Introduction: Navigating the Global Market for dental implants failure

Dental implants have revolutionized restorative dentistry, offering patients a reliable solution for tooth loss. However, understanding the intricacies of dental implant failure is crucial for B2B buyers in the international market. With failure rates fluctuating due to various factors, including surgical technique, material selection, and patient health, the implications can be significant—ranging from increased costs to reputational damage for dental practices and suppliers.

This comprehensive guide delves into the multifaceted world of dental implant failure. It covers essential topics such as types of failures, materials used in implants, quality control standards, and the role of suppliers. Additionally, it addresses cost considerations, market trends, and frequently asked questions, equipping international buyers with the knowledge necessary to make informed sourcing decisions.

For businesses operating in regions like Africa, South America, the Middle East, and Europe, including countries such as South Africa and Germany, understanding these dynamics is paramount. The guide empowers buyers to evaluate potential suppliers, ensuring they choose partners who prioritize quality and reliability in their products. By navigating the complexities of dental implant failure, stakeholders can enhance patient outcomes, optimize operational efficiency, and ultimately drive growth in their dental practices.

Understanding dental implants failure Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Early Implant Failure | Occurs shortly after placement; often due to biological rejection. | Dental clinics, implant manufacturers | Pros: Early detection can minimize costs. Cons: May require complete replacement, increasing expenses. |

| Late Implant Failure | Happens months to years post-placement; linked to peri-implantitis. | Dental practices, restoration labs | Pros: Understanding risk can improve long-term success. Cons: Treatment can be complex and costly. |

| Failed Osseointegration | Lack of bone-to-implant contact; essential for stability. | Implant suppliers, surgical practices | Pros: Knowledge of factors can guide better implant selection. Cons: Can lead to significant patient dissatisfaction. |

| Mechanical Failure | Involves fracture or loosening of the implant or components. | Dental equipment suppliers | Pros: Awareness can lead to better quality control. Cons: Replacement parts may not be readily available. |

| Surgical Trauma | Results from improper placement or technique during surgery. | Surgical training programs, clinics | Pros: Emphasizes the need for skilled practitioners. Cons: Training and oversight can be expensive. |

Early Implant Failure

Early implant failure is characterized by the implant exhibiting mobility before the final crown is placed. It is often linked to biological rejection, which can be influenced by immunological factors or the patient’s overall health. For B2B buyers, understanding this type of failure is critical, as it emphasizes the importance of patient screening and the need for high-quality materials. Early failures can lead to increased costs due to the necessity of replacing the implant, making it essential for buyers to ensure that their suppliers provide products with proven success rates.

Late Implant Failure

Late implant failure typically occurs months or years after the initial placement and is frequently associated with conditions like peri-implantitis. This inflammation can compromise the surrounding bone and soft tissue, leading to eventual implant loss. For B2B buyers, recognizing the risks associated with late failures can inform decisions regarding patient education and post-operative care products. Investing in preventative measures, such as quality oral hygiene products and regular follow-ups, can mitigate these risks and enhance patient satisfaction.

Failed Osseointegration

Failed osseointegration refers to the inability of the bone to properly bond with the implant, which is crucial for long-term stability. Factors such as bone quality and quantity, as well as surgical technique, play significant roles in this type of failure. B2B buyers should prioritize sourcing implants that are designed for optimal osseointegration, considering factors like surface texture and material composition. Understanding the implications of osseointegration can aid buyers in making informed choices that enhance the likelihood of successful outcomes.

