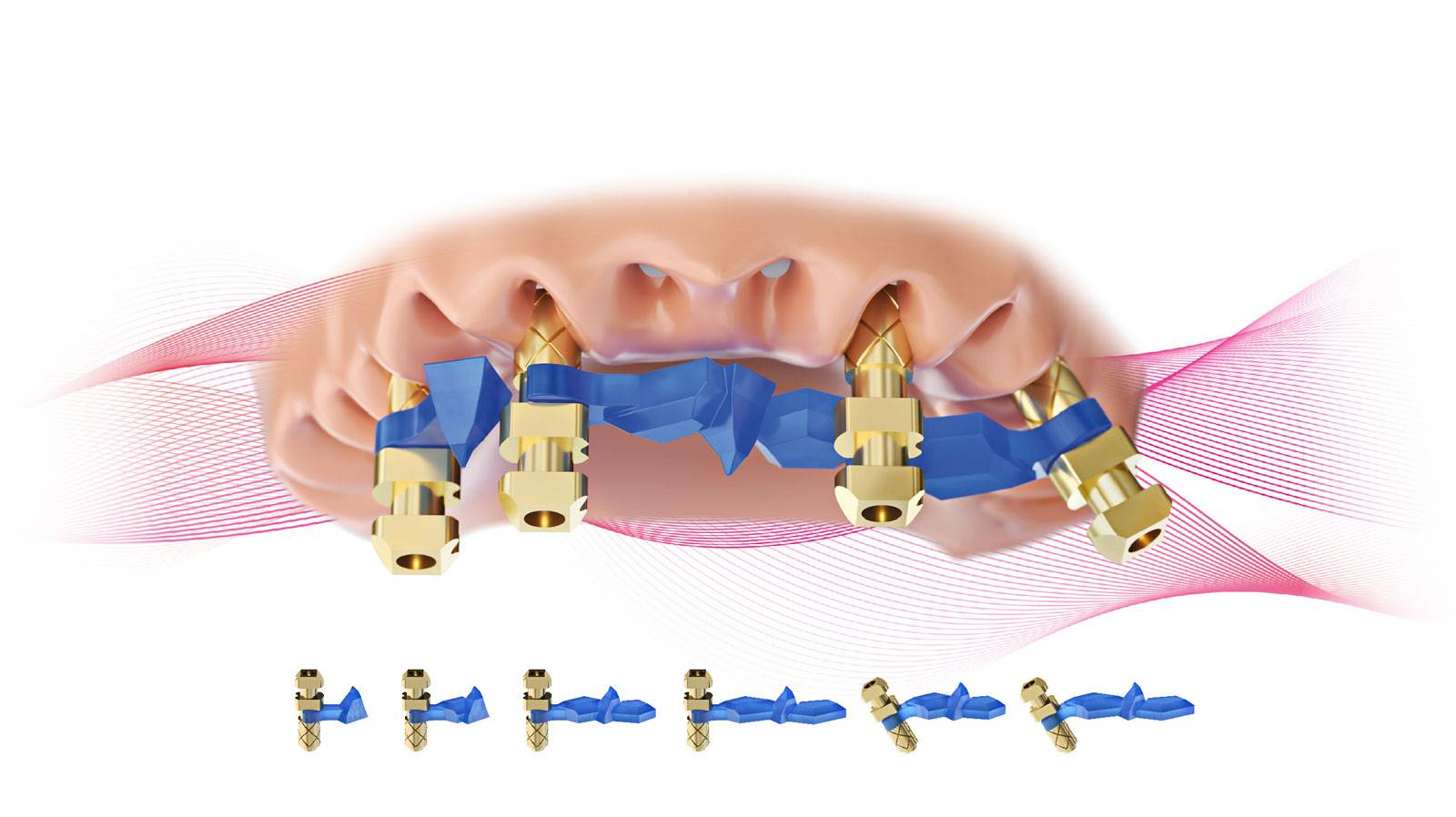

Related Video: Forever Green | TRI® Implant Insertion Demonstration (Vent)