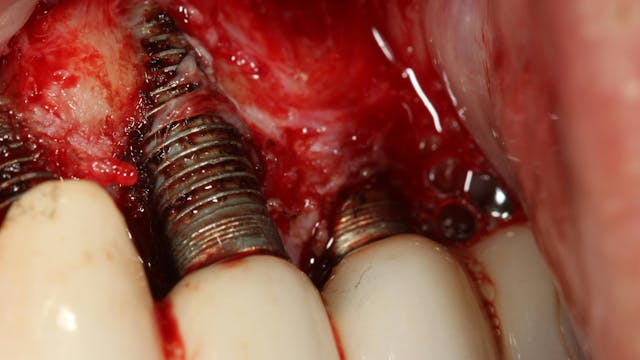

Illustrative Image (Source: Google Search)

Mechanical Failure

Mechanical failure involves the physical breakdown of the implant or its components, which can manifest as fractures or loosening. This type of failure can often be traced back to design flaws or improper loading during the healing process. For B2B purchasers, being aware of the mechanical specifications of implants can lead to better decision-making when selecting products. Investing in high-quality, durable materials can help reduce the incidence of mechanical failures, thereby improving overall patient outcomes and satisfaction.

Surgical Trauma

Surgical trauma occurs when there are complications during the implant placement process, often due to improper technique or equipment. This can lead to immediate or delayed failures. For B2B buyers, investing in comprehensive training programs for dental professionals can mitigate these risks. Providing access to advanced surgical tools and technologies can enhance the precision of procedures, ultimately reducing the likelihood of surgical trauma and fostering a reputation for quality care.

Key Industrial Applications of dental implants failure

| Industry/Sector | Specific Application of Dental Implants Failure | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Dental Clinics | Assessment of Failure Rates | Improve patient outcomes and clinic reputation | Access to robust data on failure rates and root causes |

| Dental Laboratories | Quality Control in Implant Manufacturing | Enhance product reliability and reduce returns | Sourcing high-quality materials and advanced manufacturing techniques |

| Medical Device Manufacturers | Research and Development of Implants | Innovate and differentiate product offerings | Collaboration with dental professionals for insights and testing |

| Insurance Companies | Risk Assessment and Policy Development | Better risk management and premium pricing | Data analytics capabilities to evaluate failure statistics |

| Educational Institutions | Curriculum Development on Implantology | Train future professionals on best practices | Partnerships with dental clinics for practical insights |

Dental Clinics

Dental clinics can utilize insights from dental implant failures to enhance their patient care strategies. By analyzing failure rates and the underlying causes, clinics can implement better pre-operative assessments and post-operative care protocols. This not only improves patient outcomes but also enhances the clinic’s reputation. International B2B buyers, especially in regions like Africa and South America, should ensure they have access to comprehensive data and analytics on implant failure to inform their practices.

Dental Laboratories

For dental laboratories, understanding the causes of dental implant failure is crucial in quality control and product development. By recognizing common failure points, laboratories can refine their manufacturing processes, ensuring that implants are made from high-quality materials and designed to minimize risks. Buyers in Europe and the Middle East should prioritize partnerships with suppliers that offer advanced manufacturing techniques and materials known for their durability and biocompatibility.

Medical Device Manufacturers

Medical device manufacturers can leverage the study of dental implant failures to drive research and development efforts. By analyzing failure modes, manufacturers can innovate new implant designs and materials that address common issues, such as osseointegration failures or peri-implantitis. For international buyers, particularly in South Africa and Germany, it is essential to collaborate with dental professionals to gain insights into practical challenges faced in implantology, which can guide product development.

Insurance Companies

Insurance companies can benefit from understanding dental implant failures by improving their risk assessment and policy development processes. By analyzing failure statistics, insurers can create tailored policies that reflect the actual risks associated with dental implants, leading to better risk management and more accurate premium pricing. B2B buyers in the Middle East and Europe should invest in data analytics capabilities to evaluate failure rates and trends effectively.

Educational Institutions

Educational institutions involved in dental education can utilize information about dental implant failures to develop comprehensive curricula that teach best practices in implantology. By incorporating real-world data and case studies into their training programs, they can prepare future dental professionals to recognize and mitigate risks associated with dental implants. International buyers should seek partnerships with clinics and laboratories to ensure their curriculum is aligned with current industry practices and challenges.

Related Video: Basics of Dental Implants بالعربي

Strategic Material Selection Guide for dental implants failure

When selecting materials for dental implants, particularly in the context of potential failures, it is crucial to consider various factors such as mechanical properties, biocompatibility, and the specific needs of the target market. Below is an analysis of four common materials used in dental implants, focusing on their properties, advantages, disadvantages, and considerations for international B2B buyers.

Titanium

Key Properties: Titanium is renowned for its excellent strength-to-weight ratio, high corrosion resistance, and biocompatibility. It can withstand the pressures exerted during mastication and has a temperature rating suitable for sterilization processes.

Pros & Cons: Titanium implants are durable and resistant to wear and tear, making them suitable for long-term use. However, they can be more expensive compared to other materials, and the manufacturing process can be complex due to the need for precision machining.

Impact on Application: Titanium is compatible with various media, including saliva and blood, and integrates well with bone (osseointegration). This property is crucial for the longevity of dental implants.

Considerations for International Buyers: Buyers from regions like South Africa and Germany should ensure compliance with international standards such as ASTM and ISO. The high cost may be a limiting factor for some markets, particularly in developing regions.

Zirconia

Key Properties: Zirconia is a ceramic material known for its high strength, wear resistance, and aesthetic appeal. It is also highly resistant to corrosion and has a lower thermal conductivity than metals.

Pros & Cons: The primary advantage of zirconia implants is their tooth-like appearance, making them ideal for anterior restorations. However, they may be less durable than titanium and are more prone to fracture under extreme stress.

Impact on Application: Zirconia is biocompatible and does not cause allergic reactions, making it suitable for patients with metal sensitivities. Its aesthetic properties are particularly valued in cosmetic dentistry.

Considerations for International Buyers: Buyers should be aware of the varying manufacturing standards across regions. Zirconia implants may be more expensive and less commonly available in some markets, necessitating careful supplier selection.

PEEK (Polyether Ether Ketone)

Key Properties: PEEK is a high-performance polymer known for its excellent mechanical properties, including high strength and flexibility. It has good temperature resistance and is chemically inert, making it suitable for various applications.

Pros & Cons: PEEK implants are lightweight and can be manufactured with relative ease compared to metals. However, they may not provide the same level of osseointegration as titanium, potentially leading to higher failure rates.

Impact on Application: PEEK is compatible with imaging techniques, allowing for easier monitoring of implant integration. Its flexibility can also reduce stress on surrounding bone structures.

Considerations for International Buyers: Compliance with medical device regulations (e.g., FDA, CE marking) is essential. PEEK implants are generally more affordable than titanium but may not be suitable for all applications, particularly where osseointegration is critical.

Hydroxyapatite Coatings

Key Properties: Hydroxyapatite (HA) is a naturally occurring mineral form of calcium apatite and is known for its excellent biocompatibility and ability to promote osseointegration.

Pros & Cons: HA coatings can significantly enhance the integration of implants with bone, improving success rates. However, the coatings can be costly and may require specialized manufacturing processes.

Impact on Application: HA-coated implants are particularly effective in environments where rapid osseointegration is desired, such as in patients with compromised bone quality.

Considerations for International Buyers: Buyers should consider the regulatory landscape in their regions, as HA coatings may be subject to specific standards. The higher cost of HA-coated implants may be a barrier in price-sensitive markets.

Summary Table

| Material | Typical Use Case for dental implants failure | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Titanium | General dental implants | High durability and corrosion resistance | Higher manufacturing complexity | High |

| Zirconia | Aesthetic anterior implants | Excellent aesthetics | Prone to fracture under stress | Med |

| PEEK | Lightweight implants | Lightweight and easy to manufacture | Lower osseointegration potential | Med |

| Hydroxyapatite Coatings | Implants requiring rapid osseointegration | Enhances osseointegration | Higher cost and specialized manufacturing | High |

This strategic material selection guide provides an essential overview for international B2B buyers navigating the complexities of dental implant materials, particularly in the context of potential failures. Understanding these materials’ properties and implications can lead to better purchasing decisions and improved patient outcomes.