Key Industrial Applications of tri dental implants

| Industry/Sector | Specific Application of tri dental implants | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Replacement of missing teeth using tri dental implants | Improved patient satisfaction and retention | Quality certifications, implant longevity, and compatibility with existing systems |

| Dental Laboratories | Custom prosthetics and crowns for tri dental implants | Enhanced service offerings and faster turnaround times | Access to advanced CAD/CAM technology and material quality |

| Orthodontics | Use in conjunction with orthodontic devices | Streamlined treatment plans and improved patient outcomes | Training on integration with orthodontic systems and materials sourcing |

| Maxillofacial Surgery | Reconstruction of jaw and facial structures | Ability to offer comprehensive surgical solutions | Regulatory compliance, surgical support, and patient safety standards |

| Aesthetic Dentistry | Cosmetic enhancements and smile makeovers | Increased market competitiveness and patient base | Trends in aesthetic preferences and material aesthetics |

Dental Clinics

In dental clinics, tri dental implants serve as a reliable solution for replacing missing teeth. They provide a stable foundation for crowns, bridges, or dentures, significantly enhancing patient satisfaction and retention. For international buyers, particularly in regions like Africa and South America, it’s crucial to source implants that are not only of high quality but also come with necessary certifications to ensure safety and efficacy. Additionally, clinics should consider the longevity and compatibility of the implants with their existing dental systems.

Dental Laboratories

Dental laboratories utilize tri dental implants for creating custom prosthetics and crowns tailored to individual patient needs. This application allows labs to enhance their service offerings and improve turnaround times, making them more competitive in the market. Buyers in Europe and the Middle East should prioritize sourcing implants that integrate seamlessly with advanced CAD/CAM technology, as this can significantly streamline production processes and improve precision in manufacturing.

Orthodontics

In orthodontics, tri dental implants can be used in conjunction with various orthodontic devices to provide additional anchorage. This application enables orthodontists to develop streamlined treatment plans, ultimately leading to improved patient outcomes. For B2B buyers, particularly from regions with emerging orthodontic markets, it is essential to ensure that suppliers provide adequate training on integrating these implants with orthodontic systems, as well as access to high-quality materials.

Maxillofacial Surgery

Maxillofacial surgeons apply tri dental implants for reconstructing jaw and facial structures, particularly after trauma or disease. This application expands the range of surgical solutions available to practitioners, allowing them to offer comprehensive care. International buyers must consider regulatory compliance and the availability of surgical support when sourcing these implants, as patient safety is paramount in surgical applications.

Aesthetic Dentistry

In the field of aesthetic dentistry, tri dental implants play a crucial role in cosmetic enhancements and smile makeovers. They not only improve the functional aspects of dental restorations but also contribute significantly to the aesthetic appeal. For B2B buyers, particularly in competitive markets like South Africa and Argentina, staying attuned to trends in aesthetic preferences and ensuring that sourced materials meet these demands will be key to attracting and retaining clients.

Related Video: Dental Implants 101: What You NEED to Know! Part 1 (Implant Basics)

Strategic Material Selection Guide for tri dental implants

When selecting materials for tri dental implants, it is crucial for international B2B buyers to consider various factors, including performance properties, cost implications, and compliance with regional standards. The following analysis covers four common materials used in tri dental implants: titanium, zirconia, stainless steel, and polymer composites. Each material has unique characteristics that can influence the decision-making process for buyers in regions such as Africa, South America, the Middle East, and Europe.

Titanium

Key Properties:

Titanium is renowned for its excellent strength-to-weight ratio and remarkable corrosion resistance, making it a preferred choice for dental implants. It can withstand high temperatures and pressures, ensuring durability in various oral environments.