In-depth Look: Manufacturing Processes and Quality Assurance for dental implants failure

Understanding Manufacturing Processes and Quality Assurance for Dental Implants

The manufacturing of dental implants is a complex process that must adhere to strict quality assurance standards to ensure the safety and efficacy of the final product. As international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding these processes is crucial for making informed purchasing decisions.

Manufacturing Processes

The manufacturing of dental implants typically involves several key stages, each critical to the overall success of the implant. These stages include:

-

Material Preparation

– Material Selection: The most common materials used for dental implants are titanium and titanium alloys due to their biocompatibility and strength. Alternative materials, such as ceramics, may also be used.

– Purification: Raw materials undergo rigorous purification processes to eliminate contaminants that could affect the implant’s performance. -

Forming

– Machining: The selected material is shaped into the desired implant form using precision machining techniques. This may involve CNC (Computer Numerical Control) machining for high accuracy.

– Surface Treatment: The implant surface is treated to enhance osseointegration. Techniques such as sandblasting, acid etching, and coating with bioactive materials are commonly employed. -

Assembly

– Component Integration: The implant is assembled with its components, which may include abutments and screws. This stage ensures that all parts fit together correctly and function as intended.

– Sterilization: Before packaging, implants undergo sterilization processes, such as autoclaving or gamma radiation, to eliminate any microbial contamination. -

Finishing

– Quality Inspection: Each implant is subjected to quality inspections to verify dimensions, surface integrity, and overall quality.

– Packaging: Implants are packaged in sterile conditions to maintain their integrity until they reach the end-user.

Quality Assurance

Quality assurance in the manufacturing of dental implants is governed by a combination of international and industry-specific standards. For B2B buyers, understanding these standards is vital for ensuring supplier compliance.

-

Relevant International Standards

– ISO 9001: This standard outlines the requirements for a quality management system and is essential for ensuring consistent quality in manufacturing processes.

– ISO 13485: Specific to medical devices, this standard emphasizes the importance of a quality management system that demonstrates the ability to provide medical devices that consistently meet customer and regulatory requirements. -

Industry-Specific Certifications

– CE Marking: Required for dental implants sold in Europe, CE marking indicates that the product meets EU safety, health, and environmental protection requirements.

– FDA Approval: In the United States, implants must be approved by the FDA, which involves a thorough evaluation of safety and effectiveness. -

Quality Control Checkpoints

– Incoming Quality Control (IQC): This involves inspecting raw materials upon receipt to ensure they meet specified standards.

– In-Process Quality Control (IPQC): Quality checks are performed at various stages during manufacturing to monitor compliance with standards.

– Final Quality Control (FQC): This final inspection confirms that the finished product meets all specifications before packaging and shipping. -

Common Testing Methods

– Mechanical Testing: Implants undergo tensile, shear, and fatigue testing to evaluate their strength and durability.

– Biocompatibility Testing: Ensures that the materials used do not provoke an adverse reaction in the human body.

– Sterility Testing: Assesses whether the sterilization process has been effective.

Verifying Supplier Quality Control

For B2B buyers, particularly those in international markets, verifying a supplier’s quality control processes is essential. Here are some methods to ensure compliance:

-

Supplier Audits

– Conduct regular audits of suppliers to assess their manufacturing processes and adherence to quality standards. This can be done through third-party auditing firms that specialize in medical device manufacturing. -

Review of Quality Reports

– Request access to quality control reports, including IQC, IPQC, and FQC documentation. These reports should detail the results of various tests and inspections conducted during the manufacturing process. -

Third-Party Inspections

– Engage independent third-party inspection services to evaluate the quality of implants prior to shipment. This adds an extra layer of assurance that the products meet required standards. -

Certification Verification

– Verify that suppliers hold relevant certifications (e.g., ISO 13485, CE marking) and check their validity. This can often be done through the certifying body’s website.

Quality Control and Certification Nuances for International Buyers

International B2B buyers must navigate various regulatory landscapes, which can differ significantly by region. Here are some key considerations:

- Regulatory Differences: Understand the regulatory requirements specific to your region. For instance, the CE marking is crucial for European markets, while the FDA approval is necessary for the U.S. market.

- Cultural Sensitivities: Be aware of cultural differences that may affect supplier relationships and negotiations. Establishing trust and open communication can facilitate smoother transactions.

- Supply Chain Transparency: Seek suppliers who provide transparency in their supply chain processes. This can include sharing information about sourcing practices and manufacturing processes.

By understanding these manufacturing processes and quality assurance practices, B2B buyers can make informed decisions when sourcing dental implants. Ensuring that suppliers adhere to stringent quality standards not only minimizes the risk of implant failure but also enhances overall patient outcomes.

Related Video: What Causes DENTAL IMPLANT FAILURE? | Dr. Brett Langston

Comprehensive Cost and Pricing Analysis for dental implants failure Sourcing

When sourcing dental implants, particularly in the context of managing failures, understanding the comprehensive cost structure and pricing dynamics is crucial for international B2B buyers. The cost components, price influencers, and strategic buyer tips outlined below will help you navigate this complex landscape effectively.

Cost Components

-

Materials: The primary materials used in dental implants include titanium, titanium alloys, and ceramics. The cost of these materials can vary significantly based on quality, supplier, and market fluctuations. High-grade titanium is generally more expensive but offers better biocompatibility and durability.

-

Labor: Skilled labor is essential for the production and quality assurance of dental implants. Labor costs can vary by region; for example, labor is often more expensive in Europe compared to Africa or South America. Understanding local labor markets can help in negotiating costs effectively.

-

Manufacturing Overhead: This includes costs associated with facilities, utilities, and administrative expenses. Manufacturers with advanced technology and stringent quality control processes may have higher overhead, which can reflect in the final price of implants.

-

Tooling: Specialized tools and equipment are necessary for the precise manufacturing of implants. The initial investment in tooling can be significant, but it is amortized over the production volume. Buyers should inquire about the manufacturer’s tooling capabilities as they impact both cost and quality.

-

Quality Control (QC): Rigorous QC processes are essential to ensure implant reliability. The costs associated with QC can vary depending on the complexity of the procedures and certifications required, such as ISO or CE marking.

-

Logistics: Shipping and handling costs can vary based on the destination, shipping method, and urgency. Buyers need to consider potential delays and additional costs associated with customs clearance, especially when sourcing internationally.

-

Margin: Manufacturers will typically include a profit margin in their pricing. This margin can vary based on market competition, brand reputation, and the perceived value of the implants.

Price Influencers

-

Volume/MOQ: Bulk purchasing often leads to lower prices per unit. Buyers should negotiate minimum order quantities (MOQs) to achieve better pricing, especially in markets like Europe and South America where larger orders are more common.

-

Specifications/Customization: Custom implants tailored to specific patient needs can lead to increased costs. Buyers should weigh the benefits of customization against their budget constraints.

-

Materials: The choice of materials significantly influences pricing. High-quality materials may command a premium but can lead to lower failure rates and better long-term outcomes.

-

Quality/Certifications: Implants that comply with international quality standards and certifications can be more expensive. However, investing in certified products can reduce overall costs associated with failures and replacements.

-

Supplier Factors: The reliability and reputation of suppliers play a crucial role in pricing. Established suppliers may offer higher prices but can also provide better quality assurance and customer support.

-

Incoterms: Understanding International Commercial Terms (Incoterms) is essential for pricing negotiations. Terms such as FOB (Free On Board) or CIF (Cost, Insurance, and Freight) can significantly impact the total cost of ownership.

Buyer Tips

-

Negotiation: Always negotiate pricing and terms with suppliers. Establish long-term relationships to secure better pricing over time.

-

Cost-Efficiency: Evaluate the total cost of ownership, not just the purchase price. Consider factors like durability, warranty, and potential costs associated with failures.