Pros & Cons:

The primary advantage of titanium implants is their biocompatibility, which promotes osseointegration—the process by which bone integrates with the implant. However, titanium implants can be more expensive than alternatives, and their manufacturing process is complex, potentially leading to longer lead times.

Impact on Application:

Titanium is compatible with a wide range of media, including saliva and various oral fluids, making it suitable for long-term use in dental applications.

Considerations for International Buyers:

Buyers should ensure compliance with international standards such as ASTM F136 for titanium alloys. In regions like South Africa and Argentina, understanding local regulations regarding dental materials is essential for market entry.

Zirconia

Key Properties:

Zirconia is a ceramic material known for its high strength and aesthetic appeal. It exhibits excellent wear resistance and is highly resistant to corrosion, making it suitable for dental applications.

Pros & Cons:

The aesthetic advantage of zirconia is significant, as it can closely mimic natural tooth color. However, zirconia implants can be more brittle than titanium, making them susceptible to fracture under high stress. Additionally, the cost of zirconia is generally higher due to its specialized manufacturing processes.

Impact on Application:

Zirconia is particularly effective in anterior dental applications where aesthetics are paramount. It is also compatible with various oral media, although its brittleness may limit its use in certain high-stress environments.

Considerations for International Buyers:

Buyers should verify compliance with standards such as ISO 6872 for dental ceramics. In Europe, CE marking is essential for market acceptance, while in the Middle East, local regulations may vary significantly.

Stainless Steel

Key Properties:

Stainless steel is known for its high tensile strength and resistance to corrosion. It is also cost-effective and widely available, making it a popular choice for dental implants.

Pros & Cons:

The primary advantage of stainless steel is its affordability and ease of manufacturing. However, its aesthetic appeal is limited compared to titanium and zirconia, and it may not offer the same level of biocompatibility, which can affect long-term performance.

Impact on Application:

Stainless steel is suitable for temporary implants or applications where cost is a significant factor. However, its compatibility with oral fluids may not be as robust as titanium or zirconia.

Considerations for International Buyers:

Compliance with ASTM F138 for stainless steel in medical applications is crucial. Buyers in South America should be aware of local healthcare regulations that may impact the use of stainless steel in dental implants.

Polymer Composites

Key Properties:

Polymer composites are lightweight materials that can be engineered for specific properties, including flexibility and impact resistance. They are often used in conjunction with other materials to enhance performance.

Pros & Cons:

The advantage of polymer composites lies in their versatility and lower cost compared to metals and ceramics. However, they may not provide the same level of durability or long-term performance as titanium or zirconia, especially in high-stress applications.

Impact on Application:

These materials are suitable for temporary or transitional implants, particularly in regions where cost constraints are significant.

Considerations for International Buyers:

Buyers should ensure that polymer composites meet relevant standards, such as ISO 10993 for biocompatibility. In regions like Africa and the Middle East, understanding the local market’s acceptance of polymer materials is vital.

Summary Table

| Material | Typical Use Case for tri dental implants | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | Permanent dental implants | Excellent biocompatibility | Higher cost and complex manufacturing | High |

| Zirconia | Anterior dental implants | Aesthetic appeal | Brittle under stress | High |

| Stainless Steel | Temporary dental implants | Cost-effective | Limited aesthetic appeal | Low |

| Polymer Composites | Transitional implants | Versatile and lightweight | Lower durability | Medium |

This guide provides a comprehensive overview of the strategic material selection for tri dental implants, enabling international B2B buyers to make informed decisions based on their specific market needs and regulatory environments.

In-depth Look: Manufacturing Processes and Quality Assurance for tri dental implants

When considering the procurement of tri dental implants, understanding the manufacturing processes and quality assurance protocols is essential for B2B buyers. This knowledge not only ensures the reliability and longevity of the implants but also mitigates risks associated with product failures in the field. Below is a detailed exploration of the typical manufacturing stages, quality assurance standards, and actionable insights for international buyers.

Manufacturing Processes for Tri Dental Implants

The manufacturing of tri dental implants involves several critical stages, each designed to ensure that the final product meets high standards of performance and safety. The main stages are:

-

Material Preparation

– Selection of Raw Materials: High-quality titanium or titanium alloys are commonly used due to their biocompatibility and strength. For buyers, it’s crucial to verify the material specifications and certifications, such as ASTM or ISO standards, to ensure compliance.

– Surface Treatment: Surface modifications, such as anodization or sandblasting, enhance osseointegration. B2B buyers should inquire about the specific surface treatments used and their respective benefits. -

Forming

– CNC Machining: Computer Numerical Control (CNC) machines are employed to precisely shape the implants. This process is critical for achieving the intricate designs that enhance the implants’ performance.

– Additive Manufacturing: Emerging technologies like 3D printing are increasingly being used to create complex geometries that traditional methods cannot achieve. Buyers should assess the supplier’s capabilities in both traditional and advanced manufacturing techniques. -

Assembly

– Component Integration: The assembly process involves integrating various components such as the implant body, abutments, and screws. This stage requires meticulous attention to detail to avoid contamination and ensure proper fit.

– Automation vs. Manual Assembly: Understanding whether the assembly process is automated or manual can impact the consistency and quality of the implants. Automated processes typically yield higher precision. -

Finishing

– Polishing and Coating: Final finishing processes like polishing and applying protective coatings are essential for enhancing aesthetics and preventing corrosion. B2B buyers should confirm the types of coatings used and their long-term durability.

Quality Assurance Protocols

Quality assurance is a fundamental aspect of the manufacturing process for tri dental implants, ensuring that every implant meets stringent safety and efficacy standards.

International Standards

- ISO 9001: This is a quality management standard that outlines requirements for an organization’s ability to consistently provide products that meet customer and regulatory requirements. Suppliers certified under ISO 9001 demonstrate a commitment to quality management principles.

- CE Marking: For products sold in Europe, CE marking indicates compliance with EU safety, health, and environmental protection standards. Buyers in Europe should prioritize suppliers with CE-marked products.

- API Standards: The American Petroleum Institute (API) standards, while primarily for oil and gas, can influence quality practices in manufacturing processes. Understanding the relevance of API in the context of dental implants can be beneficial for buyers seeking comprehensive quality assurance.

Quality Control Checkpoints

- Incoming Quality Control (IQC): This initial checkpoint ensures that incoming materials meet specified standards. B2B buyers should request documentation of material inspections and certifications.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing to identify defects early. Buyers can ask suppliers about their IPQC processes and how they address non-conformance.

- Final Quality Control (FQC): The final inspection before products are packaged and shipped. Buyers should ensure that FQC reports are available, detailing the tests performed and their outcomes.

Common Testing Methods

- Mechanical Testing: Includes tensile strength, fatigue, and shear tests to ensure the implants can withstand the stresses of clinical use.

- Biocompatibility Testing: Ensures that the materials used do not elicit adverse biological responses. This is crucial for international buyers, particularly in regions with stringent health regulations.

- Sterility Testing: For dental implants, ensuring sterility is vital. Buyers should confirm that suppliers follow validated sterilization processes and maintain records of sterility assurance.

Verifying Supplier Quality Control

For international B2B buyers, ensuring that suppliers adhere to high-quality standards involves several proactive measures:

- Supplier Audits: Conduct regular audits of the supplier’s manufacturing facility to assess compliance with quality standards and manufacturing practices.

- Review Quality Assurance Reports: Request detailed quality assurance documentation, including IQC, IPQC, and FQC reports, to verify the integrity of the manufacturing process.

- Third-Party Inspections: Engage third-party inspection services to conduct independent assessments of the manufacturing processes and product quality. This is particularly important for buyers from Africa and South America, where local regulatory environments may differ significantly from international standards.