-

Pricing Nuances: Be aware of the pricing dynamics in your region. In Africa and the Middle East, for instance, local economic conditions and supply chain issues can affect costs.

-

Market Research: Conduct thorough market research to understand regional pricing trends. This knowledge will empower you during negotiations and help you identify competitive suppliers.

Disclaimer

The prices and strategies discussed are indicative and can vary significantly based on market conditions, specific supplier capabilities, and regional economic factors. Always consult with multiple suppliers and conduct due diligence before making purchasing decisions.

Spotlight on Potential dental implants failure Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘dental implants failure’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for dental implants failure

When navigating the landscape of dental implants, understanding key technical properties and industry terminology is crucial for B2B buyers. This knowledge not only aids in the selection of the right products but also fosters effective communication with manufacturers and suppliers.

Critical Technical Properties

-

Material Grade

– Dental implants are primarily made from titanium or titanium alloys due to their biocompatibility and strength. The material grade (such as ASTM F136 for titanium) indicates the quality and performance standards. For B2B buyers, selecting implants made from high-grade materials ensures durability and reduces the risk of failure. -

Surface Roughness

– The texture of the implant surface can significantly affect osseointegration—the process where the bone integrates with the implant. A rougher surface increases the surface area for bone contact, enhancing stability. Understanding surface roughness specifications helps buyers choose implants that are more likely to succeed, particularly in challenging anatomical environments. -

Implant Dimensions

– The size and shape of dental implants (length, diameter, and thread design) are critical for ensuring proper fit and load distribution. For instance, implants with a larger diameter may be necessary for patients with low bone density. Buyers must consider these dimensions to ensure compatibility with patient anatomy and restoration plans. -

Load-Bearing Capacity

– This refers to the maximum stress the implant can withstand without failing. It is influenced by the implant’s design and material properties. Understanding load-bearing specifications helps buyers assess whether an implant can endure the functional demands placed on it, particularly in patients with bruxism or heavy bite forces. -

Osseointegration Timeframe

– The period required for the implant to integrate with the bone can vary. Implants designed for faster osseointegration may be advantageous in certain clinical scenarios. Buyers should be aware of these timelines to manage patient expectations and treatment plans effectively. -

Corrosion Resistance

– Implants must resist corrosion to maintain their integrity and functionality over time. Specifications related to corrosion resistance, often defined by standards such as ISO 5832, are essential for ensuring long-term success. Buyers should prioritize implants that meet these standards to minimize the risk of failure due to material degradation.

Common Trade Terminology

-

OEM (Original Equipment Manufacturer)

– This term refers to companies that produce parts and equipment that may be marketed by another manufacturer. In the dental implant industry, understanding OEM relationships can help buyers identify quality sources for implants and components, ensuring they procure reliable products. -

MOQ (Minimum Order Quantity)

– MOQ is the smallest quantity of a product that a supplier is willing to sell. Buyers need to be aware of MOQs as they can affect inventory management and cash flow. Understanding this term helps in negotiating terms with suppliers for bulk purchases. -

RFQ (Request for Quotation)

– An RFQ is a document sent to suppliers requesting a price quote for specific products or services. For B2B buyers, utilizing RFQs effectively can lead to better pricing and terms, especially when sourcing implants from multiple vendors. -

Incoterms (International Commercial Terms)

– These are standardized terms that define the responsibilities of buyers and sellers in international transactions. Familiarity with Incoterms is vital for B2B buyers to navigate shipping, insurance, and delivery obligations, thus avoiding unexpected costs and delays. -

CE Marking

– In Europe, CE marking indicates that a product meets EU safety and performance standards. For dental implants, this is crucial for regulatory compliance. Buyers should ensure that products have CE marking to guarantee quality and safety.

- Sterilization Certification

– This certification indicates that the implants have undergone processes to eliminate all forms of microbial life. For B2B buyers, confirming sterilization certification is essential to ensure patient safety and comply with health regulations.