Quality Control Nuances for International Buyers

Understanding the nuances of quality control is critical for B2B buyers, especially when dealing with international suppliers. Buyers from Africa, South America, the Middle East, and Europe must be aware of the following:

- Regulatory Compliance: Different regions have varying regulations governing medical devices. Ensure that your supplier’s products comply with both local and international regulations to avoid legal and operational challenges.

- Documentation Requirements: Maintain clear documentation of all quality control processes and certifications. This not only aids in compliance but also builds trust with end-users and regulatory bodies.

- Cultural and Communication Factors: Be cognizant of cultural differences that may impact quality assurance practices. Establish clear lines of communication with suppliers to ensure that quality standards are understood and upheld.

By comprehensively understanding the manufacturing processes and quality assurance protocols of tri dental implants, international B2B buyers can make informed decisions that align with their needs and regulatory requirements. This diligence ultimately contributes to better patient outcomes and enhances the reputation of the practices utilizing these implants.

Related Video: SMART Quality Control for Manufacturing

Comprehensive Cost and Pricing Analysis for tri dental implants Sourcing

In the competitive landscape of dental implants, particularly tri dental implants, understanding the comprehensive cost and pricing structure is crucial for international B2B buyers. This analysis outlines the essential cost components, key price influencers, and strategic buyer tips that can significantly impact sourcing decisions, especially for businesses operating in Africa, South America, the Middle East, and Europe.

Cost Components

- Materials: The primary raw materials for tri dental implants typically include titanium or zirconia. The quality of these materials can greatly influence the final price. Buyers should assess the material sourcing standards, as higher-grade materials may command a premium but also offer better longevity and patient outcomes.

Illustrative Image (Source: Google Search)

-

Labor: Labor costs can vary significantly by region. In countries with lower labor costs, such as some in Africa and South America, the overall production cost may be reduced. However, it is essential to ensure that labor quality aligns with international standards to maintain product integrity.

-

Manufacturing Overhead: This encompasses the indirect costs associated with production, such as utilities, rent, and administrative expenses. A well-optimized manufacturing process can reduce overhead, thus lowering the overall cost per unit.

-

Tooling: The cost of tooling can be substantial, especially for customized implants. Investment in advanced machinery and technology can enhance production efficiency, but it may require a higher initial capital outlay.

-

Quality Control (QC): Rigorous quality control processes are essential in the dental implant industry to ensure compliance with health regulations and standards. The costs associated with QC can vary, but investing in thorough testing and certification can prevent costly recalls and enhance brand reputation.

-

Logistics: Shipping costs can impact the total cost of ownership significantly. Factors such as distance, shipping method, and customs duties must be considered. Buyers should evaluate logistics providers to ensure timely and cost-effective delivery.

-

Margin: Suppliers will add a margin to cover their business expenses and profit. Understanding the typical margins in the industry can aid buyers in negotiating better terms.

Price Influencers

-

Volume/MOQ: Ordering in bulk can lead to significant discounts. Establishing a minimum order quantity (MOQ) can help buyers negotiate better pricing.

-

Specifications/Customization: Customized implants may incur additional costs. Buyers should weigh the benefits of customization against potential price increases.

-

Materials: The choice of materials not only affects the cost but also the implant’s performance and acceptance in the market. Higher-quality materials often justify higher prices.

-

Quality/Certifications: Implants that meet international certifications (like ISO or CE marking) may be priced higher but provide assurance of quality, which is crucial in medical applications.

-

Supplier Factors: The reputation and reliability of suppliers can influence pricing. Established suppliers may charge more but could offer better service and reliability.

-

Incoterms: Understanding Incoterms is vital for international transactions. They define the responsibilities of buyers and sellers regarding shipping, insurance, and tariffs, affecting the overall cost.

Buyer Tips

-

Negotiation: Engage in open discussions with suppliers to negotiate pricing based on volume and long-term relationships. Presenting data on market trends and competitor pricing can strengthen your position.