By mastering these technical properties and terms, B2B buyers can make informed decisions, ensuring they select high-quality dental implants that meet their specific needs while minimizing the risk of failure.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dental implants failure Sector

Market Overview & Key Trends

The dental implant sector is experiencing significant transformation driven by technological advancements, demographic changes, and evolving consumer preferences. Globally, the increasing prevalence of dental diseases and the aging population are primary catalysts for market growth. For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding these dynamics is crucial for effective sourcing decisions.

Emerging trends include the rise of digital dentistry, which encompasses CAD/CAM technology, 3D printing, and AI-assisted treatment planning. These innovations not only enhance precision in implant placement but also reduce lead times and costs. Additionally, the use of bioactive materials and surface modifications in implants is becoming prevalent, aimed at improving osseointegration and reducing failure rates.

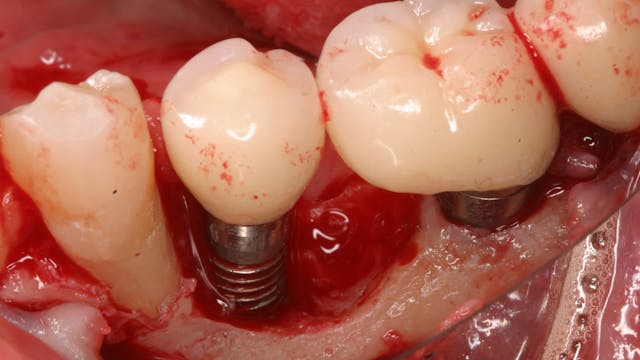

Illustrative Image (Source: Google Search)

Furthermore, the market is seeing a shift towards personalized dental solutions, where customization based on patient-specific requirements is prioritized. This trend is particularly relevant for B2B buyers looking to differentiate their offerings in competitive markets. Sustainability is also gaining traction, with buyers increasingly favoring suppliers that demonstrate eco-friendly practices and materials.

In regions like South Africa and Germany, regulatory compliance and quality assurance remain paramount. Buyers must ensure that their sourcing strategies align with local regulations and standards, as non-compliance can lead to significant financial and reputational risks.

Sustainability & Ethical Sourcing in B2B

As the dental implant sector evolves, sustainability and ethical sourcing are becoming vital considerations for B2B buyers. The environmental impact of dental implants, from production to disposal, necessitates a focus on sustainable practices. Manufacturers are increasingly adopting eco-friendly materials, such as biocompatible polymers and recycled metals, to reduce their carbon footprint.

Ethical supply chains are essential in ensuring that all materials used in dental implants are sourced responsibly. Buyers should seek suppliers with certifications such as ISO 14001 for environmental management systems or certifications for responsible mining practices. These certifications not only assure compliance with environmental standards but also enhance brand reputation among increasingly conscious consumers.

Moreover, the concept of circular economy is gaining traction, encouraging businesses to consider the entire lifecycle of dental implants. This includes initiatives for recycling implants and minimizing waste during production. By prioritizing sustainability, B2B buyers can contribute to a healthier planet while also appealing to a market that values corporate social responsibility.

Brief Evolution/History

The history of dental implants dates back to ancient civilizations, but significant advancements began in the 20th century with the introduction of osseointegration by Per-Ingvar Brånemark in the 1960s. This pivotal development established the foundation for modern dental implantology, leading to the widespread acceptance of titanium implants due to their biocompatibility and durability.

Over the years, the field has evolved with the incorporation of advanced materials and technologies, including ceramic implants and minimally invasive surgical techniques. The continuous research and development in this sector have significantly reduced failure rates, enhancing the overall success of dental implants. For B2B buyers, understanding this evolution is essential for making informed decisions regarding product selection and supplier partnerships, ensuring they remain competitive in a rapidly changing market.

Frequently Asked Questions (FAQs) for B2B Buyers of dental implants failure

-

What factors should I consider when vetting suppliers for dental implants?