-

Cost-Efficiency: Analyze the total cost of ownership, including logistics, maintenance, and potential warranty claims, rather than just the upfront price. This holistic view can lead to better purchasing decisions.

-

Pricing Nuances: Be aware of regional pricing differences, especially when sourcing from suppliers in different continents. Currency fluctuations and local economic conditions can affect pricing.

-

Supplier Relationships: Building strong relationships with suppliers can lead to better pricing and preferential treatment in terms of product availability and delivery timelines.

-

Due Diligence: Conduct thorough research on potential suppliers. Look for reviews, certifications, and case studies to ensure they meet your quality and reliability standards.

Disclaimer

Prices mentioned in this analysis are indicative and subject to change based on market dynamics, supplier negotiations, and specific buyer requirements. Always confirm current pricing with suppliers prior to making procurement decisions.

Essential Technical Properties and Trade Terminology for tri dental implants

Key Technical Properties of Tri Dental Implants

Understanding the essential technical properties of tri dental implants is crucial for B2B buyers seeking quality and reliability. Here are several critical specifications:

-

Material Grade

– Definition: The classification of the materials used in manufacturing dental implants, typically titanium or zirconia.

– Importance: Material grade impacts the durability, biocompatibility, and overall performance of the implant. High-grade titanium implants are favored for their strength and resistance to corrosion, which are vital for long-term success in dental applications. -

Surface Treatment

– Definition: The process applied to the implant surface to enhance osseointegration (the process by which the implant becomes anchored to the bone).

– Importance: Surface treatments like sandblasting or acid etching increase surface roughness, promoting better bone attachment. For buyers, selecting implants with effective surface treatments can lead to higher success rates and patient satisfaction. -

Tolerance

– Definition: The permissible limit of variation in the dimensions of the implant components.

– Importance: Tight tolerances ensure a precise fit between the implant and the abutment, which is critical for the overall stability and functionality of the dental restoration. Buyers should look for suppliers that adhere to stringent manufacturing tolerances to minimize complications. -

Length and Diameter

– Definition: The dimensions of the implant, which can vary based on the specific application and anatomical considerations.

– Importance: Different lengths and diameters are available to accommodate various bone types and patient needs. Having a range of sizes allows dental professionals to customize treatment plans effectively, which is a significant selling point for B2B buyers. -

Load-Bearing Capacity

– Definition: The maximum load an implant can withstand without failure.

– Importance: Understanding load-bearing capacity is essential for evaluating the suitability of an implant for specific patient cases, especially in complex restorations. B2B buyers should prioritize implants that demonstrate high load-bearing capabilities in clinical studies.

Illustrative Image (Source: Google Search)

Common Trade Terminology in Dental Implant Procurement

Navigating the dental implant market requires familiarity with specific trade terms. Here are some commonly used terms that buyers should know:

-

OEM (Original Equipment Manufacturer)

– Definition: A company that produces parts or equipment that may be marketed by another manufacturer.

– Importance: Understanding OEM relationships is vital for buyers looking to source high-quality implants. OEMs often have established reputations and quality control processes, ensuring product reliability. -

MOQ (Minimum Order Quantity)

– Definition: The smallest number of units that a supplier is willing to sell.

– Importance: Knowing the MOQ helps buyers plan their inventory and manage costs effectively. For international buyers, negotiating MOQ can lead to better pricing and reduced waste. -

RFQ (Request for Quotation)

– Definition: A document issued by a buyer to solicit pricing and terms from suppliers.

– Importance: RFQs are essential for comparing offers from different suppliers. A well-structured RFQ can lead to more accurate quotes and better negotiation leverage. -

Incoterms (International Commercial Terms)

– Definition: A set of predefined commercial terms published by the International Chamber of Commerce that clarify the responsibilities of buyers and sellers in international transactions.

– Importance: Familiarity with Incoterms helps buyers understand shipping costs, risk management, and delivery responsibilities. Correct usage of these terms can prevent costly misunderstandings in international trade. -

Warranty Period

– Definition: The length of time a manufacturer guarantees the performance of an implant.

– Importance: A robust warranty period is a sign of manufacturer confidence in their product. Buyers should consider warranty terms as part of their risk assessment when selecting suppliers.

By grasping these essential properties and terminology, B2B buyers can make informed decisions when sourcing tri dental implants, ultimately leading to better patient outcomes and enhanced business relationships.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the tri dental implants Sector

Market Overview & Key Trends

The global tri dental implants market is experiencing robust growth driven by increasing demand for dental restoration solutions, aging populations, and advancements in dental technology. In regions such as Africa, South America, the Middle East, and Europe, there is a notable shift towards minimally invasive procedures, which has spurred innovation in implant designs and materials. International B2B buyers are increasingly focusing on suppliers that can provide cutting-edge solutions, such as digital impressions and 3D printing technologies, which enhance precision and reduce operational costs.

Emerging trends indicate a growing emphasis on customization and patient-centric approaches in dental care. Buyers should be aware of the rise of digital workflows that integrate CAD/CAM technologies for better design accuracy and efficiency. Additionally, the integration of artificial intelligence in treatment planning and patient management is becoming more prevalent, particularly in developed markets like Europe. This shift not only optimizes clinical outcomes but also streamlines the procurement process, allowing for more informed purchasing decisions.

Furthermore, the market dynamics are influenced by regulatory changes, particularly in Europe, where stricter regulations on medical devices are driving manufacturers to comply with higher safety and quality standards. B2B buyers in Africa and South America should keep abreast of these developments to ensure compliance and to leverage opportunities for partnerships with compliant manufacturers.

Sustainability & Ethical Sourcing in B2B

Sustainability is increasingly becoming a critical focus in the tri dental implants sector. The environmental impact of dental manufacturing processes and materials is under scrutiny, prompting buyers to seek out suppliers committed to sustainable practices. Ethical sourcing is not only a moral imperative but also a significant differentiator in the marketplace. B2B buyers should prioritize partnerships with manufacturers who adhere to sustainable practices, including responsible material sourcing and waste reduction strategies.

The use of ‘green’ certifications, such as ISO 14001 for environmental management, is essential for suppliers aiming to position themselves as leaders in sustainability. Materials used in dental implants, such as titanium and zirconia, should be sourced from suppliers that demonstrate a commitment to sustainability through transparent supply chains and environmentally friendly production processes. This trend is particularly relevant for buyers in regions like Europe, where consumers increasingly prefer eco-friendly products.

Moreover, buyers should consider the lifecycle of dental implants, from production to disposal. Engaging with suppliers who offer recyclable or biodegradable options can significantly enhance a company’s sustainability profile. By adopting these practices, B2B buyers not only meet regulatory and consumer demands but also contribute to a healthier planet, aligning with global sustainability goals.

Brief Evolution/History

The tri dental implants market has evolved significantly over the past few decades. Initially dominated by traditional materials and designs, the sector has seen a shift towards more sophisticated solutions that prioritize both functionality and aesthetics. The introduction of titanium implants in the 1960s revolutionized the field, providing superior biocompatibility and longevity.

In the 21st century, advancements in technology, such as digital imaging and computer-aided design, have further transformed the landscape, enabling customized solutions tailored to individual patient needs. This evolution has not only enhanced clinical outcomes but also created new opportunities for B2B buyers to collaborate with innovative manufacturers dedicated to advancing dental implant technology. Understanding this historical context is essential for international buyers as they navigate the complexities of the current market and seek out reliable, forward-thinking partners.

Related Video: TRI® Surgical Kit Tutorial with Holger Kast

Frequently Asked Questions (FAQs) for B2B Buyers of tri dental implants

-

What criteria should I use to vet suppliers of tri dental implants?