When vetting suppliers, ensure they have a strong reputation in the industry, verified by customer testimonials and reviews. Check for compliance with international standards, such as ISO certifications, to ensure product quality. Additionally, assess their production capabilities, including technology and materials used. It’s beneficial to inquire about their experience with dental implants and their track record in handling international orders. Establishing a clear communication channel is vital for addressing any concerns promptly and effectively. -

Can I customize dental implants to meet specific needs?

Yes, many suppliers offer customization options for dental implants to address specific clinical requirements. This can include variations in size, shape, and surface treatment based on patient needs or local market preferences. When discussing customization, ensure that the supplier has the capability to produce implants that meet your specifications without compromising quality. Be clear about your requirements during the negotiation phase to avoid misunderstandings later on. -

What are the typical minimum order quantities (MOQ) and lead times for dental implants?

Minimum order quantities can vary significantly among suppliers, typically ranging from 50 to 500 units. Lead times for delivery can also differ based on the supplier’s production capacity and your location, generally falling between 4 to 12 weeks. It’s advisable to discuss these factors upfront and consider your inventory needs and market demand. Building a relationship with your supplier can sometimes lead to more flexible MOQs and expedited shipping options. -

What payment terms are standard for international purchases of dental implants?

Payment terms can vary widely based on the supplier and the nature of the transaction. Common methods include wire transfers, letters of credit, or payment on delivery. It’s important to negotiate terms that protect your interests, such as partial payment upfront and the remainder upon delivery or after quality inspection. Ensure that all payment agreements are documented clearly to avoid disputes later, and consider using escrow services for larger transactions. -

How can I ensure quality assurance and certification compliance for dental implants?

To ensure quality, request documentation of the supplier’s quality assurance processes and certifications. Look for compliance with ISO 13485, which pertains to medical devices, as well as any relevant local regulations. Suppliers should be able to provide certificates of conformity for each batch of implants. Additionally, consider third-party testing or audits to verify the quality of the products before making a large purchase. -

What logistics considerations should I be aware of when importing dental implants?

Logistics can be complex when importing dental implants, especially concerning customs regulations and import duties. Research the specific import requirements for dental devices in your country, including necessary documentation. Work with logistics providers experienced in medical device transport to ensure compliance and minimize delays. Additionally, consider the storage conditions required for dental implants to maintain their integrity during transport. -

How should I handle disputes with suppliers regarding dental implant quality or delivery?

Establish clear communication protocols from the outset to address potential disputes effectively. Document all agreements and product specifications in detail to serve as reference points during disagreements. If issues arise, initiate a dialogue with the supplier to resolve the problem amicably. If necessary, consider mediation or arbitration as a cost-effective way to settle disputes. Familiarize yourself with the legal framework governing international trade in your region to protect your rights. -

What are the common causes of dental implant failure, and how can they impact my sourcing decisions?

Understanding the common causes of dental implant failure—such as poor osseointegration, insufficient bone quality, and improper placement—can significantly influence your sourcing decisions. Choose suppliers that offer products designed to mitigate these risks, like implants with enhanced surface treatments or those that provide comprehensive training for dental professionals. Additionally, selecting implants with a proven track record of success in specific demographics can enhance patient outcomes and reduce the likelihood of failure, ultimately affecting your reputation and bottom line.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for dental implants failure

In conclusion, understanding the multifaceted causes of dental implant failure is crucial for international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe. Key takeaways highlight the significance of strategic sourcing in mitigating risks associated with implant failures. By prioritizing suppliers with robust quality assurance processes, advanced materials, and proven success rates, buyers can ensure the longevity and efficacy of dental implants.

Moreover, fostering strong relationships with dental professionals and laboratories can enhance communication and lead to better patient outcomes. Investing in education around proper implant maintenance and post-operative care is equally essential, as it empowers both providers and patients to minimize risks.

As the dental implant market continues to evolve, staying informed about innovations and best practices will be vital. B2B buyers are encouraged to engage with reputable manufacturers and explore emerging technologies that promise to enhance implant success rates. By taking proactive steps today, you can position your business for sustainable growth and success in the competitive landscape of dental solutions.