When vetting suppliers, focus on their industry reputation, certifications, and compliance with international standards such as ISO 13485 for medical devices. Request case studies or testimonials from other clients, particularly those in your region, to gauge their reliability and quality. Additionally, assess their production capabilities and technology used in manufacturing. A site visit or virtual tour can provide insights into their operational practices and quality control measures. -

Can tri dental implants be customized to meet specific market needs?

Yes, many suppliers offer customization options to cater to regional preferences and anatomical variations. Discuss your requirements upfront, including dimensions, materials, and packaging. Ensure that the supplier has experience in custom orders and can provide samples for evaluation. Be aware that customization may affect lead times and pricing, so factor these into your procurement strategy. -

What are the minimum order quantities (MOQs) and lead times for tri dental implants?

MOQs can vary significantly among suppliers, often ranging from 50 to 500 units depending on the product line and customization. Lead times typically range from 4 to 12 weeks, influenced by production schedules, complexity of the order, and shipping logistics. It’s advisable to negotiate MOQs and lead times early in the conversation to align with your inventory and sales forecasts. -

How should I handle payments and financing when sourcing tri dental implants internationally?

Payment methods commonly include wire transfers, letters of credit, and escrow services. Discuss payment terms upfront, including deposits and payment upon delivery, to mitigate risks. Consider using a reputable international trade finance service to facilitate transactions and protect against currency fluctuations. Be aware of any additional fees related to international banking and customs duties that could impact your overall cost. -

What quality assurance measures and certifications should I look for in tri dental implants?

Ensure that the supplier holds relevant certifications such as CE marking (for Europe) and FDA approval (for the U.S. market). Request documentation of their quality assurance processes, including how they conduct inspections and testing. Regular audits and compliance with international standards such as ISO 9001 can also indicate a commitment to quality. Establish clear quality benchmarks in your contract to avoid disputes. -

What logistics considerations should I keep in mind when importing tri dental implants?

Logistics planning is critical for timely delivery and cost management. Understand the shipping methods available, such as air freight for speed or sea freight for cost-effectiveness. Factor in import duties, taxes, and local regulations in your destination country. Collaborate with a logistics partner experienced in medical device imports to ensure compliance and efficient handling of customs processes. -

How can I resolve disputes with suppliers regarding tri dental implants?

To minimize disputes, establish clear terms in your contract regarding quality, delivery, and payment. In the event of a disagreement, attempt to resolve it amicably through direct communication. If necessary, refer to mediation or arbitration as stipulated in your contract. Consider the jurisdiction of the contract and local laws that may apply to the resolution process, as this can impact your approach. -

What trends should I be aware of in the tri dental implant market?

Stay informed about emerging technologies such as 3D printing and biocompatible materials that are reshaping the dental implant landscape. Additionally, monitor regulatory changes and market demands, particularly in your region, as these can affect product availability and pricing. Networking with industry professionals through trade shows and online forums can provide valuable insights into future trends and competitive strategies.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for tri dental implants

In the ever-evolving landscape of dental implant procurement, strategic sourcing emerges as a critical component for international buyers, particularly in regions such as Africa, South America, the Middle East, and Europe. By leveraging data analytics and market intelligence, businesses can identify the most reliable suppliers, negotiate favorable terms, and ensure the quality of tri dental implants that meet regulatory standards.

Key takeaways for B2B buyers include the importance of establishing strong supplier relationships, understanding local market dynamics, and being adaptable to technological advancements. Buyers should also prioritize suppliers who demonstrate a commitment to sustainability and ethical practices, which are increasingly valued in global markets.

As we look to the future, the demand for innovative dental solutions is set to rise, driven by an aging population and growing aesthetic preferences. This presents a unique opportunity for businesses to position themselves as leaders in the dental implant market. Act now by evaluating your sourcing strategies and aligning them with the latest trends and technologies. By doing so, you can ensure not only the success of your procurement processes but also contribute positively to the broader healthcare landscape in your region.